Table of contents

For over a decade, Google Ads and Facebook Ads dominated online advertising. But, that monopoly weakened in 2022. The companies’ combined market share dipped down to 48.4% — the first time they held less than 50% of the market.

Google Ads and Facebook Ads may still be the largest names in digital ads, but the ad spend they lost has to be going somewhere. It seems like companies are diversifying their ad spend, but where else are they going?

We surveyed 52 advertisers and talked to 20 experts on LinkedIn to see how and where they spend their advertising budget. Our investigation dug into which paid advertising channels are the most cost-effective for respondents and what changes in ad spend they predicted for 2023. In addition, we asked survey participants how they optimized their use of each ad platform and referenced data from our Benchmark Groups.

Here’s what we found:

- Our Digital Advertising Performance and Cost Benchmarks

- What Advertising Behavior Do We See in B2B Services and Products?

- 7 Best Practices for Optimizing PPC Campaigns Based on B2B Brand Behavior

- How Do B2C Services and Products Advertise Themselves?

- How B2C Brands Optimize Their PPC Campaigns: 8 Best Practices

- How Do Agencies and Consultants Approach Advertising?

- 8 Ways Agencies and Consultants Optimize Their PPC Campaign Performance

Our Digital Advertising Performance and Cost Benchmarks

Before we go over our survey data, let’s see what data from our Benchmark Groups indicate about ad spend. We took February 2023 data from our Digital Advertising Performance & Cost Benchmarks group (2413 contributors) and cross-referenced it with these groups for individual platforms:

- Google Ads Benchmarks for B2B Companies

- Google Ads Benchmarks for B2C Companies

- Facebook Ads Benchmarks for B2B Companies

- Facebook Ads Benchmarks for B2C Companies

- LinkedIn Ads Benchmarks for B2B companies

- LinkedIn Ads Benchmarks for B2C companies

- Microsoft Advertising Benchmarks for B2B

- Microsoft Advertising Benchmarks for B2C

As you check out this data, keep in mind that participation in a platform-specific group doesn’t always overlap with participation in the Digital Advertising Performance & Cost Benchmarks and vice-versa. We organized our data based on three groups — all companies, business-to-business (B2B) companies, and business-to-consumer (B2C) companies.

Businesses paid this much in cost-per-click (CPC) for each platform, based on the median of our data:

| All Companies | B2B | B2C | |

| Google Ads | $1.19 | $1.50 | $0.96 |

| Facebook Ads | $0.39 | $0.49 | $0.38 |

| LinkedIn Ads | $3.02 | $3.42 | $2.36 |

| Microsoft Advertising | $1.49 | $1.76 | $0.71 |

LinkedIn Ads had the highest CPC by a significant margin, with B2B spending the highest rate at $3.42 per click. Meanwhile, Facebook Ads offered the lowest CPC, with all rates under $0.50 per click.

Companies spent the following median amounts on each ad platform in February:

| All Companies | B2B | B2C | |

| Google Ads | $1,912.84 | $2,076.76 | $2,569.71 |

| Facebook Ads | $1,503.44 | $1,402.14 | $1853.68 |

| LinkedIn Ads | $1,387.59 | $1,646.16 | $1,117.55 |

| Microsoft Advertising | $1,698.74 | $2,250.85 | $1,612.32 |

Despite LinkedIn’s high CPC, B2B companies, B2C companies, and companies in general dedicated the most total spend to Google Ads. B2C companies spent more on Facebook Ads and Google Ads than B2B, while B2B paid more for LinkedIn Ads and Microsoft Advertising.

Now, let’s look at the median number of clicks for each group:

| All Companies | B2B | B2C | |

| Google Ads | 1410 | 1310 | 2090 |

| Facebook Ads | 4710 | 3520 | 4710 |

| LinkedIn Ads | 366.5 | 388 | 376 |

| Microsoft Advertising | 806.5 | 884.5 | 1260 |

Companies in every group got the most clicks from Facebook Advertising. B2C companies got more clicks than B2C businesses on all platforms except for LinkedIn Ads, but they only had eight fewer clicks.

Businesses had the following median number of impressions per platform:

| All Companies | B2B | B2C | |

| Google Ads | 44.72K | 37.39K | 65.98K |

| Facebook Ads | 263.19K | 240.19K | 269.88K |

| LinkedIn Ads | 54.27K | 54.27K | 52.97K |

| Microsoft Advertising | 24.3K | 54.92K | 17.82K |

Facebook Ads provided an immensely higher number impressions than any other platform for all companies, B2B companies, and B2C companies.

Considering these numbers so far, you may wonder how they translate into leads and conversions. Let’s see the median leads and conversions per platform for each group:

| All Companies | B2B | B2C | |

| Google Ads | 55 | 45 | 78 |

| Facebook Ads | 40.5 | 36 | 35 |

| LinkedIn Ads | 8 | 8.5 | N/A |

| Microsoft Advertising | 16.5 | 17.5 | N/A |

Google Ads provided the highest number of leads and conversions, with Facebook Ads coming in second. We did not have enough data to determine the median leads and conversions for LinkedIn Ads or Microsoft Advertising for the B2C group.

Looking at these numbers, it seems that Google Ads and Facebook Ads provided the highest return on investment for group participants. Google Ads excelled at generating leads, especially for B2C companies, and Facebook Ads raised brand awareness through a significant number of impressions.

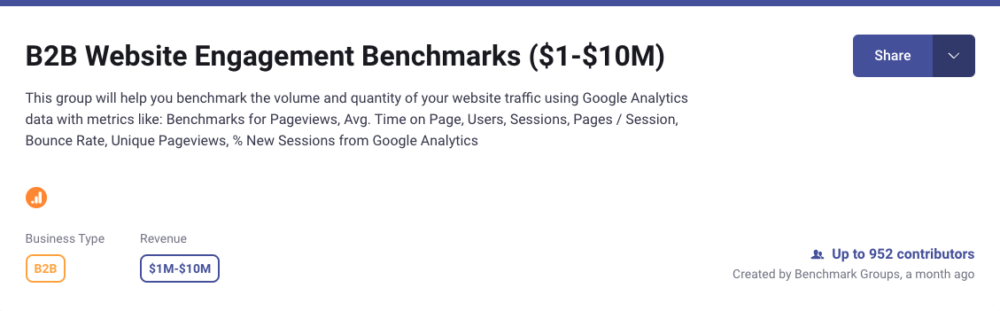

By the way, if you’d like to access the current version of this data at any time, you can join any of these Benchmark Groups yourself. You just need to have the same data source in your Databox account and match the company type (B2B or B2C).

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning. Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

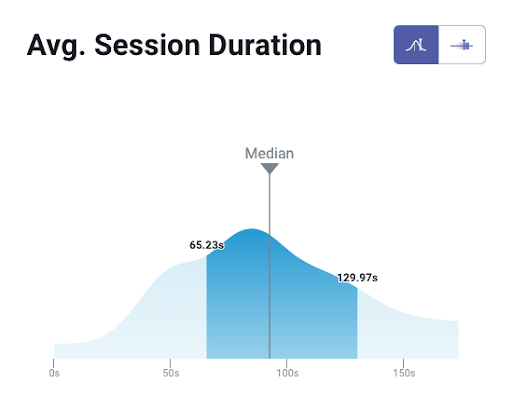

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

What Advertising Behavior Do We See in Advertisers for B2B Services and Products?

Out of the advertisers who responded to our survey, 23.08% advertise B2B services, and 5.77% advertise B2B products. We combined these categories into a B2B group that makes up 28.85% of all respondents. Here are the takeaways we found from their responses and our LinkedIn discussion:

- What Were B2B Companies’ Monthly Paid Ads Budgets?

- Ad Budget Changes for B2B Companies in 2023

- B2B Companies’ Most Effective Paid Ad Channels

Monthly Paid Ads Budget for B2B Companies

B2B businesses mainly invest their advertising money in Google Ads, Facebook Ads, and LinkedIn Ads. Microsoft Ads, TikTok Ads, and, Snapchat Ads are the least popular options, with more than 40% of respondents investing nothing in these platforms.

The marketing manager at Farseer, Vjeko Škarica’s, experience with advertising matches these results. “I work in a B2B SaaS space (Farseer), and we’re currently doing a combo of Google Search and LinkedIn Ads for lower funnel stages and some light YouTube Ads and Google Display for the upper funnel,” Škarica says.

Škarica continues, “As a B2B SaaS marketer, it’s a no-brainer for me to use LinkedIn. Yeah, it’s expensive, but the targeting is significantly better than on any other platform, and it pays out in the long run. I’ve been thinking about experimenting with Twitter lately but haven’t done it so far.”

SoStocked’s Chelsea Cohen puts platform choices in terms of audience location:

“We allocate advertising budget based on the platforms with the highest presence of our target audience. Platforms like TikTok, Snapchat, and even Instagram are more focused on B2C audiences. They’re platforms for consumerism. On the other hand, LinkedIn is known as the official professional network. Today, Facebook is gaining traction in this arena, though more through private business-related communities. It only makes sense for us to direct our investments toward platforms that cater best to our client base.”

Want to get highlighted in our next report? Become a contributor now

Related: No Ad Budget? 20 Marketers Share How to Grow Your Audience on Facebook for Free

Ad Budget Changes for B2B Companies in 2023

Looking at their changes in ad budget for 2023, it seems that B2B businesses doubled down on their most effective platforms. More than half of B2B respondents stated they increased their Google Ads budget. Forty percent of the B2B group also increased their budgets for LinkedIn Ads and Facebook Ads.

B2B Companies’ Most Effective Paid Ad Channels

The B2B participants in our survey name the following platforms the best options for specific goals:

- Brand awareness: Google Ads

- Lead generation: Facebook Ads

- Sales: Google Ads

- Retargeting: Facebook Ads and LinkedIn Ads

- Customer retention: LinkedIn Ads

- Traffic: LinkedIn Ads

We also asked about the best platforms for database growth and reputation management, but most respondents stated they didn’t use ads for those goals.

At Syte, head of demand generation Shahar Heimann categorizes each platform by its relation to demand. “For Syte, a B2B SaaS solution, it was always about LinkedIn for creating demand, and Google (and also some LinkedIn) for capturing demand. The ability to create lists in our CRM based on different cohorts and then pushing them to LinkedIn is just invaluable, allowing us to create complex ad sequences to drive pipeline size and velocity.”

The head of growth at Speakap, Mina Kozman, highlights the importance of choosing channels by their goals and place in the funnel. According to Kozman, framing a platform’s effectiveness solely by its cost-effectiveness “reduces the buyer journey to a unidimensional moment in time.”

Kozman explains, “No B2B buyer would make a significant purchase decision, impulsively. No single piece of content/landing page/ad-copy is able to ‘close the deal’.

In my humble opinion, trying to reduce the media mix into a single channel, with the intent of doubling down on it and pulling investments in other (allegedly) more cost-efficient ones, lead to elimination of crucial touchpoints. Those touchpoints may have not appeared on the ‘tracked’ conversion path, because of flawed attribution models (which they all are).”

As you figure out what platforms work best for your B2B business, consider their place in the customer journey as well as their ability to directly generate leads and conversions.

Related: Who Gets the Best Use Out of Google Ads?

7 Best Practices for Optimizing PPC Campaigns Based on B2B Brand Behavior

When we asked B2B advertisers about their budget management habits, we gathered these best practices based on their behavior:

- Monitor CPC Multiple Times a Week

- Check Campaign Performance and Switch Budgets Between Ads Every Week

- Reduce Paid Social CPC by Updating Audience Targeting

- Lower Paid Search CPC by Using Long Tail Keywords and New Keyword Match Types

- Increase Impressions in Paid Social and Paid Search by Increasing Campaign Budget

- Boost Paid Social Conversions With a Multi-Pronged Approach

- Improve Conversions from Paid Search by Testing Multiple Offers

1. Monitor CPC Multiple Times a Week

Among B2B respondents, 33.33% check their CPC multiple times a week. This habit corresponds with B2B advertisers’ mentions of adjusting their advertising based on changes in their target audience.

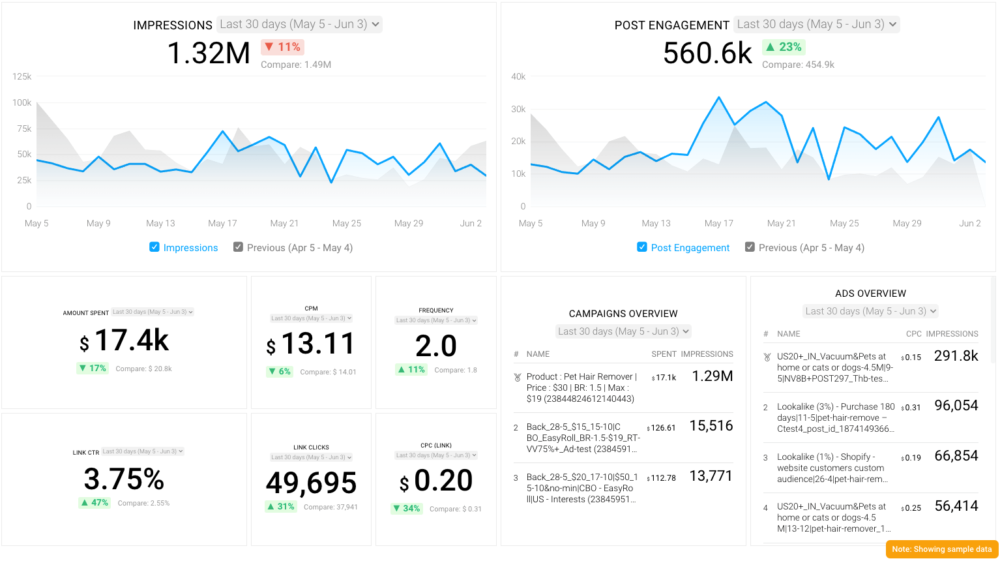

PRO TIP: Here Is Your Go-To Dashboard for Monitoring the Performance of All of Your PPC Campaigns in One Place

To monitor the performance of your pay-per-click campaigns, you probably have to log into multiple tools and spend hours compiling a comprehensive report. But, with Databox, PPC reporting doesn’t have to be a time-consuming chore anymore. Now you can instantly review all of your paid campaigns in a single dashboard that monitors fundamental metrics, such as:

- Total ad spend. How much have you spent on Facebook Ads and Google Ads? Monitor both channels to measure your ROI and determine which campaigns deserve further investment.

- Facebook Ads account overview. Track engagement metrics like impressions, click-through rate, cost per click, and more, to determine which campaigns are generating the highest ROI.

- Google Ads keyword overview. See which keywords are generating the most impressions and clicks from your Google Ads campaigns.

- Cost per conversion from Google Ads. Allocate your ad spend better by measuring how much each conversion costs.

And much more.

Now you can benefit from the experience of PPC experts, who have put together a plug-and-play Databox template showing all the key insights you need to optimize your paid campaigns for conversions. It’s simple to implement and start using as a standalone dashboard or in PPC reports.

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Facebook Ads & Google Ads accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

2. Check Campaign Performance and Switch Budgets Between Ads Every Week

In line with their tendency to check CPC frequently, B2B advertisers also change their budgets often. Over half of the B2B group — 53.33% — check campaign performance and switch budgets every week.

3. Reduce Paid Social CPC by Updating Audience Targeting

The B2B group’s CPC management for social ads also prioritizes audience targeting. Just over 30% keep CPC lower by updating their targeting parameters.

Related: Facebook CPC: 17 Ways to Reduce Your Advertising Costs on Facebook

4. Lower Paid Search CPC by Using Long Tail Keywords and New Keyword Match Types

B2B advertisers aim for specificity in paid search as well when managing their CPC. Their top two strategies are to use long-tail keywords and new keyword match types.

Related: 42 Paid Marketers Share Strategies for Lowering Your AdWords CPC

5. Increase Impressions in Paid Social and Paid Search by Increasing Campaign Budget

Looking at B2B advertisers’ responses to how they increase impressions for social and search ads, we saw the same pattern for both platform types. Their top strategy by far is to increase their campaign budget.

Related: Cost-Efficiency Showdown: Paid Search vs Paid Social for SMB Advertising

6. Boost Paid Social Conversions With a Multi-Pronged Approach

When we asked B2B advertisers about their tactics for increasing conversions from social ads, multiple strategies tied for the top spot. Their favorite options are:

- Improving/optimizing their landing pages

- Creating custom landing pages for each of their audience segments

- Running split tests to optimize ad copy and creative

- Testing multiple offers

- Testing multiple ad formats

- Optimizing ads for conversions

7. Improve Conversions from Paid Search by Testing Multiple Offers

In contrast to their social strategies, B2B tactics for improving conversions for paid search mainly focus on one method: testing multiple offers.

Related: Conversion Rate Optimization: How to Discover Your Next A/B Test

How Do B2C Services and Products Advertise Themselves?

Our survey’s respondents included 13.46% B2C services advertisers and 15.38% B2C product advertisers, making up a combined total of 28.84% of participants. We discovered these trends in their responses and insights from our LinkedIn discussion:

- Monthly Paid Ads Budgets for B2C Companies

- Changes in Ad Budget for B2C Companies in 2023

- Best Paid Ad Channels for B2C Brands

Monthly Paid Ads Budgets for B2C Companies

B2C services and product advertisers mainly invest in Google Ads, followed by Facebook Ads and Instagram Ads. More than 40% answered they don’t invest in any ads for LinkedIn Ads or Snapchat Ads.

At Ninja Transfers, Tom Golubovich uses audience data to choose where to invest ad spend. Golubovich says, “We take a data-driven approach to decide where to focus our advertising efforts. We analyze past ad performance to identify the platforms and channels that have been most effective in reaching our target audience and driving desired outcomes.”

Additionally, we use trending data related to our audience to identify new opportunities and emerging channels that may be worth exploring. By leveraging both historical and real-time data, we can make informed decisions on where to allocate our advertising budget and optimize our campaigns for maximum impact,” Golubovich adds.

Changes in Ad Budget for B2C Companies in 2023

B2C budgets in 2023 mainly increased ad spend on Google Ads and Facebook Ads. Even though Instagram is another popular channel for B2C companies, Instagram Ads spending tended to stay the same.

Sasha Matviienko from SimplyPro Appliance Repair invested primarily in paid search platforms this year due to diminishing returns from paid social. “We initially started with Google Ads because this is where prospects have the intent to get our service. We then added Facebook and Instagram Ads, but last year performance decreased, and our decision was to reinvest more money into Google and Bing because that’s where we saw the best results in the past,” Matviienko tells us.

Related: Will Increasing Your Facebook Ad Budget Increase Sales?

Best Paid Ad Channels for B2C Brands

Google Ads and Facebook Ads meet B2C goals most effectively. Here are the top channels by B2C business goal:

- Brand awareness: Facebook Ads

- Lead generation: Google Ads

- Sales: Google Ads

- Retargeting: Facebook Ads

- Traffic: Google Ads

Most B2C respondents didn’t use ads for database growth, customer retention, or reputation management.

Related: 8 Ways to Choose the Right Facebook Ad Objectives for Your Agency or SME

For cost efficiency, Duncan Jones, head of marketing at Cluey, prefers paid partnerships directly between Cluey and other companies. They can’t always top Google search ads, though.

“But when it comes to volume – Google Search is still the number one driver of volume of new customers along with an acceptable cost per new customer (including both the media cost to generate a lead and the sales team’s cost to call and convert it). This is true for both our core, high-intent search terms and additional low-intent search terms being carried out by our target market but not specifically about our service. The way Google is changing (trying to monetise low-quality areas of their networks whilst at the same time removing advertiser controls), I’m not sure this will be the case in the future.”

Want to get highlighted in our next report? Become a contributor now

Google Ads can do plenty of the heavy lifting for core metrics like impressions and conversions. But, consider how partnerships with smaller names can achieve more specific goals.

Related: A Detailed Guide to Partnership Marketing: Modern Way to Grow Your Business

How B2C Brands Optimize Their PPC Campaigns: 8 Best Practices

We also checked in with B2C companies to see what their strategies for managing ad budgets consisted of. Their answers revealed these best practices for their industry:

- Monitor CPC on a Weekly Basis

- Check Campaign Performance and Switch Budgets Between Ads Every Week

- Lower Paid Social CPC by Updating Audience Targeting

- Reduce Paid Search CPC by Testing New Keyword Variations

- Amplify Impressions in Paid Social by Optimizing Audience Targeting

- Increase Impressions in Paid Search by Adjusting Geo-Targeting Settings

- Improve Conversions from Paid Social Campaigns by Running Multiple Split Tests

- Boost Conversions from Paid Search by Optimizing Your Landing Page

1. Monitor CPC on a Weekly Basis

B2C brands tend to monitor their CPC less frequently than their B2B counterparts. Among B2C respondents, 46.67% check CPC every week.

PRO TIP: Here Is Your Go-To Dashboard for Monitoring Your Google Ads Campaigns in One Place

To monitor and improve the performance of your Google Ads campaigns, you can spend hours running a variety of reports and compiling selected metrics manually into one dashboard. Or, you can pull all your data automatically into one dashboard with Databox.

You can instantly review all of your campaigns and drill down on important metrics, such as:

- Campaign overview. Which ads generate the most engagement? Get complete insight into your active Google Ads campaigns and easily track their performance.

- Impressions. View the total number of times your ad was shown/seen on Google or the Google Network daily, weekly, monthly, yearly, or within the specified date range.

- Clicks. Visually monitor the number of clicks your ad receives daily. It helps track this data as it is a good indicator that your ad is compelling and valuable to the people who come across it.

- Cost. How much do I pay for each click on my ads? See the amount you pay on average for each click your ad receives.

- Conversions. How many users completed the desired action after clicking on my ads? Learn whether your ad clicks are resulting in users taking some desired action.

- Cost per Conversion (CPC). How much on average does conversion on my ads cost? See how much you get charged for each desired action taken by a user after coming across your ad.

Now you can benefit from the experience of our Google Ads experts, who have put together a plug-and-play Databox template showing all the key insights you need to optimize your Google Ads campaigns for conversion and ROI. It’s simple to implement and start using as a standalone dashboard or in PPC reports!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Google Ads account with Databox.

Step 3: Watch your dashboard populate in seconds.

2. Check Campaign Performance and Switch Budgets Between Ads Every Week

But, B2C respondents have similar budget-switching schedules to B2B participants. They also prefer to change ad budgets every week.

3. Lower Paid Social CPC by Updating Audience Targeting

B2C participants also use B2B respondents’ favorite tactics for lowering paid social CPC. Like B2B businesses, they mainly update their audience targeting to keep CPC costs down.

4. Reduce Paid Search CPC by Testing New Keyword Variations

Here’s where B2C strategies start to differ from B2B strategies. Forty percent of B2C respondents test new keyword variations to manage their CPC costs.

5. Amplify Impressions in Paid Social by Optimizing Audience Targeting

The B2C crowd in our survey prefer to work with the budget they already had to boost paid social impressions over increasing or changing their budgets. Their favorite technique for getting more impressions is to optimize their audience targeting.

6. Increase Impressions in Paid Search by Adjusting Geo-Targeting Settings

Local search features like Google My Business can work especially well for B2C businesses trying to gain customers in their area. The B2C participants in our survey chose adjusting geo-targeting settings as their top strategy for increasing search ad impressions.

7. Improve Conversions from Paid Social Campaigns by Running Multiple Split Tests

B2C respondents split test their ads based on multiple factors when aiming to improve paid social conversions. They have a tie among their top strategies — running split tests to optimize ad copy and creative and testing multiple ad formats.

Related Reading: How to Run Effective A/B Tests According to 28 Marketing Experts

8. Boost Conversions from Paid Search by Optimizing Your Landing Page

When B2C participants want to improve their paid search conversions, they like to turn to their landing pages. While this tactic is B2B respondents’ second favorite method, the top B2B tactic — testing multiple offers — isn’t nearly as popular with B2C companies.

PRO TIP: Not sure whether your landing pages are optimized properly? Watch this video to learn how to build a dashboard that will show you:

- Your landing pages’ overall conversion rate

- Your most successful landing pages, split up by your end-goal

- A visual pipeline view of your landing pages performance at each stage of the customer journey

How Do Agencies and Consultants Approach Advertising?

Agencies and consultants made up 42.31% of survey participants, making them the largest group. Marketing professionals from agencies were also very prevalent in our LinkedIn discussion. Let’s see what their experiences are with advertising budgets and goals:

- Agencies and Consultants Monthly Paid Ads Budgets

- How Did Ad Budgets Change for Agencies and Consultants in 2023?

- Most Effective Paid Ad Channels for Agencies and Consultants

Agencies and Consultants’ Monthly Paid Ads Budgets

Google Ads is the most popular platform for agencies and consultants to invest their ad budgets in, followed by Facebook Ads, Instagram Ads, and LinkedIn Ads. More than 60% of agency and consultant advertisers stated they don’t invest in Snapchat Ads, TikTok Ads, Twitter Ads, and Microsoft Ads.

At Level 343, Gabriella Sannino decides what channels to invest in based on the client’s needs: “We discuss this with the client. Together, we consider several factors when deciding on where to allocate their advertising budget. These include the target audience, the effectiveness of different marketing channels in reaching that audience, the company’s goals and objectives, and the available budget. We also conduct market research and analyze data on customer behavior and preferences to inform their decision-making process. Ultimately, the goal is to maximize the return on investment by selecting advertising channels that are most likely to reach and engage with their target audience while staying within their budget constraints.”

Jonathan Aufray from GrowthHackers determines ad spend with audience and performance research at multiple stages of a campaign. “To decide where to invest the advertising budget, we study our ideal customers to see where they’re active and engaged. We also study our competitors to reverse engineer their strategies. Finally, after launching the ads, we analyze the results to either optimize the campaigns, pause them, or double down on them depending on the data we collect,” Aufray says.

Matt Fehrmann, VP of Business Development at Zgraph, prefers to invest in both Google Ads and Meta (Facebook and Instagram) ads because of what they bring to the table separately. Fehrmann explains, “I may have the unpopular opinion here, but I saw the greatest ROAS from Google Ads, with a big caveat: Most of the clients were B2C, specifically in these verticals: Law, Home Contractors/Services, Tourism, Economic Development, Real Estate. As such, many qualify for Google Local Services ads, which performed well, and Google Search/Display/Video was used too.”

Fehrmann says, “When we tracked the return on ad spend though, Google Ads came out ahead of Meta ads (Facebook, IG). However, when we tracked cost per lead, Facebook and Instagram came out ahead with lower numbers. The issue was the sales conversion rates. With our client-base and to be honest, our management/optimization, leads obtained from Google Ads were higher quality and led to sales conversions more often. But I really prefer to use both in combination, if possible.”

In addition, Fehrmann chalks up some of the differences to reporting tools. It can be tricky to access ROAS data for clients with certain software stacks.

Senior Consultant of MOps and ABM at Compound Growth Marketing, Quincy Johnson, finds success in dedicating some ad budget to LinkedIn Ads: “In the space we are in, shifting to LinkedIn has been successful. Acquisition costs are on the expensive side, but being able to optimize ads on targeting, intent, and buyer journey stages allows companies to prioritize and identify their weighted funnel strategies. Given this, we know Awareness is going to be cheapish, where Consideration and Decision are going to be a bit more expensive but tend to have more velocity based on their intent.”

How Did Ad Budgets Change for Agencies and Consultants in 2023?

About half of agencies and consultants reported increasing their budgets for Google Ads, making it the most popular choice for this group.

These results match what Brian Andreasen, Google Ads specialist and founder at WydeMedia, predicted about upcoming spending trends.

“The last 12 months contain the big TikTok wave which I am seeing dying a bit out now, and Google and Meta are getting more and more traction again, so I think digital ad spend on the O.G. channels like Google and Meta will return to their natural level in the next 12 months.”

Want to get highlighted in our next report? Become a contributor now

Andreasen doesn’t see platform diversification as a bad thing, however. “Customer journeys are more complex now than 7-10 years ago and more and more platforms will continue to develop over the next 10 years,” he says.

Related: 5 Ways to Calculate Profitability for Your Agency Clients and Projects

Most Effective Paid Ad Channels for Agencies and Consultants

Like B2C advertisers, agencies and consultants achieve many of their goals using Google Ads and Facebook Ads. They voted for the most effective platform for common business goals as follows:

- Brand awareness: Facebook Ads

- Lead generation: Google Ads

- Sales: Google Ads

- Retargeting: Google Ads

- Database growth: Google Ads

- Customer retention: Facebook Ads

- Traffic: Google Ads

Most respondents in this group don’t use ads for reputation management. It’s also worth noting that just as many respondents don’t use ads for database growth at all as those who use Google Ads for that goal.

Jason Lauritzen, Director of Programmatic at AUDIENCEX, encourages you to consider audience, platform changes, and how channels work together when determining how channels meet different goals. “There is no ‘silver bullet’ paid channel; it will vary from company to company and vertical to vertical, as well as from B2C/DTC to B2B,” he says.

Lauritzen points out how Meta’s reporting tools contributed to the platform’s drop in ad spend. “One of the main reasons we saw such a huge dip in Meta (Facebook) spend is not because Meta suddenly became less efficient. When the iOS 14.5 update hit Meta, Meta shifted from large conversion windows to a 7-day click and 1-day view window (and threw modeled conversions in the mix, too). Since the majority of marketers never knew the incrementality of Meta spend but relied on Meta to grade its own homework, they saw ‘performance’ drop.”

He continues, “When you shrink attribution windows so much, things like CPA, CAC, ROAS, etc. look worse, but savvy marketers that had previously run incrementality tests and/or done marketing mix modeling (MMM) already had a much better read on their realistic Meta performance and didn’t pull back as much and still saw the saw backend results for their businesses.”

This explanation leads to Lauritzen’s greater point: “Marketers need to focus on incrementality by position in the funnel (is the top of the funnel more incremental than bottom?), and how channels work together to make conversion rates better or worse, e.g., maybe display ads aren’t incremental on their own but when combined with paid search, they are.”

8 Ways Agencies and Consultants Optimize Their PPC Campaign Performance

When we examined agencies and consultants’ answers to our survey questions regarding their advertising habits, we discovered these 8 tips:

- Monitor CPC Many Times a Week

- Check Campaign Performance and Switch Budgets Between Ads (At Least) Every Week

- Reduce Paid Social CPC by Updating Audience Targeting and Using Custom Audiences

- Lower Paid Search CPC by Testing New Keyword Match Types

- Increase Impressions in Paid Social by Optimizing Audience Targeting and Using Videos to Encourage Engagement

- Amplify Impressions in Paid Search by Adjusting Geo-Targeting Settings

- Boost Conversions from Paid Social Campaigns by Testing Multiple Offers

- Improve Conversions from Paid Search by Optimizing Ads for Conversions

1. Monitor CPC Many Times a Week

Agencies and consultants split the difference between B2B and B2C CPC-monitoring habits. They check in at least once per week, with 40.9% monitoring multiple times a week, and 36.36% monitoring weekly.

PRO TIP: What’s the overall engagement of your ad campaigns?

Want to make sure your Meta ads are performing and trending in the right direction across platforms? There are several types of metrics you should track, from costs to campaign engagement to ad-level engagement, and so on.

Here are a few we’d recommend focusing on.

- Cost per click (CPC): How much are you paying for each click from your ad campaign? CPC is one of the most commonly tracked metrics, and for good reason, as if this is high, it’s more likely your overall return on investment will be lower.

- Cost per thousand impressions (CPM): If your ad impressions are low, it’s a good bet everything else (CPC, overall costs, etc.) will be higher. Also, if your impressions are low, your targeting could be too narrow. Either way, it’s important to track and make adjustments when needed.

- Ad frequency: How often are people seeing your ads in their news feed? Again, this could signal larger issues with targeting, competition, ad quality, and more. So keep a close eye on it.

- Impressions: A high number of impressions indicates that your ad is well optimized for the platform and your audience.

- Amount spent: Tracking the estimated amount of money you’ve spent on your campaigns, ad set or individual ad will show you if you staying within your budget and which campaigns are the most cost-effective.

Tracking these metrics in Facebook Ads Manager can be overwhelming since the tool is not easy to navigate and the visualizations are quite limiting. It’s also a bit time-consuming to combine all the metrics you need in one view.

We’ve made this easier by building a plug-and-play Facebook Ads dashboard that takes your data and automatically visualizes the right metrics to give you an in-depth analysis of your ad performance.

With this Facebook Ads dashboard, you can quickly discover your most popular ads and see which campaigns have the highest ROI, including details such as:

- What are your highest performance Facebook Ad campaigns? (impressions by campaign)

- How many clicks do your ads receive? (click-through rate)

- Are your ad campaigns under or over budget? (cost per thousand impressions)

- What are your most cost-efficient ad campaigns? (amount spent by campaign)

- How often are people seeing your ads in their news feed? (ad frequency)

And more…

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Facebook Ads account with Databox.

Step 3: Watch your dashboard populate in seconds.

2. Check Campaign Performance and Switch Budgets Between Ads (At Least) Every Week

Respondents in the agency and consultant group had a much more even spread among answers related to their budget-switching schedule compared to their CPC-monitoring habits. However, a weekly cadence came out on top at 31.82%, with multiple times a week following with 22.73%.

3. Reduce Paid Social CPC by Updating Audience Targeting and Using Custom Audiences

Advertisers working for agencies and consultants opted for updating audience targeting and managing custom audiences to keep CPC costs low. Since they work with so many different accounts, it makes sense that agencies and consultants keep a close eye on audience targeting to cater each campaign to their clients.

Related Reading: How to Create High-Converting Facebook Custom Audiences

4. Lower Paid Search CPC by Testing New Keyword Match Types

Among agencies and consultants, more than 30% prefer to try new keyword match types when managing their CPC costs. Note that this is one of the B2B crowd’s favorite tactics as well.

5. Increase Impressions in Paid Social by Optimizing Audience Targeting and Using Videos to Encourage Engagement

Like B2C respondents, agencies and consultants optimize audience targeting to increase paid social impressions, but they add another tactic into the mix — encouraging engagement with videos. This trend might correlate with the fact that the experts who mentioned TikTok in our LinkedIn discussion mainly came from agencies.

6. Amplify Impressions in Paid Search by Adjusting Geo-Targeting Settings

Agencies and consultants take a similar route to B2C companies when trying to boost paid search impressions. They prefer to adjust their geo-targeting settings over running split tests or changing other aspects of the campaign.

7. Boost Conversions from Paid Social Campaigns by Testing Multiple Offers

In situations where they need to improve paid social conversions, agencies and consultants like to test multiple offers.

8. Improve Conversions from Paid Search by Optimizing Ads for Conversions

Agencies and consultants count on their campaign algorithm when they want to boost paid search conversions. They tend to use options like Google Ads’ “optimize for conversions” goal to display ads effectively.

Optimize Your Ad Spend With Databox Benchmark Groups

Google Ads and Facebook Ads still provide good value for their cost, despite their decrease in market share this year. But, of course, they aren’t a one-size-fits-all solution. You need to understand your industry, audience, and goals to make the most of your advertising budget.

That’s where Databox can help. You can benefit from joining Benchmark Groups for your platform and industry, not to mention our data tracking tools. You’ll get access to these groups when you sign up for a free Databox account and contribute your data:

- Google Ads Benchmarks for B2B Companies

- Google Ads Benchmarks for B2C Companies

- Facebook Ads Benchmarks for B2B Companies

- Facebook Ads Benchmarks for B2C Companies

- LinkedIn Ads Benchmarks for B2B companies

- LinkedIn Ads Benchmarks for B2C companies

- Microsoft Advertising Benchmarks for B2B

- Microsoft Advertising Benchmarks for B2C

- Digital Advertising Performance & Cost Benchmarks

Using data from hundreds of other businesses, you’ll get an idea of which platforms work best for different metrics. Combine your benchmark data with Databox’s KPI-tracking features, and you’ll be able to monitor where your ads are delivering value.

Why not give it a shot? It’s free. Sign up for Databox Benchmarks today.