Table of contents

Would you go out on an open highway with a blindfold covering your eyes?

Probably a bad idea, right?

Well, that’s pretty much the same for running marketing campaigns and not having any concrete benchmarks to help you steer the way and outperform your competition.

But with our comprehensive report on marketing benchmarks, we’ll help you take that blindfold off and better understand where you’re going.

We have listed marketing benchmarks for the 12 metrics for 15 selected industries. These 12 metrics offer a holistic view of a brand’s online visibility, engagement, and conversion capabilities.

And if you want to dig even deeper, you can go down our Benchmark Groups rabbit hole for additional insights and data. It’s free, and you can start within the next 5 minutes.

Shall we start?

- Sessions

- Average Session Duration

- Engagement Rate

- Session Conversion Rate

- Impressions

- Position

- Clicks

- CTR

- Searches

- Views

- Interactions

- Website clicks

Sessions

Across all industries, we found that the median number of sessions for August 2023 is 3.74K.

Here’s a closer look at the number of sessions for each industry:

| Industry | Sessions |

| Apparel & Footwear | 27.05K |

| Automotive | 12.02K |

| Construction | 1.56K |

| Consulting & Professional Services | 2.56K |

| eCommerce & Marketplaces | 14.08K |

| Education | 7.98K |

| Food | 8.09K |

| Health Care | 4.92K |

| Health & Wellness | 5K |

| Information Technology & Services | 4.63K |

| Industrials & Manufacturing | 2.91K |

| Real Estate | 3.54K |

| SaaS | 3.49K |

| Technology | 5.02K |

| Travel & Leisure | 3.94K |

Per data, the Apparel & Footwear industry is leading in sessions. The disparity can be attributed to several factors:

- Apparel & Footwear is a consumer-centric industry and naturally attracts a higher number of online visitors due to frequent shopping, browsing habits, and seasonal changes in fashion. On the other hand, industries like Construction, and Consulting & Professional Services are more B2B-focused, which may result in fewer website sessions because decision-making processes are longer and not based on impulse.

- The Apparel & Footwear industry often employs aggressive online marketing campaigns, utilizing social media influencers, digital ads, and email marketing, which can drive significant traffic to their sites. Other industries may not invest as heavily in such campaigns.

- Apparel brands cultivate brand loyalty and often have a strong community following, leading to repeat website sessions. This kind of community engagement might be less in other industries.

- For Apparel & Footwear, websites often serve as primary sales channels, encouraging more visits. In contrast, the primary purpose of websites in other industries might be informational or for lead generation, resulting in fewer but more targeted sessions.

Expert recommendation: When analyzing page sessions, do you pay attention to which links users click and what other content they check out? If you do, a good way to utilize that data is to create content groupings based on page sessions. This way, you’re building silos that help your users find all the beneficial information they need in one place (or, at least, find it easier).

Average Session Duration

Across all industries, the median average session duration for August 2023 is 2m 38s.

Here’s a closer look at the average session duration for each industry:

| Industry | Average Session Duration |

| Apparel & Footwear | 2m 46s |

| Automotive | 2m 42s |

| Construction | 2m 24s |

| Consulting & Professional Services | 2m 35s |

| eCommerce & Marketplaces | 2m 24s |

| Education | 3m 14s |

| Food | 2m 35s |

| Health Care | 2m 46s |

| Health & Wellness | 2m 44s |

| Information Technology & Services | 2m 42s |

| Industrials & Manufacturing | 2m 41s |

| Real Estate | 2m 34s |

| SaaS | 2m 34s |

| Technology | 2m 46s |

| Travel & Leisure | 3m 16s |

Based on this data, users spend the most time on Travel & Leisure and Education industry websites. This can be because both industries often offer content that is engaging and interesting to users. Travel & Leisure websites may provide detailed travel guides, photos, and user-generated content about exotic destinations, while Education websites usually offer interactive lessons, quizzes, and resources that keep users engaged for longer periods.

Also, in the Travel & Leisure industry, users may spend a significant amount of time researching and planning their trips, looking for accommodations, flights, activities, and reviews. Similarly, in the Education industry, learners may spend extended periods studying, completing assignments, or taking online courses, which leads to longer sessions.

Expert recommendation: One of the best ways to increase the average session duration on your website is to focus on building content libraries, not publications. When we say publications, we’re referring to one-off blog posts that don’t “push” readers to stay on your website and explore further topics. Instead, a better game plan is to pinpoint one high-intent topic and create a library of quality articles around it to get the users to stick around longer.

Engagement Rate

Across all industries, the median engagement rate for August 2023 is 56.23%.

Here’s a closer look at the engagement rate for each industry:

| Industry | Engagement Rate |

| Apparel & Footwear | 60.23% |

| Automotive | 57.83% |

| Construction | 54.92% |

| Consulting & Professional Services | 52.43% |

| eCommerce & Marketplaces | 63.86% |

| Education | 58.1% |

| Food | 53.74% |

| Health Care | 59.15% |

| Health & Wellness | 62.03% |

| Information Technology & Services | 52.98% |

| Industrials & Manufacturing | 58.18% |

| Real Estate | 53.96% |

| SaaS | 52.9% |

| Technology | 54.44% |

| Travel & Leisure | 62.43% |

One of the potential reasons why Ecomms and Marketplaces have a better engagement rate than most industries is that they often use algorithms to recommend products, increasing the chances of user engagement + multiple interactive elements like product zoom, reviews, Q&A, and related product suggestions, encouraging user interaction.

Similarly, Health & Wellness websites – another high engagement rate industry – frequently use a mix of articles, videos, infographics, and interactive tools (like BMI calculators or symptom checkers). The diverse content types can cater to various user preferences, encouraging more interaction.

Expert recommendation: Tracking your engagement (properly) in Google Analytics 4 is still a challenge for most marketers and business owners. To understand the full picture of what’s happening, you need to navigate through several dashboards and extract your data in a separate spreadsheet before you start with the analysis. With Databox, you can do that from one place. With our Google Analytics 4 Engagement Overview Dashboard, you can stay on top of all of your key website engagement insights and see how visitors interact with your most relevant pages, all in one screen. Connect your data, pick out the metrics, and you’re ready to go.

Session Conversion Rate

Across all industries, the median session conversion rate for August 2023 is 2.01%.

Here’s a closer look at the session conversion rate for each industry:

| Industry | Session Conversion Rate |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 3.02% |

| Consulting & Professional Services | 1.56% |

| eCommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | 2.93% |

| Health & Wellness | 1.63% |

| Information Technology & Services | 2.04% |

| Industrials & Manufacturing | 2.29% |

| Real Estate | MISSING |

| SaaS | 2.01% |

| Technology | 1.82% |

| Travel & Leisure | MISSING |

In both Construction and Healthcare, which have the highest session conversion rates, there is often a sense of urgency and a high level of intent among users. People seeking construction services may have an immediate need for home repairs or renovations, while healthcare seekers may be looking for medical care or treatment. This urgency can lead to quicker decision-making and higher session conversion rates.

Expert recommendation: You probably already know how important it is to add social proof to your landing pages when it comes to conversions, but how much time have you spent split-testing the placement of your social proof? Experimenting with social proof placements can be an easy way to increase your conversions, without changing any of the other elements on your page. For example, some of our past respondents found that adding social proof next to CTA buttons can have a significant increase in session conversion rates.

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning. Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

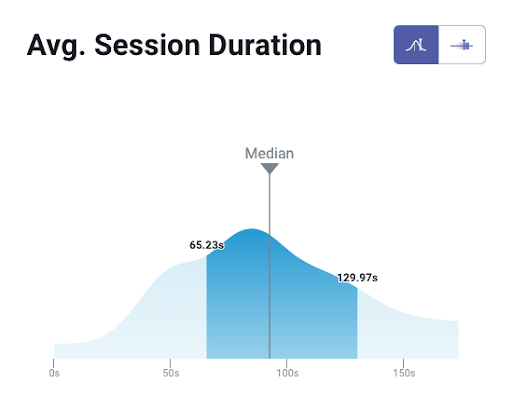

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

Impressions

Across all industries, the median number of impressions for August 2023 is 107.81K.

Here’s a closer look at the number of impressions for each industry:

| Industry | Impressions |

| Apparel & Footwear | 161.79K |

| Automotive | MISSING |

| Construction | 60.65K |

| Consulting & Professional Services | 81.22K |

| eCommerce & Marketplaces | 57.62K |

| Education | 154.42K |

| Food | 156.68K |

| Health Care | 150.53K |

| Health & Wellness | 202.31K |

| Information Technology & Services | 112.48K |

| Industrials & Manufacturing | 121.2K |

| Real Estate | 81.97K |

| SaaS | 112.02K |

| Technology | 165.85K |

| Travel & Leisure | 269.57K |

Industries publishing more content or updating their content regularly might generate more impressions. Frequent content additions or updates signal to search engines that the website is active, making it more likely to appear in search results.

Also, seasonality makes a difference – as August is a holiday season, it makes sense that Travel & Leisure spike. The same might be true for Health and Wellness. This trend is also present in Views – as Travel often involves significant planning and research, potential travellers might view multiple listings to compare accommodations, attractions, or packages before making a decision.

Expert recommendation: To properly track impressions – and all of the relevant complementary metrics that help you understand the big picture – the best approach is to compile all of your numbers in a single place and simplify the analysis process. Unfortunately, this just isn’t as intuitive as it should be in Google Search Console, and if you segment the data manually it ends up taking too much time off your schedule. The solution is to use specialized dashboard software like Databox to track all of this in one place. You can download our Google Search Console Basics Dashboard Template and have your own dashboard up and running in a matter of minutes.

Position

Across all industries, the median position for August 2023 is 30.34.

Here’s a closer look at each industry’s position:

| Industry | Position |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 31.57 |

| Consulting & Professional Services | 35.82 |

| eCommerce & Marketplaces | 20.54 |

| Education | 28.55 |

| Food | 19.01 |

| Health Care | 31.15 |

| Health & Wellness | 27.15 |

| Information Technology & Services | 34.34 |

| Industrials & Manufacturing | 23.41 |

| Real Estate | 30.89 |

| SaaS | 33.89 |

| Technology | 32.28 |

| Travel & Leisure | 25.93 |

Based on August data, Food and Ecommerce & Marketplaces have the best average position on Google, while Consulting & Professional Services and Information Technology are currently at the higher end sitting at 35.82 and 34.34 average positions.

Expert recommendation: The search analytics report in Google Search Console can easily help you improve your search position by identifying the keywords you should further optimize or write new content for. For example, examine queries on your top-ranking content. Take a look at queries with high impressions, low CTR and average position below 40 to uncover content opportunities that will help you expand your content clusters.

Clicks

Across all industries, the median number of clicks for August 2023 is 1.73K.

Here’s a closer look at the number of clicks for each industry:

| Industry | Clicks |

| Apparel & Footwear | 3.58K |

| Automotive | 8.71K |

| Construction | 708 |

| Consulting & Professional Services | 923.5 |

| eCommerce & Marketplaces | 781 |

| Education | 3.72K |

| Food | 3.18K |

| Health Care | 2.06K |

| Health & Wellness | 4.74K |

| Information Technology & Services | 1.61K |

| Industrials & Manufacturing | 2.05K |

| Real Estate | 1.92K |

| SaaS | 1.67K |

| Technology | 2.04K |

| Travel & Leisure | 7.7K |

The Automotive and Travel & Leisure industries received the highest number of clicks in August, and this can be due to several reasons.

For starters, consumers typically conduct extensive research when making automotive purchases or planning vacations. They search for reviews, specifications, pricing, availability, and other details, leading to multiple clicks to gather information.

Furthermore, Travel and Automotive-related decisions often involve significant financial investments. People want to make informed choices, which motivates them to click on multiple search results to compare options and find the best deals.

Expert recommendation: If there’s one tested and proven method to get more clicks, it’s to talk about hot topics. Take AI for example, in the past few months, generative AI has dominated everything from social media content and blog posts to YouTube and video content. And the trend is still going strong. There are several ways you can spot exploding topics to cover, including using Google Search Console to monitor upcoming trends.

Click-Through Rate (CTR)

Across all industries, the median CTR for August 2023 is 1.56%.

Here’s a closer look at the CTR for each industry:

| Industry | CTR |

| Apparel & Footwear | MISSING |

| Automotive | 1.73% |

| Construction | 1.39% |

| Consulting & Professional Services | 1.44% |

| eCommerce & Marketplaces | 0.88% |

| Education | 2.73% |

| Food | 2.23% |

| Health Care | 1.27% |

| Health & Wellness | 1.76% |

| Information Technology & Services | 1.32% |

| Industrials & Manufacturing | 2.23% |

| Real Estate | 2.02% |

| SaaS | 1.43% |

| Technology | 1.44% |

| Travel & Leisure | 2.13% |

Based on our data, industries that are seeing the highest CTR (over 2%) include Education, Industrials & Manufacturing, Travel & Leisure, Real Estate, and Food. The rest fall under the 1% – 2% threshold, while the Ecommerce industry is the only one that stands below it at 0.88%.

Expert recommendation: Meta descriptions are insanely valuable when it comes to attracting more clicks, yet, most marketers still use them to just fit in a few extra keywords instead of generating more visitors. Sure, optimizing it with more keywords is great, but the main focus should be on pitching the page to the users and building enough intrigue so they open your website.

Searches

Across all industries, the median number of searches for August 2023 is 371.

Here’s a closer look at the number of searches for each industry:

| Industry | Searches |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 224 |

| Consulting & Professional Services | 203.5 |

| eCommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | 5.86K |

| Health Care | 596.5 |

| Health & Wellness | 457 |

| Information Technology & Services | 325.5 |

| Industrials & Manufacturing | 316 |

| Real Estate | MISSING |

| SaaS | 368.5 |

| Technology | 561.5 |

| Travel & Leisure | MISSING |

The Food industry heavily outperforms others when it comes to searches. Whether it’s finding a nearby restaurant, trying out a new recipe, or reading reviews about a particular meal, food-related queries are common and have a universal interest.

Furthermore, many food-related searches are location-based. People often search for restaurants, cafes, or food delivery services in their area.

At the same time, Construction has the lowest number of searches. This can be because construction services are typically specialized and not as frequently sought after by the general population. Unlike food, which is a daily necessity, construction services are usually required for specific projects such as building a house, renovating a property, or undertaking commercial construction.

Expert recommendation: Frequently make sure that your NAP on Google My Business is in line with other company listings – e.g. your website, social media profile, external directories, etc. Any NAP consistency discrepancies can cause serious ranking issues, but are easily avoidable if you pay attention.

Views

Across all industries, the median number of views for August 2023 is 1.32K.

Here’s a closer look at the number of views for each industry:

| Industry | Views |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 917 |

| Consulting & Professional Services | 845.5 |

| eCommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | 2.81K |

| Health & Wellness | 1.71K |

| Information Technology & Services | 1.01K |

| Industrials & Manufacturing | 666 |

| Real Estate | 1.13K |

| SaaS | 1.25K |

| Technology | 1.1K |

| Travel & Leisure | 8.91K |

Similar to impressions, one big reason behind the high volume of views in the Travel industry for August can be due to the holiday season. August is a peak month for summer vacations in many parts of the world. Families, individuals, and tourists plan trips and holidays during this time, leading to increased interest in travel-related businesses, such as hotels, restaurants, tour operators, and attractions.

At the same time, travel companies often run marketing campaigns and promotions during the summer months to attract travellers. These campaigns can drive more traffic to their GMB listings as people search for deals and special offers.

Expert recommendation: To stay on top of Google My Business data, some of the main things you need to keep an eye on are the number of people who viewed your listing, monthly GMB searches, customer interactions with your listing, calls received, and other complementary metrics. When you combine the views metric with these insights, you get a complete overview of your listing’s performance on GMB. And that’s exactly what you can do once you download our Google My Business Dashboard. After connecting your account, you can easily drag-and-drop your key metrics and turn them into professional visuals in just a few clicks.

Interactions

Across all industries, the median number of interactions for August 2023 is 203.5.

Here’s a closer look at the number of interactions for each industry:

| Industry | Interactions |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 138 |

| Consulting & Professional Services | 110 |

| eCommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | 362.5 |

| Health & Wellness | 285 |

| Information Technology & Services | 132 |

| Industrials & Manufacturing | 103 |

| Real Estate | 188 |

| SaaS | 143.5 |

| Technology | 159.5 |

| Travel & Leisure | MISSING |

One of the reasons why the Healthcare industry gets such a high number of interactions can be because user intent is high, and their needs are often urgent. People may use Google My Business to find the nearest healthcare facility, especially during emergencies. This can lead to a surge in interactions such as calls, directions, and website visits.

Plus, with COVID-19 flaring up again, healthcare businesses frequently update their Google My Business listings with information on testing sites, vaccination centers, and safety measures. This also leads to increased interactions from users seeking pandemic-related information.

Expert recommendation: Customer reviews are one of the biggest contributors to interactions. When visitors are thinking about whether or not to interact with your business, they usually look at reviews before making a final decision. And don’t make the mistake of only seeking 5-star reviews. Even reviews in the 3.5 to 4.5 range have their place if you respond to them with respect and showcase your business’s dedication to a good customer experience.

Website Clicks

Across all industries, the median number of website clicks for August 2023 is 129.

Here’s a closer look at the number of website clicks for each industry:

| Industry | Website Clicks |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 88 |

| Consulting & Professional Services | 117.5 |

| eCommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | 268 |

| Health & Wellness | 168 |

| Information Technology & Services | 123 |

| Industrials & Manufacturing | MISSING |

| Real Estate | MISSING |

| SaaS | 128 |

| Technology | 115 |

| Travel & Leisure | MISSING |

Just like with interactions, the Healthcare industry leads in the number of website clicks for August, with the Health & Wellness industry coming in second.

Construction has the lowest number of website clicks on Google My Business listings at 88, which is in line with our previous stat on it having the lowest number of searches as well.

Marketing Benchmark Groups for All Industries

All the data we showcased in this article comes from Databox’s Benchmark Groups.

With this product, companies can access performance data and instantly see how they stack up against similar-sized businesses in their niche. You can check out in which areas you’re ahead and which might need a bit more fine-tuning. All of our contributors are 100% anonymous.

Joining Benchmark Groups is completely free and any business can share its data and see how they compare against others in the niche.

And to make the insights in the product even more actionable, we encourage you to join the Benchmark Group relevant to your industry or the group for all industries. With more contributors, we also get more valuable benchmarks for everyone involved.

Below, we compiled a list of all Google Analytics 4, Google Search Console, and Google My Business Benchmark Groups we used when creating this report.

To review the group you’re interested in and join, all you have to do is click on the link:

- Apparel & Footwear

- Automotive

- Construction

- Consulting & Professional Services

- E-commerce & Marketplaces

- Education

- Food

- Health Care

- Health & Wellness

- Information Technology & Services

- Industrials & Manufacturing

- Real Estate

- SaaS

- Technology

- Travel & Leisure

Make Informed Decisions and Better Strategies Based on Real-Time Performance Insights

Are we generating more traffic than our competitors? How are our advertising campaigns performing compared to similar businesses? Is our conversion rate good enough?

These are just some of the questions business owners ask on a regular basis.

And unfortunately, the only way to get the answers to them (until now) has been to look at industry reports or maybe ask some of your peers for their numbers, if you have a good relationship with them.

The thing is, while meaningful, the data in these reports isn’t always relevant to your specific business. Most of the time, you won’t know the size of the sample companies and what industry they’re in.

Databox’s Benchmark Groups is changing the way performance benchmarking works.

Now, companies can see how they stack up against similar-sized businesses in the same industry in a matter of seconds. Free of charge.

You’ll get real-time insight into the performance of others in the industry and know whether your strategies are on par. If they’re not, you’ll know immediately that it’s time for a bit more fine-tuning.

Plus, you’ll have a much easier time spotting emerging trends and hot opportunities, and allocating your resources properly to stay on top of them. The data is 100% anonymous and you can opt out at any time.

For the community to get the best insights, we’re always looking for more businesses to join and share their data for comparison.

So, if you want to take your performance up a notch and see how you stack up against niche competitors, join our free Benchmark Groups and get the data in the next 5 minutes.

FAQ

Databox is a Business Intelligence (BI) platform known for its ease of use, analytics, and shareable dashboards. It helps marketers benchmark performance by allowing them to compare key KPIs—such as sessions, CTR, conversion rate, and engagement rate—against anonymized data from similar companies through industry-specific Benchmark Groups.

By joining a relevant group, you can quickly identify where your marketing efforts excel or fall short, set realistic goals, and visualize comparisons directly within your dashboard. This enables more strategic, data-driven decisions without the need for manual reports or generic benchmarks.

With Databox, you can benchmark 12 essential marketing metrics across industries including marketing sessions, average session duration, engagement rate, and more. Moreover, these metrics cover brand visibility, customer engagement, and conversion tracking on different platforms.

Databox gathers anonymized performance data from thousands of businesses and shares them in Benchmark Groups. Such data is visualized and presented in form of easy to understand dashboards, thus enhancing comprehension and comparison within the industry.

Databox Benchmark Groups help access critical data showcasing competitive performance. An accessible data set identifying areas of excellence and downfall helps track marketing engagements enabling resource allocation to evolving industry standards.

With Databox’s benchmarking features, monitoring your competitors’ click-through rates (CTR) and conversion rates is seamless. The benchmarks highlight areas of potential value for optimization, and most importantly reveal whether campaigns are truly underperforming.