Table of contents

Sales teams track sales KPIs. Marketing teams track marketing KPIs. But together, those teams should also be tracking financial KPIs.

Why? At the end of the day, the goal of these two teams is to improve a company’s finances. You get users into your funnel to grow revenue. You close deals to grow revenue. You retain customers to grow revenue.

So if your sales and marketing teams aren’t tracking financial KPIs, there’s a huge gap between your company’s overall goals and what your teams are striving toward and measuring.

That’s why it’s a little concerning that only 59% of the respondents to our latest survey said that everyone on their sales and marketing teams is aware of how their financial KPIs are trending at any given moment.

38.5% said their teams were either only somewhat aware (30.8%) of how their most important financial KPIs were trending or weren’t aware at all (7.7%). The final 2.6% simply didn’t know.

Additionally, around a third of our respondents said that there is no owner for the financial metrics their teams are tracking:

In order for marketing and sales teams to help their companies grow revenue in the most cost-effective way possible, it’s crucial for these teams to track the financial KPIs that provide insight into how their activities impact company revenue.

So what financial KPIs should sales and marketing teams track? To find out, we asked our respondents to share the financial KPIs they feel are the most important to track and measure.

Here’s what we learned.

Editor’s note: If your sales and marketing teams are struggling to track your company’s most important financial metrics—and particularly those metrics they directly influence—consider using one of the Databox dashboards featured below to make it easy for everyone to access key financial KPIs anytime, anywhere.

17 Financial KPIs Every Marketing and Sales Team Should Track

When we polled our respondents on which financial KPIs they track, more than three-fourths said they track revenue, sales generated, and customer acquisition cost. More than half also track profit margin, sales by rep, customer lifetime value, and sales by channel.

But our respondents also said they track several KPIs we didn’t ask about in our poll in their financial dashboards.

Here are the 17 financial KPIs they feel are the most important for sales and marketing teams to track, along with their reasons for why they feel each KPI is important.

- Revenue

- Increases in Monthly Revenue from Current Customers

- Marketing-Attributed Revenue

- Revenue/Sales by Channel

- Revenue Per Employee

- Customer Acquisition Cost (CAC)

- Net Revenue Minus CAC

- Profit Margin

- Customer Lifetime Value (CLV)

- Ratio of CLV to CAC

- Conversion Rate

- Cost Per Acquisition

- Cost Per Lead

- Cost Per Marketing-Qualified Lead (MQL)

- Return on Investment (ROI)

- Lead-to-Client Conversion Rate

- Sales Pipeline Leakage

PRO TIP: Are You Tracking the Right Metrics for Your SaaS Company?

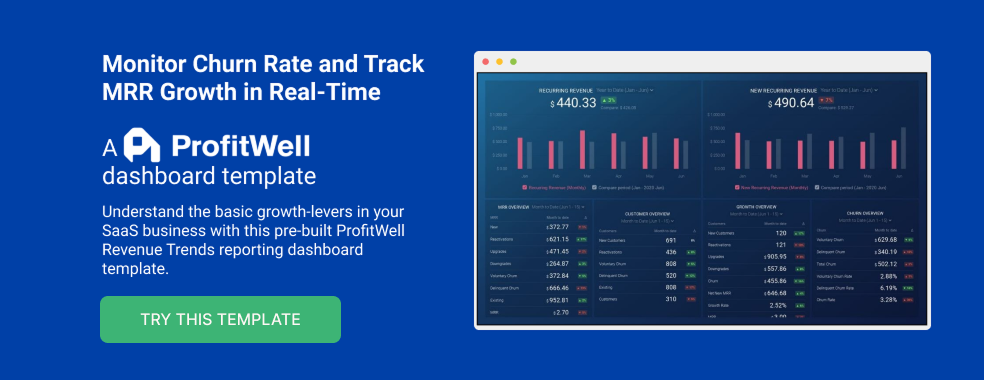

As a SaaS business leader, there’s no shortage of metrics you could be monitoring, but the real question is, which metrics should you be paying most attention to? To monitor the health of your SaaS business, you want to identify any obstacles to growth and determine which elements of your growth strategy require improvements. To do that, you can track the following key metrics in a convenient dashboard with data from Profitwell:

- Recurring Revenue. See the portion of your company’s revenue that is expected to grow month-over-month.

- MRR overview. View the different contributions to and losses from MRR from different kinds of customer engagements.

- Customer overview. View the total number of clients your company has at any given point in time and the gains and losses from different customer transactions.

- Growth Overview. Summarize all of the different kinds of customer transactions and their impact on revenue growth.

- Churn overview. Measure the number and percentage of customers or subscribers you lost during a given time period.

If you want to track these in ProfitWell, you can do it easily by building a plug-and-play dashboard that takes your customer data from ProfitWell and automatically visualizes the right metrics to allow you to monitor your SaaS revenue performance at a glance.

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Profitwell account with Databox.

Step 3: Watch your dashboard populate in seconds.

Editor’s note: Having a hard time tracking your KPIs? With Databox, you can automate performance alerts and make adjustments when they matter most or schedule automated snapshots of your dashboards to any Slack channel. See how today.

1. Revenue

“The number-one financial metric every sales and marketing team should track is revenue,” says Shuey Shujab of Whitehat Agency. “The end goal is always growth, and revenue is the best metric for growth. By tracking revenue closely, marketing and sales teams can calibrate and recalibrate activities.”

Editor’s note: Do you know how much revenue is in your pipeline this month? And what about the amount of revenue your team will close this month? You can answer these questions by doing a sales forecast. Here’s how you can visualize your sales forecast data from HubSpot CRM with Databox.

2. Increases in Monthly Revenue from Current Customers

“We’ve found that increases in monthly revenue from current clients is a great metric to track to ensure financial success,” says Online Optimism’s Flynn Zaiger.

“Many businesses track monthly recurring revenue or customer lifetime value, but a growing business can typically get more revenue out of an individual client/customer if the customer is delighted by their work.”

“By measuring the clients that are now paying you more than they were previously giving you, you can identify and track not only how many clients are loyal, but also how many are investing even more in your business’ services.”

Editor’s note: ProfitWell users can easily track changes in recurring revenue—and increases and decreases in reactivations and upgrades—by grabbing this free ProfitWell Revenue Trends dashboard.

3. Marketing-Attributed Revenue

“Tracking marketing-attributed revenue gives you powerful insight into the effectiveness of your marketing efforts, the quality of your leads, and the success of your sales tactics,” says Jennifer Lux of LyntonWeb. “This type of closed-loop reporting is essential to really uncovering the ROI of your marketing and sales efforts.”

4. Revenue/Sales by Channel

“Sales and marketing need to closely track revenue by channel,” says Joe Sloan of Jurassic Sand.

“We have a very seasonal product, and our ads go from having a 300% ROI in the summer months to a negative ROI over the winter months. By tracking revenue generated by channel, we can recognize when we need to change our ad spend and which markets we need to be targeting,” Sloan says.

Lola.com’s Collin Burke agrees: “Sometimes, it can be tempting to focus on which channels are generating leads most efficiently, but it’s important to dig deeper into your sales dashboard and see which channels are generating customers most cost-effectively.”

“For example, let’s say that last month, channel A cost $10,000 and generated 500 leads, while channel B cost $10,000 and generated 100 leads. At the surface level, channel A is clearly generating leads more efficiently.”

“But let’s say channel A generated one customer, while channel B generated 10 customers. Then it becomes apparent that channel B is better for generating business results.”

“If your company has strong sales and marketing alignment, this type of down-the-funnel data makes it easy to decide which channels are more deserving of additional budget,” Burke says.

Editor’s note: HubSpot Marketing Hub users can easily track which channels are generating the most leads, MQLs, SQLs, and customers by grabbing this free HubSpot Sources Report dashboard.

5. Revenue Per Employee

“Revenue per employee can be tough to calculate accurately, but it’s definitely worth the time,” says Eddie Johnson of Anabolic Bodies. “It will help you figure out exactly how much revenue you are bringing in for each member of your sales team so that you can operate more efficiently and identify rock-star employees.”

“Sometimes. the answer is to find the right middle ground as far as compensation and benefits. Offering non-cash benefits—such as time off—is always a great way to reward efforts without directly adding to costs.”

6. Customer Acquisition Cost (CAC)

“Tracking customer acquisition cost is vital to developing an understanding of the profitability of your company,” says 9Sail’s Kyle Kasharian. “When used correctly, CAC can dramatically improve profitability, as it will pinpoint the channels that can convert the most qualified leads without breaking the bank.”

Growth Hackers’ Jonathan Aufray agrees: “If you know how much it costs to acquire a customer, you can easily track other metrics such as profit margin and ROI.”

“You want your sales and marketing teams to be optimizing their time spent on the sales cycle process from prospect to close,” says Danny Peavey of One Week Website. “Minimizing customer acquisition cost means an increase in productivity and success.”

“Knowing how much it costs to buy a new customer lets you forecast how much investment is needed to grow your customer base, which makes planning possible,” says Andy Hoek of Invalshoek. “Also, if CAC is higher than customer lifetime value, you know it’s time to switch up your marketing and sales strategies.”

And Drew Beechler of High Alpha says that “marketing and sales teams should constantly measure how their CAC changes with different channels, campaigns, and timeframes.”

“Always measure your overarching blended CAC for a given time period, but also be aware of how different channels and touchpoints impact your CAC and how you can tweak and adjust spending and focus in order to optimize your CAC based on the different opportunities you have,” Beechler says.

PRO TIP: Track any fluctuations or trends in your CAC in sales reporting software to gain insights into the effectiveness and efficiency of your customer acquisition efforts.

7. Net Revenue Minus CAC

“Net revenue minus CAC is a key financial metric derived from tracking and reporting cost per click (CPC), cost per conversion, and, ultimately, CAC,” says Robert Donnell of P5 Marketing.

“If it costs $100 to acquire a customer and the resulting sale is $800 with a $300 gross profit, then you’re in great shape. Conversely, if the net revenue is too close to $100, you may have a ‘successful’ ad campaign that loses money on every sale.”

8. Profit Margin

“The metric I advise all sales teams to track is profit margin, especially if salespeople have the freedom to give price breaks,” says James Pollard of The Advisor Coach.

“I’ve seen several scenarios where salespeople will work twice as hard to only make 150% of their commission because they are discounting the product and hurting margins. Not only does a decreased margin hurt the company, but it means the salesperson is working harder for less money.”

“One solution to this is to educate your salespeople on better sales tactics. Don’t let them use ‘low price’ as a sales technique. Break down the math and show them that they could actually sell less with more profit margin and make the same amount of money.”

9. Customer Lifetime Value (CLV)

“Customer lifetime value should be the cornerstone metric that all of your marketing investments are based around,” says Ryan Nicholson of TSL Marketing. “Measuring this KPI allows for larger sales and marketing investments, versus focusing on the immediate revenue driven by a win.”

Greg Moskovitch of Full Measure Digital agrees: “A lot of the focus in marketing and sales is placed at the top of the funnel where conversions can be up to five times more costly to acquire. Not only is it easier to convert a returning customer, but it’s also far cheaper.”

“If you’re not tracking CLV, you could be misinterpreting your data,” says Laura Gonzalez of Audi Peoria. “For example, the cost of acquisition could be high and the initial purchase of goods/services low, but the amount spent by the customer over a lifetime could be great.”

However, Maple Holistics’ Nate Masterson says you shouldn’t just measure purchases when calculating CLV: “For instance, the lifetime value of a customer may go up if they consistently refer friends and family.”

And Alex Vale of Attio says, “Lifetime value isn’t black and white. Larger customers will have a larger LTV—but will also probably take longer to acquire. If your marketing campaign is targeting one-man bands, make sure you’re using the LTV of small clients and not larger ones.”

10. Ratio of CLV to CAC

“The ratio of CLV to CAC is a good way for marketing and sales teams to estimate the total value they derive from each customer compared with what they spend to acquire that new customer,” says Evan Elizabeth Harder of Hello Marketing Agency.

“The higher the CLV:CAC, the more ROI marketing and sales teams are delivering to the bottom line.”

“However, it’s important to consider overarching business goals. Since companies should always be investing in strategies to reach new buyers, this ratio shouldn’t be too high. Spending more on sales and marketing strategies will reduce the CLV:CAC ratio, but it could help speed up a company’s total growth,” Harder says. To ensure you’re spending on key areas of your business in line with your budget, use this free expenses dashboard.

Patrick Rafferty of Online Optimism agrees: “If you can identify the lifetime value of a customer, it can justify an increase in marketing spend, which can then increase sales numbers and better predict overall business growth.”

11. Conversion Rate

“One important financial metric every marketing and sales team should track is their conversion rate,” says Maxburst’s Andrew Ruditser. “A conversion rate is when a user completes a desired action that a company wants them to make. This can mean making a purchase or simply filling out a form.”

“It’s important to know if your strategy is working enough to push users to complete this action. If your strategies are not working and users are not converting, then you will not benefit financially.”

Editor’s note: Ecommerce businesses can easily track their conversion rate—alongside other key financial metrics like revenue, top-selling products, and average order value—by grabbing this free Google Analytics Ecommerce Overview dashboard.

“In order to know if your strategies are working, you must keep track of your conversion rates. Keeping track of your conversion rates will give you a better understanding of which strategies work best for your company—and which do not. This will help increase your conversion rate, benefiting you financially.”

Editor’s note: Need a quick update on your finance department? With Scorecards, you can select up to 15 metrics and automate performance updates of those metrics to your whole company or specific departments.

12. Cost Per Acquisition

“Cost per acquisition is the lifeforce of your business,” says Eric Tyler of Innovate House Buyers. “This KPI makes your team aware of how many dollars are going out of the door in order for revenue to come back in.”

“If tracked properly, you can compare this metric against the cost per lead in each individual marketing channel that your business uses. This will allow your business to make calculated decisions to cease marketing in a channel—or pivot that channel to become more fruitful.”

Erica Stacey of Scout Digital Training agrees: “It’s essential to understand how much it is costing you to achieve each sale in order to determine whether or not your approach is viable—or to assist with pricing and positioning your product or service.”

“This cost isn’t just a financial one either. You need to consider the time, resources, and energy costs in addition to the hard costs,” Stacey says.

13. Cost Per Lead

“Lead generation is often a responsibility of both sales and marketing, which makes it particularly important for measuring the effectiveness of your efforts,” says Laetitia Caron of MedicalSearch. “If you know the cost per lead, you can prioritize some channels over others and allocate your budget accordingly.”

To determine your cost per lead, REthority’s Sara Butler says to “divide the cost of the campaign you’re running by the number of leads you’ve gotten. It’s simple to calculate and essential to know in order to assess if what you’re doing is working and—more importantly—if it’s cost-effective.”

14. Cost Per Marketing-Qualified Lead (MQL)

“Cost per marketing-qualified lead (MQL) is an extremely important financial KPI for marketing teams to track,” says Ellen Sluder of RingBoost. “Generating impressions is different from generating interest. An MQL has engaged with your marketing materials (including website, downloads, and even social media).”

“Not everyone is in a buying state when they come across your messaging, but if you can obtain and retain MQLs, it’s likely they’ll turn into sales-qualified leads with enough nurturing.”

“Knowing how to balance your marketing portfolio to keep your cost per MQL reasonable requires you to track the costs.”

15. Return on Investment (ROI)

“The main KPI every sales and marketing team should be tracking is return on investment (ROI),” says Colibri Digital Marketing’s Andrew McLoughlin. “At the end of the day, that’s really the primary bit of data that a marketing team is going to need to understand the practical value of their efforts.”

Jennifer Noto of Carolinas IT agrees: “We always track the cost of our events and marketing initiatives through individual marketing campaigns in our CRM. When a campaign is complete, the account managers tie any opportunities to that campaign so we can track ROI.”

“This metric is essential to showing what initiatives are more profitable for marketing,” Noto says.

“Without tracking and understanding ROI, all marketing efforts become no better than a guessing game,” says Dmitrii Kustov of Regex SEO. “Maybe it works; maybe it doesn’t. There is no way to find out which marketing channels are worth investing more in and which channels should have investments taken away.”

16. Lead-to-Client Conversion Rate

“Let’s say you’re a local service company, and you don’t process payments online,” says Sebastien Godin of Performance Marketers. “You generate leads through Google, Facebook, and other online channels. Then you contact these leads, set up an appointment, and offer your service if they are ready to buy from you.”

“But the question is, how do you track your revenue? How do you know how much profit your campaigns are bringing in?”

“Of course, there are advanced methods that allow you to track it pretty well based on email collection, click IDs, and others, but not every small business owner has the ability to build or purchase these tools.”

“So what do you do? You calculate your lead-to-client conversion rate.”

“Once you know that, on average, one lead out of every 10 becomes a client—and that your average order value is, for example, $500—then you know how much a lead is worth to you, and you can calculate your ROI.”

“Even if these are estimations, they can really help you understand the profitability of your campaigns—or of a specific action happening on your website.”

To help service-based businesses calculate their lead-to-client conversion rate, Godin provided this spreadsheet that Performance Marketers uses internally with its service-based clients. To use it, just make a copy of the spreadsheet and fill it out with your company’s/client’s details.

17. Sales Pipeline Leakage

“For years, we were tracking the obvious sales metrics such as customer acquisition costs and total new sales generated per sales cycle,” says Eric Melillo of COFORGE. “However, in taking a more holistic approach to our entire sales pipeline, we realized a slow but steady decline in our proposal to close numbers.”

“We had pipeline leakage, which on the surface wasn’t so easy to spot with a higher number of leads advancing through to proposal.”

“However, once we started tracking this sales metric with a sales dashboard software, we discovered that a few sales reps were shortcutting part of our sales process that affected our close rates. It wasn’t a malicious error by the reps—but it was one that cost revenue.”

“Once we knew we had a problem, it was much easier to hunt for the root cause. The process errors were both easily corrected, and we saw our proposal-to-close rates return to their original baseline within a few short months.”

Editor’s note: HubSpot CRM users can easily keep track of pipeline and sales rep performance with this free HubSpot CRM dashboard that includes pipeline metrics, a sales leaderboard, and trends in closing, closed, and lost deals.

Aligning Sales and Marketing Around Financial Metrics

When we asked our respondents how aligned their marketing and sales team were in terms of tracking the same metrics, only one-third said they had very strong alignment:

If you’re struggling to align your sales and marketing teams around financial KPIs, Leo Friedman of iPromo offers a recommendation for one final metric you can track: the lead lifecycle.

“Tracking the lifecycle of qualified leads through marketing-qualified to sales-qualified helps create synergy between sales and marketing,” Friedman says. “This can increase lead quality and open up the lines of communication between departments for a deeper understanding of lead qualification.”