Table of contents

How can you identify the warning signs before your SaaS customers disappear for good? And which risk factors should you be monitoring to prevent churn before it happens?

In SaaS, customer retention is often the difference between sustainable growth and a constantly leaking bucket. Even a small improvement in churn rate can dramatically impact your bottom line and valuation.

But the challenge is knowing exactly where to look. Is it product usage patterns? Customer support interactions? Billing issues? Or perhaps something less obvious like team adoption rates or feature usage? This is also where churn risk becomes visible—by spotting it early, you can act before customers decide to leave.

That’s what we set out to discover when we ran this survey. We collected feedback from over 40 SaaS companies to better understand the most effective strategies for spotting churn risk factors and implementing proactive retention measures.

We got valuable insights into which indicators most reliably predict churn and how top-performing companies are turning potential churn situations into opportunities for stronger customer relationships. These early signs of churn risk can help you determine which customers need proactive outreach.

Let’s check out the details.

- What Is Customer Churn

- SaaS Benchmark KPIs

- Key Insights From Our Research

- Most Effective Predictors of Customer Churning

- Most Successful Initiatives to Reduce Churn Rates

- Stay on Top of Your SaaS Performance Data with Databox

What Is Customer Churn?

Customer churn is the percentage of customers who stop using your product during a specific period. In the context of SaaS, churn typically occurs when customers cancel their subscriptions, downgrade to a free plan, or simply fail to renew.

Churn is often measured as a rate—the number of customers lost during a period divided by the total number of customers at the beginning of that period.

For example, if you start a month with 1,000 customers and lose 50 by the end of the month, your monthly churn rate would be 5 percent. This straightforward churn calculation measures how many customers you lose in relation to how many you had at the start.

While monthly churn is common, some businesses also track annual churn to measure long-term retention patterns.

While some level of churn is inevitable in any business, high churn rates can severely impact a SaaS company’s growth and profitability. Each lost customer represents not just lost recurring revenue, but also wasted acquisition costs and unrealized lifetime value. Keeping customers engaged and preventing churn has a direct impact on CLV (customer lifetime value). Every lost customer also makes your CAC (customer acquisition cost) harder to recoup, since you have to replace that lost revenue all over again.

It’s important to understand these three types of customer churn:

- Voluntary churn occurs when customers actively decide to cancel their subscription

- Involuntary churn happens due to payment failures, overlooked renewal notices or other technical issues

- Net churn factors in both lost customers and expansion revenue from existing customers

SaaS Benchmark KPIs

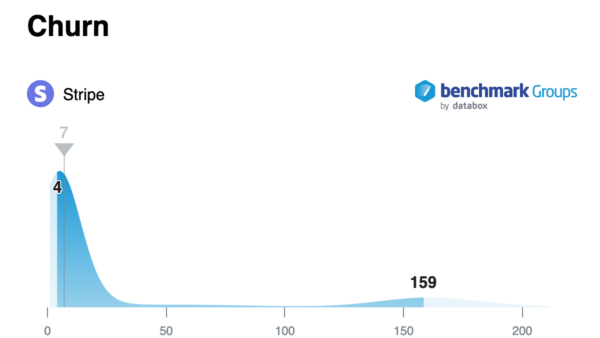

To better understand how SaaS companies are performing, we analyzed data from the SaaS Benchmark KPIs group, which tracks key metrics across various performance indicators.

This dataset allows SaaS companies to compare their results with the median value, as well as the top and bottom quartiles. It provides insights into essential KPIs such as sessions, new customers, churn rate, churn, recurring revenue (MRR), net profit margin, average revenue per user, and more.

According to data provided by the Benchmark Group SaaS Benchmark KPIs, in February 2025, the median churn value in February 2025 was 7.

If you’re running a SaaS business and want even more actionable insights into churn metrics and other key performance indicators, you can join our free Benchmark Group SaaS Benchmark KPIs.

By joining, you’ll be able to anonymously compare your churn rate, customer retention, MRR, and other important SaaS metrics with other similar companies at no cost.

All it takes is connecting your account to the group—completely anonymous and secure. You can even create your own Benchmark Group, giving you full control over who accesses it and shares data.

Whether you’re focused primarily on reducing churn or tracking a broader set of business metrics, Benchmark Groups cover a wide range of other categories, including marketing, finance, accounting, and many more—providing valuable performance benchmarks across all aspects of your business operations.

Key Insights From Our Research

Our research helped us find several key insights about how SaaS companies identify and address churn risks, as well as the strategies they use to improve customer retention.

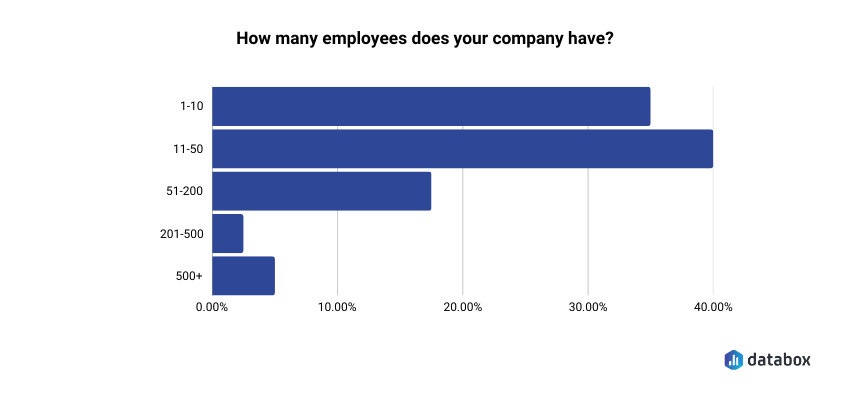

Interestingly, most surveyed companies have fewer than 50 employees, meaning many teams are likely balancing customer retention efforts with limited resources.

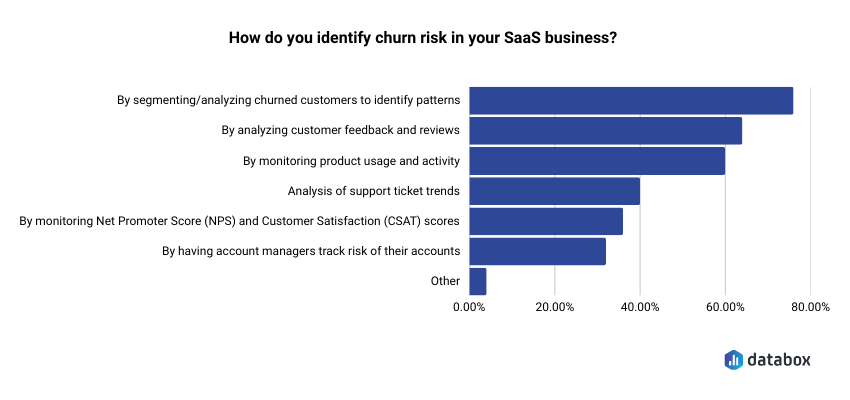

When it comes to identifying churn risks, 76% of the companies segment and analyze churned customers to identify patterns, while 64% analyze customer feedback and reviews, and 60% monitor product usage and activity.

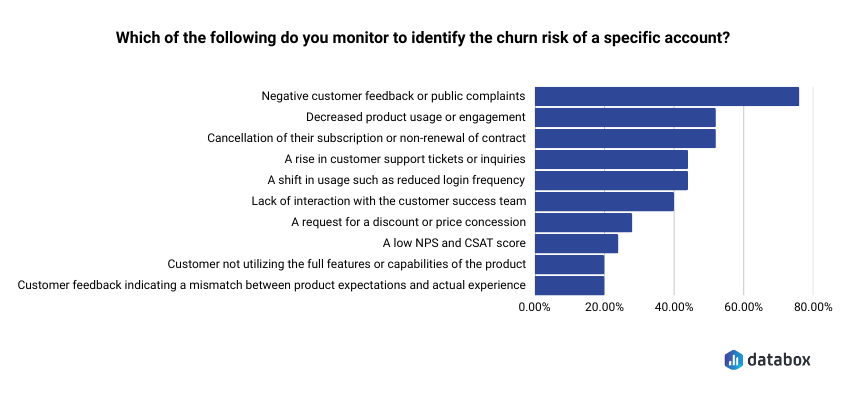

Pinpointing risk at the individual account level often comes down to recognizing warning signs. Tracking the count of at-risk accounts helps teams prioritize which customers need attention first.

The most common signals include negative customer feedback or public complaints (76%), decreased product usage or engagement (52%), and cancellations or non-renewals (52%).

But identifying risk is just the first step — what happens next is equally important.

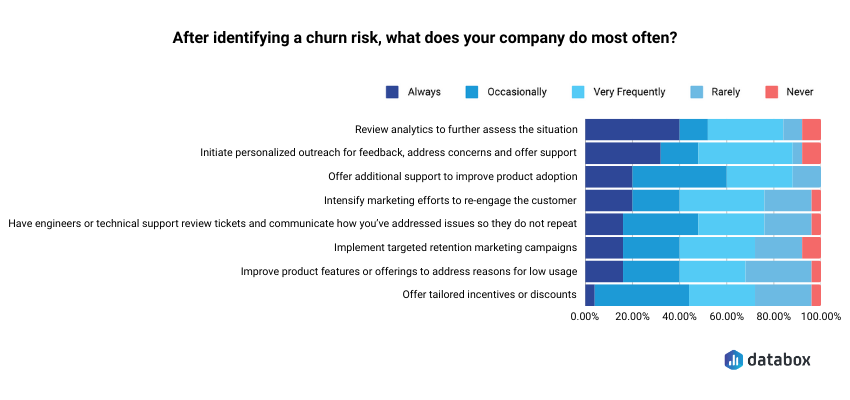

Once companies spot potential churn, they often take immediate action by reviewing analytics to better understand the situation and initiating personalized outreach to gather feedback, address concerns, and offer support.

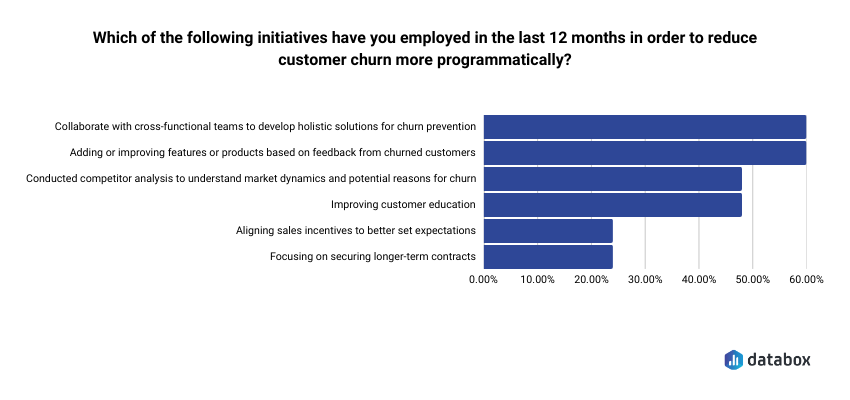

For longer-term churn prevention, companies are getting more proactive. Over the past 12 months, many have focused on collaborating with cross-functional teams to develop holistic solutions and add or improve features based on feedback from churned customers.

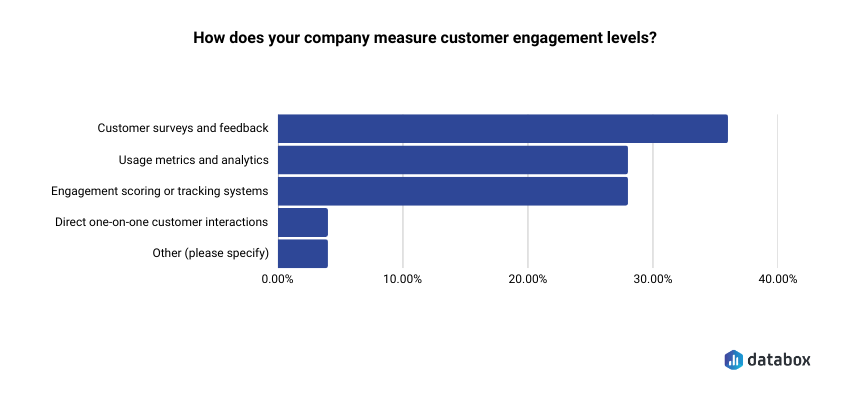

Measuring engagement levels also plays a major role in retention. While there’s no single method that works for everyone, 36% of respondents rely on customer surveys and feedback to assess satisfaction and engagement.

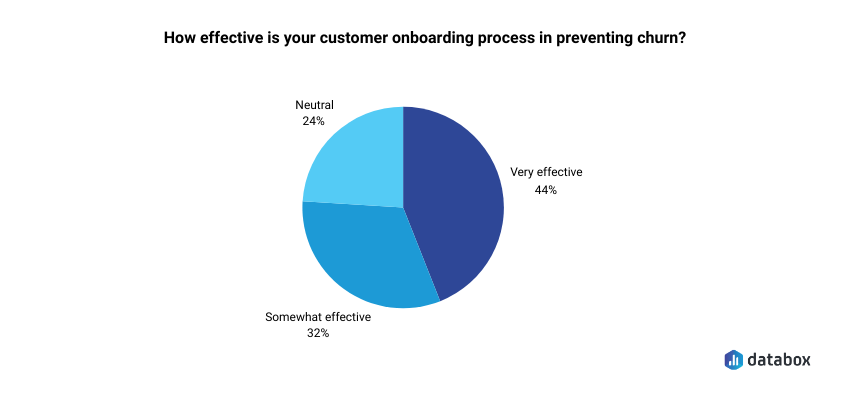

Onboarding also emerged as a crucial factor in retention, with 44% of respondents rating their onboarding process as very effective. This suggests that companies investing in clear, helpful onboarding processes are seeing stronger retention rates.

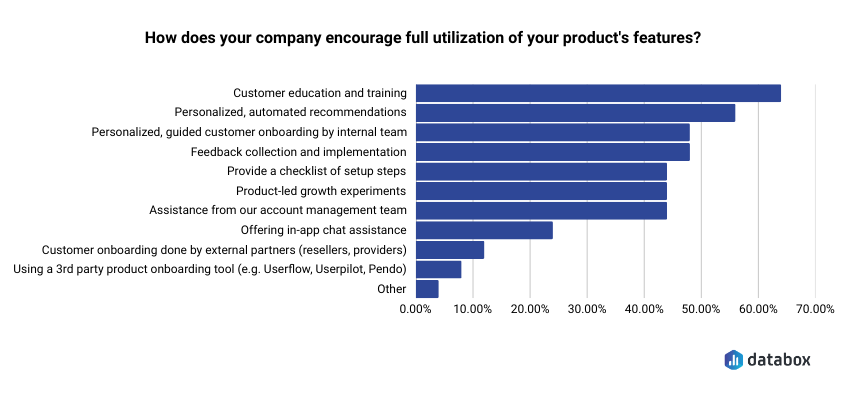

To ensure customers fully utilize their platform’s features, SaaS teams commonly lean on customer education and training (64%) as well as personalized, automated recommendations (56%). Both strategies help users discover the product’s full potential and prevent disengagement.

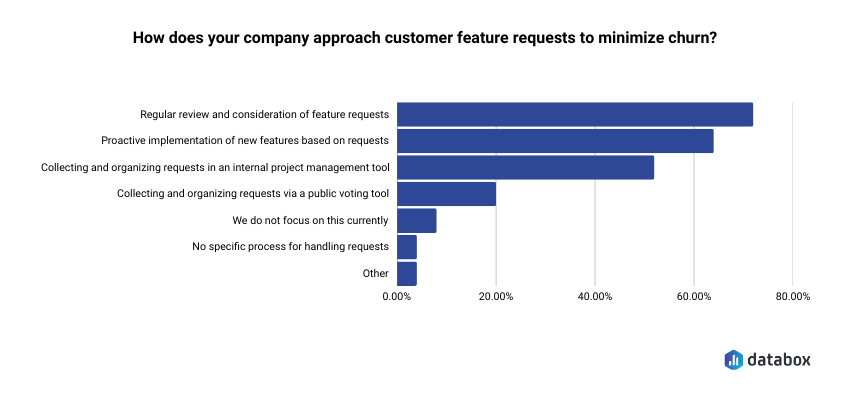

Finally, when it comes to feature requests, SaaS companies tend to prioritize organization and action.

Most respondents reported using regular review and consideration (72%), proactive implementation of new features (64%), and collecting and organizing requests in an internal project management tool (52%).

This structured approach ensures customer feedback is heard—and acted upon—before it turns into a churn risk.

Most Effective Predictors of Customer Churning

While churn can sometimes feel unpredictable, certain behaviors and patterns often signal when a customer is at risk of leaving.

Here are some of the most effective predictors to watch for:

- Negative Customer Sentiment Based on Call Summaries

- Engagement Level Drop

- Declining Product Usage

- Increase in Support Tickets

Negative Customer Sentiment Based on Call Summaries

Customer calls are often a goldmine of insight, especially when frustration starts to build. Negative sentiment expressed during support calls, account reviews, or success check-ins can be an early warning sign that a customer is considering leaving.

SaaS companies that track call summaries—often using AI tools that analyze tone, language, and key phrases—can flag at-risk accounts before issues escalate.

If a once-positive client starts voicing repeated concerns about product performance, pricing, or unmet expectations, it’s a clear signal that proactive intervention is needed.

Arielle Kimmer of CallTrackingMetrics says that they’ve found that “our AI-generated call summaries are among the most effective predictors of churn. These summaries can often identify unresolved support needs and negative customer sentiment, and signal potential churn months before it’s detected by our account managers.”

Engagement Level Drop

A sudden or gradual decline in how customers engage with your product often precedes churn by weeks or even months. This engagement drop can manifest in various ways, depending on your specific product.

Metrics worth monitoring include:

- Decreased login frequency

- Shorter session durations

- Lower user counts within a customer account

- Declining participation in webinars or training sessions

Particularly concerning is when admin or decision-maker engagement drops while regular users continue normal usage patterns. This often means that the account administrator may be evaluating alternatives.

Andre Oentoro of Breadnbeyond says that they’ve found “that the best indicator of a customer potentially leaving us is their level of engagement.”

“When customers actively participate in the production process, share feedback, and stay in touch, they’re usually happier with our services and less likely to churn. Engaged customers understand the value we offer and are committed to achieving their goals with us.

Conversely, if customers seem disengaged—like taking longer to respond or not participating in meetings—it often signals they’re not satisfied. By keeping a close eye on engagement levels and addressing any concerns promptly, we can reduce the risk of losing customers and maintain strong relationships.”

Mateusz Calik of Delante is another respondent who pointed out that “if the engagement rate goes down, they are going to churn.”

“There’s a very simple rule behind it – if you don’t use something it means you don’t need it or have found a better replacement for it. So I’d also divide churning cases into two categories: people who stopped needing the provided solution and people who weren’t satisfied with the product. With the first category, you can’t really prevent it from happening, but you definitely should pay attention to reasons why your product is worse than the other ones.”

Declining Product Usage

While similar to engagement drops, declining product usage focuses specifically on the core value metrics specific to your product. These are the actions that directly correlate with customers receiving value from your solution.

For example:

- A project management tool might track the number of projects created

- A communication platform would monitor message volume

- An analytics solution would measure report generation and sharing

Companies with sophisticated retention strategies map the entire customer journey and identify ‘success milestones’ for each stage. When customers fall behind on reaching these milestones, it can be a strong indicator of potential churn.

Michal Kierul of INTechHouse says that “if I had to choose one factor, it would be definitely be sustained decrease in product usage.”

“Our platform’s analytics enable us to track user activity levels, alerting us to any notable declines that could signal dissatisfaction or disengagement. This is how we deal with it effectively. We implemented these features after years of analyzing things on our own and trying to approach each issue directly.

But as our business grew, it became increasingly difficult to care about each customer in such detail. Analytics are the best solution to this, as they pose a system that’s manageable and simple. It’s easier to notice bigger mistakes and solutions of problems looking at the current situation from a wider perspective.”

Hyfa K of Empxtrack also mentioned that “one common predictor that tends to be highly effective is declining product usage or activity.”

“When customers start using our product less often or engaging with its features less actively, it’s usually a sign that they might be considering leaving. This makes sense because if someone isn’t using a product as much as before, it could mean they’re not finding it as useful or valuable as they once did. For instance, think about when you stopped using an app on your phone because you found a better one or because it just didn’t do what you needed anymore. It’s kind of like that. When customers stop using our product as much, it’s often because their needs have changed or they’ve found another solution that works better for them.

So, by keeping an eye on how much our customers are using our product and how active they are with it, we can get a good sense of whether they might be thinking about leaving. Then, we can reach out to them, see if there’s anything we can do to help, or maybe even offer them some new features or improvements to keep them happy. It’s all about making sure we’re giving our customers what they need and keeping them satisfied so they stick around.”

Increase in Support Tickets

A sudden spike in support tickets—especially for previously stable accounts—shows growing frustration that could lead to churn. However, the nature and pattern of these tickets matter as well.

An increase in “how-to” questions actually indicates healthy engagement, while tickets about product limitations, bugs, or feature requests might show growing dissatisfaction.

Another important pattern involves the seniority of ticket submitters. When executives who rarely interact with support suddenly start submitting tickets, this often indicates escalating concerns that may lead to cancellation decisions.

“An increase in support tickets, especially regarding the same issues repeatedly, can signify deeper problems with product satisfaction. We try to analyze support ticket patterns to identify and address underlying issues as often and as thoroughly as we can. I think customers will want to tell you what’s wrong, it’s human nature. If they won’t do it out of empathy, they will do it out of anger. So as a CEO, I try to urge my workers to pay close attention to listening to customers (not just literally, but through some non-obvious signals).”

Want to get highlighted in our next report? Become a contributor now

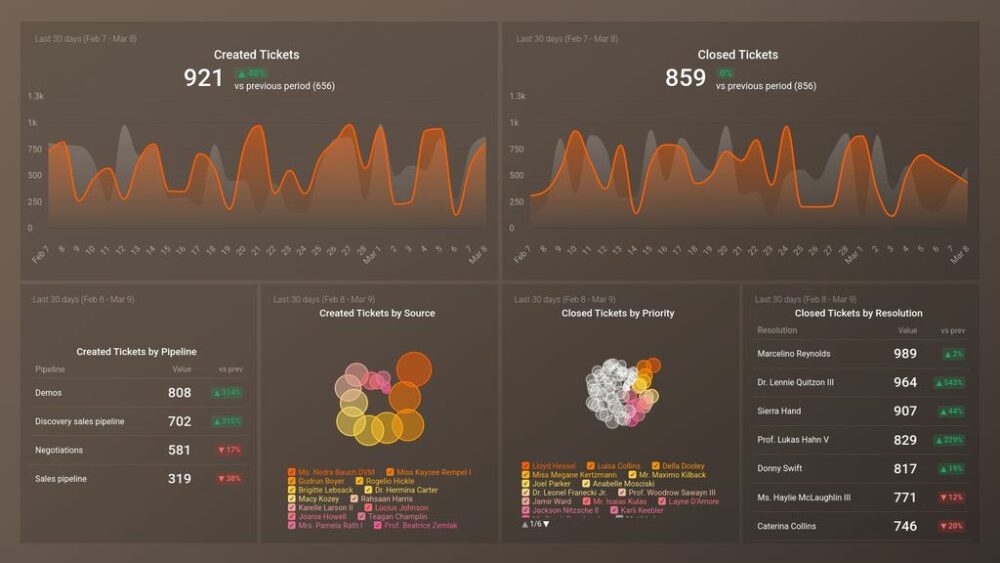

PRO TIP: Want an easier way to track and monitor support tickets and similar CS metrics? You can download our free HubSpot Service (Tickets Overview) Dashboard Template and compile all of your most important customer support metrics in one place.

Most Successful Initiatives to Reduce Churn Rates

Identifying at-risk customers is only half the battle. Here’s what top-performing SaaS companies are doing to actually prevent those customers from leaving:

- Create Loyalty Programs

- Personalized Email Campaigns Targeting Inactive Users

- Offering Special Deals to Users Who Stopped Using the Product

- Building a “Customer Success” Program

Create Loyalty Programs

Loyalty programs create extra value that makes customers think twice before canceling their subscriptions. For SaaS businesses, these programs can take various forms aside from traditional points systems.

They could include tiered membership benefits that activate additional features or support options based on subscription length or exclusive access to beta features for long-term customers.

Many companies find success by gamifying product usage with achievement badges, leaderboards, or status levels that users are reluctant to abandon. Others focus on tangible benefits like usage credits, expanded storage, or complimentary training sessions that increase in value the longer a customer maintains their subscription.

Manoj Kumar of Orderific says that they’ve “rolled out a loyalty program for restaurants using our SaaS technology, aimed at boosting customer retention through rewards.”

“This initiative addressed a critical challenge – helping restaurants build strong, lasting connections with their diners. The program led to increased repeat visits and higher revenue for restaurants. Plus, the insights from this program let them understand their customers better so they can offer exactly what their guests want. As a result, our clients enjoyed stronger relationships with their customers and higher overall satisfaction.”

Personalized Email Campaigns Targeting Inactive Users

Strategic, personalized outreach to dormant accounts can help re-engage users before they churn. These campaigns are successful because they respond directly to specific usage patterns and behaviors.

Re-engagement emails typically focus on specific features the user hasn’t explored, success stories from similar customers, or personalized tips based on the user’s historical interaction with the product.

Irene Graham of Spylix talked about this strategy and mentioned that they “incorporated a personalized email campaign targeting inactive users into our mix of efforts to re-engage them. Via user behavior data analysis, we found out about the customers who have not engaged with our platform for a specific period.”

“After that, we sent a number of emails with specially tailored content and deals to persuade them to re-visit. This measure brought the churn rate down almost by a quarter, also with a 20% increase in re-activation of even the previous non-users.”

PRO TIP: Do you use Mailchimp for email marketing, but still struggle with the platform’s main interface? You can use our Mailchimp Overview Dashboard to keep track of all your key metrics easily, from email open rates to deliverability.

Offering Special Deals to Users Who Stopped Using the Product

When usage has already dropped, special offers can sometimes prevent imminent churn. These actions acknowledge the customer’s disengagement and provide incentives to give the product another chance.

Successful approaches include temporary discounts tied to renewed usage commitments, free access to premium features that might better address the customer’s needs, or credits that extend the subscription period to allow more time for demonstrating value.

Some companies offer complimentary consulting sessions to understand the customer’s needs and reconfigure their product experience accordingly. Others temporarily adjust service tiers to better match current usage patterns without requiring customers to downgrade.

“To prevent customers from leaving, target those who stopped using the software after trying it for free. These are individuals who gave the software a try but didn’t continue using it. Reaching out to them again and offering special deals or extended trial periods can be quite effective.”

Want to get highlighted in our next report? Become a contributor now

Building a “Customer Success” Program

Many SaaS companies assign Customer Success Managers (CSMs) to proactively guide users through onboarding, adoption, and expansion.

This team can spot potential blockers, provide tailored recommendations, and offer advice to ensure customers achieve their goals. Regular check-ins, success reviews, and proactive outreach ensure customers feel supported throughout their journey, so they’re far less likely to leave.

Michal Kierul of INTechHouse says that they’ve “launched a ‘customer success program’ designed to proactively engage with customers at every stage of their journey with our software.”

“We decided to create a separate team that does onboarding and we have a step-by-step guide of displaying and learning different options on your own. We also actively promote giving feedback on features and quality of our service.”

Stay on Top of Your SaaS Performance Data with Databox

Keeping track of key SaaS metrics—from churn rates to customer retention and product engagement —is critical for maintaining healthy growth.

But how do you know if your retention strategies are actually working or if your churn rate is competitive in your industry?

Databox can help.

Databox offers a comprehensive SaaS Benchmark Group that covers key churn metrics and other critical SaaS KPIs. By joining this group, you’ll get instant access to industry-specific benchmarks, so you can compare your churn rate, customer engagement, and retention metrics against similar companies.

This comparative analysis helps you see where you’re excelling, spot areas that need improvement, and refine your retention strategy accordingly.

That’s just one small fraction of our Benchmark Group product – there are 50+ groups you can join for free, covering everything from marketing and sales to customer success and finance.

But that’s just one part of what Databox offers. With Databox Dashboards, you can consolidate all your critical SaaS metrics—including data from tools like HubSpot, Stripe, and Google Analytics—into a centralized, real-time view. No more bouncing between platforms or struggling with manual reports.

We have 130+ integrations – all you have to do is select the key metrics you want to track and generate one-click visuals.

Sign up for a free trial and finally get the insights you need to transform your approach to customer retention and build a more resilient SaaS business.