Table of contents

Becoming profitable (and staying there) with PPC advertising is getting harder each year, especially for smaller businesses.

And if you’re only relying on your own data and have no insight into how your competition is performing… things get that much harder.

Are your ads getting enough clicks? Is your profit margin in line with what others in the industry are saying?

These are just some questions you’ll need answers to in order to optimize your PPC strategies accordingly.

That’s why in this report, we examined PPC advertising metrics such as clicks, CTR, CPC, and impressions, across all the biggest PPC advertising networks like Google Ads, Facebook Ads, and LinkedIn Ads and compiled benchmarks that can shed more light on the competitive landscape right now.

For more insight into other benchmarks, you can join our Benchmark Groups for free and get instant access to a variety of groups most relevant to your business.

We’ve divided the insights into:

Impressions

First, let’s start with the number of impressions advertisers are seeing across the board:

Google Ads Impressions

Across all industries, the median number of impressions on Google Ads for October 2023 was 42.87K.

Let’s take a closer look at Google Ads impressions across different industries:

| Industry | Impressions (Google Ads) |

| Apparel & Footwear | 337.96K |

| Automotive | 114.04K |

| Construction | 13.39K |

| Consulting & Professional Services | 35.12K |

| Ecommerce & Marketplaces | 475.78K |

| Education | 21.89K |

| Food | 144.55K |

| Health Care | 7.07K |

| Health & Wellness | 6.84K |

| Information Technology & Services | 46.7K |

| Industrials & Manufacturing | 56.98K |

| Real Estate | 32.82K |

| SaaS | 46.99K |

| Technology | 49.64K |

| Travel & Leisure | 29.46K |

Apparel & Footwear and Ecommerce and Marketplaces have the highest number of impressions, indicating a strong focus on Google as an advertising platform.

Apparel & Footwear present regular purchases and consumers frequently browse online for the latest trends and deals. This is especially true in the last few years in which we’ve seen a huge shift toward online shopping.

And Ecommerce platforms, in general, cater to a wide range of products, making them a common destination for online shoppers that are looking for different products – from dog toys to beauty products.

Expert recommendation: Are you taking advantage of responsive search ads (RSA) on Google Ads? This feature can be a great way to quickly find winning headlines and copy and boost your Google Ads impressions. You write several headlines and Meta descriptions that you want to test out, and then let Google automatically test the different combinations to optimize for the best-performing ad.

Facebook Ads Impressions

Across all industries, the median number of impressions on Facebook Ads for October 2023 was 250.71K.

Let’s take a closer look at Facebook Ads impressions across different industries:

| Industry | Impressions (Facebook Ads) |

| Apparel & Footwear | 624.42K |

| Automotive | 376.56K |

| Construction | 146.52K |

| Consulting & Professional Services | 226.65K |

| Ecommerce & Marketplaces | 794.64K |

| Education | 218.01K |

| Food | 448.36K |

| Health Care | 71.03K |

| Health & Wellness | 82.08K |

| Information Technology & Services | 295.48K |

| Industrials & Manufacturing | 521.23K |

| Real Estate | 174.38K |

| SaaS | 187.69K |

| Technology | 251.15K |

| Travel & Leisure | 295.96K |

Again, we see Apparel & Footwear and Ecommerce & Marketplaces industries record the highest number of impressions on the platform. One big reason for this could be the visual appeal of Facebook.

These two industries often involve visually appealing products and industries that can showcase their products through high-quality images or videos tend to attract more attention on Facebook.

Facebook Ads generally show higher impressions across industries compared to Google and LinkedIn, indicating a wider reach or higher user engagement on Facebook.

Expert recommendation: If you haven’t used it before, try out the “Reach” objective to potentially increase your number of impressions with Facebook Ads. Most brands opt for the Brand Awareness campaign and never even experiment with the reach option. But if you have quality creative, good copy, and top-notch images, there’s a good chance you’ll reach a larger number of people.

LinkedIn Ads Impressions

Across all industries, the median number of impressions on LinkedIn Ads for October 2023 was 54.07K.

Let’s take a closer look at LinkedIn Ads impressions across different industries:

| Industry | Impressions (LinkedIn Ads) |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 39.81K |

| Consulting & Professional Services | 44.05K |

| Ecommerce & Marketplaces | MISSING |

| Education | 40.45K |

| Food | MISSING |

| Health Care | 66.66K |

| Health & Wellness | MISSING |

| Information Technology & Services | 70.52K |

| Industrials & Manufacturing | 43.4K |

| Real Estate | 54.11K |

| SaaS | 65.11K |

| Technology | 70.78K |

| Travel & Leisure | MISSING |

When it comes to LinkedIn Ads, Information Technology and Services show a strong presence, which is in line with LinkedIn’s professional network nature.

LinkedIn is primarily used by professionals for networking and career-related activities.

Industries related to information technology and technology services are inherently tied to professional development, making LinkedIn a natural fit for advertising in these sectors.

Expert recommendation: Want to stay on top of your LinkedIn Ads performance? In that case, you’ll need to track a lot more than impressions. But unfortunately, LinkedIn’s campaign manager doesn’t make the monitoring process easy on the users. Users tend to spend more time collecting data than actually analyzing it. But with our LinkedIn Ads Campaign Performance Dashboard, that’s not an issue anymore. You can compile all of your most relevant insights into one comprehensive dashboard and then make them even more understandable by transforming the data into professional visuals.

Clicks

Next up, let’s check out how many clicks businesses are recording.

Google Ads Clicks

Across all industries, the median number of clicks on Google Ads for October 2023 was 1.18K.

Let’s take a closer look at Google Ads clicks across different industries:

| Industry | Clicks (Google Ads) |

| Apparel & Footwear | 9.72K |

| Automotive | 3.43K |

| Construction | 443 |

| Consulting & Professional Services | 1.12K |

| Ecommerce & Marketplaces | 5.39K |

| Education | 1.13K |

| Food | 3.92K |

| Health Care | 435 |

| Health & Wellness | 387 |

| Information Technology & Services | 1.32K |

| Industrials & Manufacturing | 1.36K |

| Real Estate | 1.43K |

| SaaS | 1.54K |

| Technology | 1.33K |

| Travel & Leisure | 2.25K |

Apparel & Footwear lead in clicks, aligning with their high impression rates. In the second spot, we have Ecommerce & Marketplaces with 5.39K clicks in October.

It’s not surprising that these two industries have the highest number of clicks seeing that they outperform other industries by a wide margin when it comes to impressions.

Expert recommendation: If you’re looking for a streamlined way to manage your Google Ads performance data and stop monitoring key metrics in spreadsheets, you can download our Google Ads Dashboard Template. In this customizable template, you can drag and drop your most relevant Google Ads metrics and track changes as they occur in real time. No more slouching over several spreadsheets to figure out what’s going on with your numbers.

Facebook Ads Clicks

Across all industries, the median number of clicks on Facebook Ads for October 2023 was 2.77K.

Let’s take a closer look at Facebook Ads clicks across different industries:

| Industry | Clicks (Facebook Ads) |

| Apparel & Footwear | 15.86K |

| Automotive | 4.77K |

| Construction | 2.32K |

| Consulting & Professional Services | 3.54K |

| Ecommerce & Marketplaces | MISSING |

| Education | 2.66K |

| Food | 4.83K |

| Health Care | 791 |

| Health & Wellness | 779 |

| Information Technology & Services | 3K |

| Industrials & Manufacturing | 5.95K |

| Real Estate | 2.79K |

| SaaS | 2.68K |

| Technology | 2.86K |

| Travel & Leisure | 4.24K |

Just like with Google Ads, we can notice similar trends with Apparel & Footwear getting more clicks on Facebook Ads as well.

On the other side of the spectrum, we have Health & Wellness with the lowest number of clicks (779). This can be because the Health & Wellness industry is often subject to strict regulations and compliance requirements.

Advertisers in this sector may face limitations on the type of claims they can make or the language they can use in their ads, which can impact the overall effectiveness of the campaign.

Expert recommendation: You’re probably using social proof on your landing page, but are you leveraging it on the Facebook ad as well? Using social proof in the first touch point of your ad can be a great way to increase your CTR and get more people into your funnel. Especially nowadays, when users are looking for more credibility and trust before they engage with a certain brand and purchase their products.

LinkedIn Ads Clicks

Across all industries, the median number of clicks on LinkedIn Ads for October 2023 was 452.

Let’s take a closer look at LinkedIn Ads clicks across different industries:

| Industry | Clicks (LinkedIn Ads) |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 306.5 |

| Consulting & Professional Services | 336 |

| Ecommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | MISSING |

| Health & Wellness | MISSING |

| Information Technology & Services | 581.5 |

| Industrials & Manufacturing | 331 |

| Real Estate | MISSING |

| SaaS | 559 |

| Technology | 582 |

| Travel & Leisure | MISSING |

On LinkedIn Ads in general, we’re seeing fewer clicks, possibly due to its more niche and professional audience.

Users might be more selective about the content they engage with, and ads may need to be particularly relevant and targeted to capture their attention.

Expert recommendation: On PPC platforms like Facebook and Google, hyper-targeting is usually a good idea. But that’s not always the case with LinkedIn. On LinkedIn Ads, one best practice is to limit your targeting to two specific options (not including the location). This way, you’re not limiting your reach on LinkedIn. If your audience is too narrowly defined, your ads may not be shown to a sufficient number of users, reducing the overall visibility of your campaign.

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

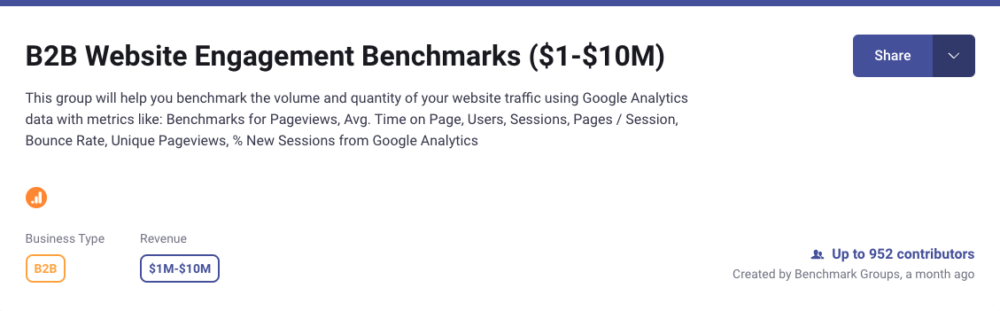

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning. Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

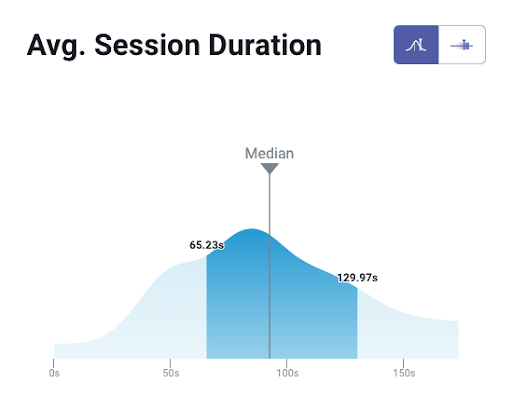

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

CTR

What about the click-through rate (CTR)? Let’s see how businesses are performing with this metric.

Google Ads CTR

Across all industries, the median CTR on Google Ads for October 2023 was 3.8%.

Let’s take a closer look at the Google Ads CTR across different industries:

| Industry | CTR (Google Ads) |

| Apparel & Footwear | 2.04% |

| Automotive | 2.64% |

| Construction | 6.09% |

| Consulting & Professional Services | 4.19% |

| Ecommerce & Marketplaces | 1.38% |

| Education | 6.81% |

| Food | 2.39% |

| Health Care | 7.71% |

| Health & Wellness | 6.99% |

| Information Technology & Services | 4.03% |

| Industrials & Manufacturing | 3.14% |

| Real Estate | 4.69% |

| SaaS | 3.94% |

| Technology | 3.88% |

| Travel & Leisure | 8.74% |

The Travel & Leisure industry has the highest CTR on Google Ads and part of the reason for this is that many users that search these keywords have high commercial intent.

People actively searching for travel-related information are likely to click on ads that closely match their search intent.

Health-related industries (Healthcare and Health & Wellness) have also shown impressive CTR in our research.

Expert recommendation: One great way to secure more clicks on your Google Ads is to utilize ad extensions. Not only are you taking up more valuable space, but you’re also able to provide more information about your business and solutions to your potential customers. For example, if you’re a local business, you can use ad extensions to directly provide a phone number or customer reviews.

Facebook Ads CTR

Across all industries, the median CTR on Facebook Ads for October 2023 was 1.63%.

Let’s take a closer look at the Facebook Ads CTR across different industries:

| Industry | CTR (Facebook Ads) |

| Apparel & Footwear | 1.84% |

| Automotive | 1.59% |

| Construction | 1.7% |

| Consulting & Professional Services | 1.68% |

| Ecommerce & Marketplaces | 2.03% |

| Education | 1.27% |

| Food | 1.28% |

| Health Care | 1.3% |

| Health & Wellness | 1.22% |

| Information Technology & Services | 1.44% |

| Industrials & Manufacturing | 1.51% |

| Real Estate | 1.66% |

| SaaS | 1.37% |

| Technology | 1.69% |

| Travel & Leisure | 2.26% |

On Facebook Ads as well, Travel & Leisure has the highest CTR. This suggests better audience targeting or visually attractive content.

The travel industry often involves visually stunning destinations and seeing that Facebook is a highly visual platform, engaging imagery or videos of exotic locations can capture users’ attention and prompt them to click.

Facebook also offers robust targeting options, allowing advertisers to tailor their ads to specific audiences based on their travel history, interests, or online behavior, making the ads more relevant.

Expert recommendation: No matter what industry you’re in, it’s rare for users to buy something from your ads after just one touchpoint. That’s why retargeting is so crucial in boosting your Facebook Ads CTR. Retargeting on Facebook can boost your CTR by re-engaging users who have previously visited your website or interacted with your content. By targeting this audience, you’re reaching users who have already shown interest, increasing the likelihood of getting a click.

LinkedIn Ads CTR

Across all industries, the median CTR on LinkedIn Ads for October 2023 was 0.74%.

Let’s take a closer look at the LinkedIn Ads CTR across different industries:

| Industry | CTR (LinkedIn Ads) |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | 0.63% |

| Consulting & Professional Services | 0.74% |

| Ecommerce & Marketplaces | MISSING |

| Education | 0.85% |

| Food | MISSING |

| Health Care | 0.68% |

| Health & Wellness | MISSING |

| Information Technology & Services | 0.71% |

| Industrials & Manufacturing | 0.65% |

| Real Estate | 0.58% |

| SaaS | 0.75% |

| Technology | 0.71% |

| Travel & Leisure | MISSING |

For LinkedIn Ads, no specific industry in our research stood out and none have a CTR higher than 1%.

Expert recommendation: If you’re running video ads on LinkedIn, make sure you use subtitles. There are two reasons for this – the default option on LinkedIn videos is “mute” and people generally start the video with the audio turned off. And considering how crucial those first few seconds are, you don’t want to risk the audience missing your initial hook.

CPC

Lastly, let’s talk about the CPC on these different platforms.

Google Ads CPC

Across all industries, the median CPC on Google Ads for October 2023 was $1.22.

Let’s take a closer look at the Google Ads CPC across different industries:

| Industry | CPC (Google Ads) |

| Apparel & Footwear | $0.51 |

| Automotive | $0.90 |

| Construction | $2.12 |

| Consulting & Professional Services | $1.39 |

| Ecommerce & Marketplaces | $0.42 |

| Education | $2.27 |

| Food | $0.81 |

| Health Care | $3.64 |

| Health & Wellness | $2.33 |

| Information Technology & Services | $1.28 |

| Industrials & Manufacturing | $1.10 |

| Real Estate | $1.14 |

| SaaS | $1.35 |

| Technology | $1.28 |

| Travel & Leisure | $0.70 |

Health Care and Health & Wellness have higher CPC, potentially due to strong competition.

The Health Care and Health & Wellness industries are typically competitive, with numerous businesses fighting for attention. Increased competition can drive up CPC as advertisers bid against each other for premium ad placements on the network.

Expert recommendation: Google wants to make sure users have the best possible experience on their platform, which means you’ll need to improve your ad relevance if you want to lower your Google Ads CPC. The best way to do this is to ensure that your keywords are closely related to your ad copy and landing page content. Another big factor is to craft compelling ad copy that aligns with the intent of the user’s search query.

Facebook Ads CPC

Across all industries, the median CPC on Facebook Ads for October 2023 was $0.44.

Let’s take a closer look at the Facebook Ads CPC across different industries:

| Industry | CPC (Facebook Ads) |

| Apparel & Footwear | $0.40 |

| Automotive | $0.28 |

| Construction | $0.39 |

| Consulting & Professional Services | $0.51 |

| Ecommerce & Marketplaces | $0.29 |

| Education | $0.56 |

| Food | $0.46 |

| Health Care | $1.07 |

| Health & Wellness | $1.02 |

| Information Technology & Services | $0.44 |

| Industrials & Manufacturing | $0.36 |

| Real Estate | $0.58 |

| SaaS | $0.57 |

| Technology | $0.50 |

| Travel & Leisure | $0.19 |

Similar to Google Ads, Health Care and Health & Wellness industries also lead Facebook Ads when it comes to CPC (both over $1).

The travel industry has a broad target audience, allowing for more extensive targeting options. Advertisers can reach a wide range of people, potentially resulting in lower CPC.

Plus, the travel industry often experiences seasonal fluctuations in demand. During off-peak seasons like October, advertisers may face less competition, leading to lower CPC.

Expert recommendation: Are your ads engaging? Are there any areas for improvement? What metrics need to be optimized ASAP? Getting answers to these questions can be difficult if you’re only tracking your performance through the Facebook Ads Manager. Luckily, there’s an easier way to do it – download our Facebook Ads Campaign Performance Dashboard. In just a few minutes, you can compile all of your key Facebook Ads metrics in one place and track your performance from one place. No more digging through several reports to get the information you need.

LinkedIn Ads CPC

Across all industries, the median CPC on LinkedIn Ads for October 2023 was $3.37.

Let’s take a closer look at the LinkedIn Ads CPC across different industries:

| Industry | CPC (LinkedIn Ads) |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | $3.35 |

| Consulting & Professional Services | $4.18 |

| Ecommerce & Marketplaces | MISSING |

| Education | $2.89 |

| Food | MISSING |

| Health Care | $6.37 |

| Health & Wellness | MISSING |

| Information Technology & Services | $4.03 |

| Industrials & Manufacturing | $2.20 |

| Real Estate | $5.75 |

| SaaS | $3.64 |

| Technology | $4.04 |

| Travel & Leisure | MISSING |

For LinkedIn Ads, Health Care and Real Estate have the highest CPC, aligning with the platform’s professional focus.

Both Health Care and Real Estate industries often require highly targeted advertising to reach specific professional audiences. The nature of these industries may lead advertisers to narrow down their audience criteria significantly, resulting in a smaller pool of potential clicks but a higher CPC.

But for both industries, the potential customer lifetime value is often high. Advertisers are willing to invest more in acquiring a customer because the long-term value of that customer can justify higher advertising costs.

Expert recommendation: Many businesses overlook ad scheduling on LinkedIn Ads for some reason. But if you use it properly, it’s possible to see lower CPC on the platform. To do this, you need to analyze your audience’s behavior patterns and see at which time they’re likely to be active on LinkedIn. Then, use this data to schedule your ads to appear during the high-traffic periods.

PPC Benchmark Groups for Your Industry

The data outlined in this report originates from Databox’s Benchmark Groups product.

This tool provides businesses, regardless of their size or industry, with an unbiased performance evaluation by their comparing metrics with industry peers.

In just seconds, you can get insight into how your competitors are performing in specific areas and see how you stack up.

And guess what – joining Benchmark Groups is entirely free.

All you have to do to join is connect your data and share it with the rest of the group (the shared data remains 100% anonymous for all contributors).

We’ve already compiled a lot of great insights from various groups, but we’re always looking for more contributors to join and enrich the groups.

If you want to keep getting actionable insights like the ones in this article, we invite you to join the Benchmark Group relevant to your industry or the group for all industries.

Below, we’ll list all the groups we analyzed for this article:

- Apparel & Footwear

- Automotive

- Construction

- Consulting & Professional Services

- Ecommerce & Marketplaces

- Education

- Food

- Health Care

- Health & Wellness

- Information Technology & Services

- Industrials & Manufacturing

- Real Estate

- SaaS

- Technology

- Travel & Leisure

Use Benchmark Groups to Stay on the Right Track With Your PPC Advertising

PPC advertising is still one of the most effective marketing channels… but in recent years, running these campaigns has become increasingly expensive.

This is especially the case if you’re bidding for popular keywords and are in a highly competitive industry.

To make sure you’re PPC ads are performing nowadays… businesses need all the help they can get.

Until now, most of the external resources that businesses used to better understand their performance data came from industry reports.

But these reports don’t always provide the insights you need. You can’t rely on general numbers when assessing your performance. And you can’t rely only on your own numbers either.

That’s why Databox’s Benchmark Groups are such a game-changer.

Now, any business can instantly see how it stacks up against its competitors in the same niche and of similar size – for free.

Wondering if you’re CPC should be lower? Worried about your CTR? What about your conversion rate?

You can get insights into all of this (and more) once you join a cohort relevant to your specific industry and the PPC platform you’re using.

And there’s a lot more you can benchmark aside from PPC performances – we have 130+ integrations with some of the most popular marketing, sales, and financial tools in the world.

Ready to fine-tune your strategies based on real-time competitor performance data? Join Benchmark Groups for free and get started today.

FAQ

Databox is a Business Intelligence (BI) platform known for its analytics, intuitive dashboards, and benchmarking tools. It helps marketers improve PPC performance by comparing key ad metrics—like impressions, clicks, CTR, CPC, and conversions—against anonymized data from similar companies through industry-specific Benchmark Groups.

By identifying how your campaigns stack up across platforms such as Google Ads, Facebook Ads, and LinkedIn Ads, Databox enables smarter optimization. This insight helps you fine-tune strategies, eliminate guesswork, and make data-driven decisions to maximize the return on your PPC investment.

Databox’s Benchmark Groups provide businesses with valuable insights by comparing their PPC advertising metrics with industry peers. This allows companies to understand how they stack up against competitors in specific areas, such as CTR, CPC, and impressions. By joining these groups, businesses can get actionable insights and optimize their PPC campaigns accordingly.

Once you join a Benchmark Group on Databox, you can compare your PPC metrics, such as impressions, clicks, CTR, and CPC, with other companies in your industry. This comparison will show you where your PPC performance stands relative to competitors, helping you identify areas for improvement or confirmation that your strategies are on track.

Databox offers several advantages over traditional PPC reporting tools, including:

Integration with multiple PPC platforms (Google Ads, Facebook Ads, LinkedIn Ads).

updates to your metrics without the need for manual reporting.

Customizable dashboards that consolidate PPC performance data in one place.

Access to Benchmark Groups for comparative analysis, providing actionable insights on how your PPC campaigns are performing relative to industry peers.

How can Databox help improve my PPC strategies based on competitor data?

By using Databox’s Benchmark Groups, you can gain insights into how your competitors are performing in terms of impressions, clicks, CTR, and CPC. This allows you to identify potential gaps in your PPC strategy, fine-tune your approach, and adjust your bids, targeting, and ad copy based on industry standards and competitor performance.