Table of contents

Content marketing benchmarks are essential for measuring success, yet many marketers overlook them while navigating AI-driven content creation and Google’s ever-changing algorithms.

With increasing pressure to manage complex campaigns, leverage AI, and prove content ROI, it’s easy to skip competitor analysis.

But without benchmarking your performance against industry standards, how can you know if your strategy is truly effective?

Fortunately, there’s no need anymore to spend hours reading industry reports or reaching out to similar-sized companies in your niche to share content performance data.

You can do that in minutes easily with Databox’s Benchmark Groups.

For this report, we examined different Google Analytics 4, Google Search Console, Facebook Pages, and HubSpot content marketing benchmarks such as sessions, bounce rate, engagement rate, average session duration, conversions, position, CTR, page views, page engagement, and new leads.

Let’s dive in.

- Google Analytics 4 Sessions

- Google Analytics 4 Bounce Rate

- Google Analytics 4 Engagement Rate

- Google Analytics 4 Average Session Duration

- Google Analytics 4 Conversions

- Google Search Console Position

- Google Search Console CTR

- Facebook Page Views

- Facebook Page Engagement

- HubSpot New Leads

- Resources: Content Marketing Benchmarks by Industry

Google Analytics 4 Sessions

Across all industries, the median number of sessions for September 2024 was $3.39K.

Let’s take a closer look at sessions across different industries:

| Industry | Sessions (GA4) |

| Apparel & Footwear | 13.28K |

| Automotive | 11.93K |

| Construction | 1.42K |

| Consulting & Professional Services | 2.18K |

| Ecommerce & Marketplaces | 4.59K |

| Education | 6.07K |

| Food | 5.8K |

| Health Care | 4.13K |

| Health & Wellness | 3.86K |

| Information Technology & Services | 3.84K |

| Industrials & Manufacturing | 3.35K |

| Real Estate | 3.36K |

| SaaS | 3.35K |

| Technology | 4.36K |

| Travel & Leisure | 8.03K |

The median value for sessions across all sectors is 3.39K, yet this number varies by industry. Apparel & Footwear and Automotive stand out with notably high sessions, 13.28K and 11.93K respectively, indicating more effective content strategies and a high audience interest.

Construction and Consulting & Professional Services lag behind with only 1.42K and 2.18K sessions respectively. One of the possible reasons is that these industries often deal with specific clientele who may not require frequent online interactions.

Expert recommendation: Backlinks are still as strong as ever, but for some reason, many content marketers are ignoring just how important it is to create linkable assets. Instead of going via the traditional route, you can level up your link-building efforts by doing something such as creating comprehensive research reports on trending topics.

Google Analytics 4 Bounce Rate

Across all industries, the median bounce rate for September 2024 was 44.04%.

Let’s take a closer look at the bounce rate across different industries:

| Industry | Bounce Rate (GA4) |

| Apparel & Footwear | 35.76% |

| Automotive | 40.1% |

| Construction | 45.28% |

| Consulting & Professional Services | 47.84% |

| Ecommerce & Marketplaces | 38.61% |

| Education | 46.28% |

| Food | 38.93% |

| Health Care | 40.94% |

| Health & Wellness | 39.41% |

| Information Technology & Services | 48.38% |

| Industrials & Manufacturing | 41.78% |

| Real Estate | 42.14% |

| SaaS | 48.27% |

| Technology | 48.28% |

| Travel & Leisure | 38.84% |

The industry records the lowest bounce rate, and there are a few potential reasons for this.

For starters, people visiting Apparel & Footwear websites often have a clear intent to browse and shop for products. This intent may lead to lower bounce rates compared to industries where visitors might be seeking information or content of a different nature.

Also, when users are actively shopping, they tend to interact with multiple pages on the website before making a purchase, which can reduce bounce rates at large.

Expert recommendation: Understanding search intent is undoubtedly one of the best ways you can improve your bounce rate. And the thing is, so many businesses claim that they understand the user search intent, but when you go through their content it doesn’t show that at all. The key isn’t just to give users what they’re searching for – it’s to do it in such a way that they won’t find the same recycled answer on all of the top-ranking SERPs.

Google Analytics 4 Engagement Rate

Across all industries, the median engagement rate for September 2024 was 56.21%.

Let’s take a closer look at the engagement rate across different industries:

| Industry | Engagement Rate (GA4) |

| Apparel & Footwear | 60.03% |

| Automotive | 61.48% |

| Construction | 55.06% |

| Consulting & Professional Services | 52.97% |

| Ecommerce & Marketplaces | 60.71% |

| Education | 53.82% |

| Food | 55.53% |

| Health Care | 59.1% |

| Health & Wellness | 61.74% |

| Information Technology & Services | 52.91% |

| Industrials & Manufacturing | 57.85% |

| Real Estate | 59.57% |

| SaaS | 52.93% |

| Technology | 53.34% |

| Travel & Leisure | 60.71% |

The Automotive and Health & Wellness industries have the highest engagement rate per our benchmark data. For the Automotive industry, this could be explained with high purchase intent searches where users spend more time comparing different models and analyzing all the different features.

What’s more, both industries have the potential for interactive features. For example, automotive websites might include tools for comparing different car models, and health & wellness websites can have calculators for estimating calorie intake or workout plans. These interactive features can boost engagement.

Expert recommendation: To stay on top of your overall engagement levels, the best tactic is to shortlist 5-8 engagement metrics that are the most important for your specific business and focus your tracking efforts on them. Unfortunately, when it comes to GA4’s interface, this is easier said than done. Most of the time, you’ll be spending more time compiling data and moving it to spreadsheets than you will actually analyzing it. But there’s a simpler way to do it – you can download our Google Analytics 4 Engagement Overview Dashboard and monitor your key engagement metrics in one place. In less than 10 minutes, you can have a ready-to-analyze dashboard at your fingertips (like the one below).

The Growing Role of AI in Content Engagement

AI is no longer just a tool for content automation—it’s actively shaping how audiences engage with content. From AI-powered chatbots that boost on-site engagement to automated video summaries that enhance user experience, businesses that integrate AI-driven features tend to see higher engagement rates.

Expert recommendation: Want to keep your engagement rates high? Leverage AI for interactive content, personalized experiences, and smart recommendations. AI-powered tools like chat-based product recommendations or dynamic content adjustments based on user behavior can help keep visitors engaged longer.

Google Analytics 4 Average Session Duration

Across all industries, the median average session duration for September 2024 was 2m 38s.

Let’s take a closer look at the average session duration across different industries:

| Industry | Average Session Duration (GA4) |

| Apparel & Footwear | 2m 40s |

| Automotive | 2m 51s |

| Construction | 2m 22s |

| Consulting & Professional Services | 2m 33s |

| Ecommerce & Marketplaces | 2m 38s |

| Education | 2m 53s |

| Food | 2m 37s |

| Health Care | 2m 40s |

| Health & Wellness | 2m 58s |

| Information Technology & Services | 2m 40s |

| Industrials & Manufacturing | 2m 38s |

| Real Estate | 2m 43s |

| SaaS | 2m 34s |

| Technology | 2m 43s |

| Travel & Leisure | 3m 1s |

Travel & Leisure is the only industry with an average session duration of over three minutes.

One reason for this is that travel decisions often involve multiple steps and considerations. Visitors to travel websites may spend more time researching destinations, accommodations, flights, and activities. This complex decision-making process can lead to longer sessions as users navigate through various options.

Travel websites also provide a wealth of information, including travel guides, reviews, itineraries, and booking options. Users may spend more time exploring this information to plan their trips effectively.

Expert recommendation: Want to increase your average session duration? Consider breaking up text with images. And this doesn’t mean just throwing anything that seems engaging into the mix. Instead, you can create images that add further context to what you’re talking about or add something extra to the information you’re providing.

Google Analytics 4 Conversions

Across all industries, the median number of conversions for September 2024 was 153.

Let’s take a closer look at the number of conversions across different industries:

| Industry | Conversions (GA4) |

| Apparel & Footwear | 537 |

| Automotive | 400 |

| Construction | 61 |

| Consulting & Professional Services | 120 |

| Ecommerce & Marketplaces | 711 |

| Education | 337 |

| Food | 394 |

| Health Care | 167 |

| Health & Wellness | 230.5 |

| Information Technology & Services | 164 |

| Industrials & Manufacturing | 160 |

| Real Estate | 122 |

| SaaS | 182 |

| Technology | 212 |

| Travel & Leisure | 141 |

Ecommerce & Marketplaces record the highest number of conversions, which might be due to the higher purchase intent that their visitors have. Ecom visitors are often looking to buy the products they’re searching for and this intent leads to higher conversion rates for the industry.

A similar situation is with Apparel & Footwear and Food and Health & Wellness.

Expert recommendation: To make sure your conversion rate is on par, you need to ensure that you’re covering the basics. A compelling CTA doesn’t mean much if you’re landing page copy isn’t good. That’s why you need to make sure to cover all the key conversion principles on your page – from a strong USP and social proof section to including the FAQs and a singular, clear CTA button.

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning. Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

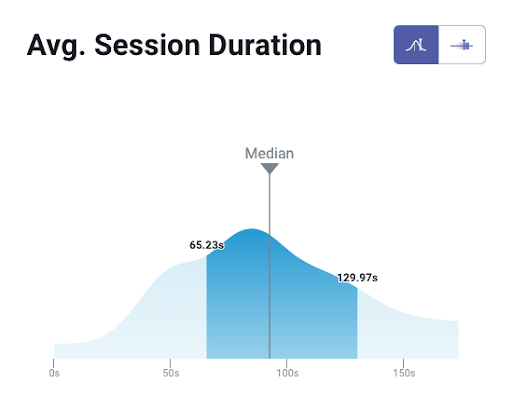

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

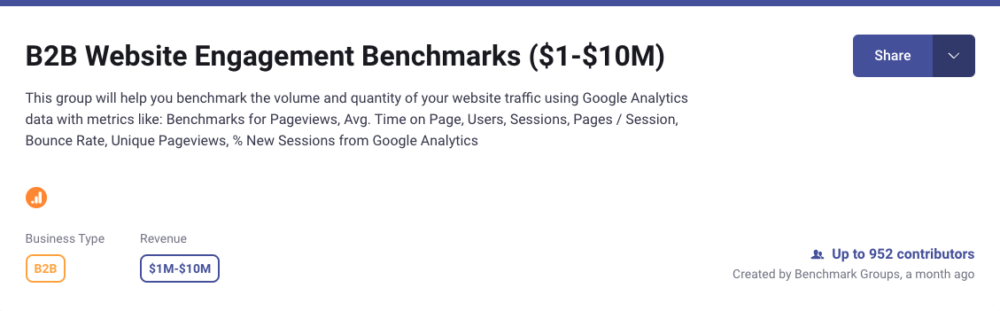

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

Google Search Console Position

Across all industries, the median position for September 2024 was 29.56.

Let’s take a closer look at the position metric across different industries:

| Industry | Position (GSC) |

| Apparel & Footwear | 22.17 |

| Automotive | 27.94 |

| Construction | 32.75 |

| Consulting & Professional Services | 35.47 |

| Ecommerce & Marketplaces | 20.41 |

| Education | 24.77 |

| Food | 23.93 |

| Health Care | 31.11 |

| Health & Wellness | 26.17 |

| Information Technology & Services | 33.49 |

| Industrials & Manufacturing | 24.04 |

| Real Estate | 28.4 |

| SaaS | 34.06 |

| Technology | 32.32 |

| Travel & Leisure | 25.55 |

The Consulting & Professional Services industry records the lowest rankings based on our data, and one of the reasons could be the highly competitive nature of this industry, with numerous firms and individuals fighting for online visibility.

Many businesses in this sector are engaged in SEO and content marketing to improve their rankings, and due to the similar services most companies offer, it can be difficult to differentiate from competitors in the eyes of Google.

Expert recommendation: Improving your average position on Google requires continuous efforts on multiple fronts. There’s no one tactic that can dramatically boost your rankings. That said, here’s one interesting tip that might be helpful – use heat maps to analyze your pages. You’ll see which sections of your page users engage with the most and identify the areas that need to be fine-tuned a bit more. This way, you’ll be able to reduce your page bounce rate, giving Google a signal that users are finding your content helpful.

How Google’s AI-Generated Search Results Impact Rankings

Google’s Search Generative Experience (SGE) is changing how search results appear, prioritizing AI-generated summaries and conversational responses over traditional organic rankings. This means that businesses relying on traditional SEO strategies may need to rethink their approach.

Expert recommendation: To stay competitive, focus on structured content that AI can easily extract. Formatting content with clear headings, bullet points, and concise answers increases the likelihood of being featured in AI-driven search results. Adding FAQ sections and optimizing for conversational queries can also help improve search visibility.

Google Search Console CTR

Across all industries, the median CTR for September 2024 was 1.56%.

Let’s take a closer look at the CTR metric across different industries:

| Industry | CTR (GSC) |

| Apparel & Footwear | 1.84% |

| Automotive | 2.04% |

| Construction | 1.3% |

| Consulting & Professional Services | 1.23% |

| Ecommerce & Marketplaces | 1.44% |

| Education | 2.2% |

| Food | 2.17% |

| Health Care | 1.27% |

| Health & Wellness | 1.83% |

| Information Technology & Services | 1.4% |

| Industrials & Manufacturing | 2.12% |

| Real Estate | 2.06% |

| SaaS | 1.32% |

| Technology | 1.44% |

| Travel & Leisure | 2.24% |

The Travel & Leisure and Education industry have the highest CTR in the Benchmark Groups. One of the reasons could be that the intent of users in these industries is often more explicit. People actively searching for travel destinations, hotels, flights, or educational resources are usually closer to making a decision, making them more likely to click on search results.

The Travel & Leisure industry also often experiences seasonal fluctuations in demand. During peak travel seasons, the competition among travel-related websites can lead to higher CTRs as users actively seek travel information. While the summer months are over, September is also a high-travel month in many countries.

Expert recommendation: Don’t ignore featured snippets if you’re looking to improve your CTR. By competing for featured snippets, you’re adding a huge persuasion asset to your toolset that you can use to get the users to find out more about the topic by visiting your page. If the information you’re providing is good and satisfies their search intent, they’re far more likely to see what else you have to say about that specific topic.

Facebook Page Views

Across all industries, the median number of page views on Facebook for September 2024 was 467.

Let’s take a closer look at the page views metric across different industries:

| Industry | Page Views (Facebook) |

| Apparel & Footwear | 1.09K |

| Automotive | 149 |

| Construction | 409 |

| Consulting & Professional Services | 188 |

| Ecommerce & Marketplaces | 153 |

| Education | 756.5 |

| Food | 1.32K |

| Health Care | 382 |

| Health & Wellness | 539 |

| Information Technology & Services | 295 |

| Industrials & Manufacturing | 570 |

| Real Estate | 345 |

| SaaS | 248 |

| Technology | 295 |

| Travel & Leisure | 1.56K |

When it comes to Facebook page views, Travel & Leisure’s, Food’s, and Apparel & Footwear’s results stand out.

This probably emerges from a blend of visual content appeal, audience alignment, adaptive and fresh content, user-generated material, strategic marketing, and integrative shopping or booking experiences. This synergy not only enhances their visibility but also leverages the inherent interest and engagement of audiences within a platform that generally supports visual and interactive content.

Expert recommendation: To stay on top of page views and all other key Facebook engagement metrics, you can download our Facebook Page Insights Dashboard. Combine all of your most relevant page insights in one place so you can stop wasting hours each time manually extracting them from the admin interface. You can connect your account, populate the dashboard with your key metrics, and turn them into professional visuals all in less than ten minutes.

The Shift from Facebook to Video-Centric Platforms

While Facebook remains a key platform for certain industries, short-form video platforms like TikTok, Instagram Reels, and YouTube Shorts are now driving higher engagement rates. Brands that adapt to video-first content strategies see significantly better reach and interaction than those relying solely on static posts.

Expert recommendation: If your engagement on Facebook has plateaued, experiment with short-form video content. Repurpose blog posts into video explainers, showcase behind-the-scenes footage, or leverage AI-generated video tools to maximize reach across newer platforms.

Facebook Page Engagement

Across all industries, the median page engagement on Facebook for September 2024 was 499.

Let’s take a closer look at the page engagement metric across different industries:

| Industry | Page Engagement (Facebook) |

| Apparel & Footwear | 3.85K |

| Automotive | 196 |

| Construction | 351 |

| Consulting & Professional Services | 106 |

| Ecommerce & Marketplaces | 61 |

| Education | 548 |

| Food | 1.57K |

| Health Care | 458.5 |

| Health & Wellness | 417 |

| Information Technology & Services | 215 |

| Industrials & Manufacturing | 337 |

| Real Estate | 390 |

| SaaS | 151 |

| Technology | 213 |

| Travel & Leisure | 1.9K |

Just like with page views, the Travel & Leisure, Food, and Apparel & Footwear industries dominate the Facebook page engagement game.

On the other side of the spectrum, we have Ecommerce & Marketplaces and SaaS as the industries with the lowest Page Engagement on Facebook. This could be because their content tends to be more product-centric, which may not be as visually appealing or emotionally engaging as the content from industries like travel, food, or fashion.

Expert recommendation: To boost your Facebook Page Engagement, you need to, well, engage with your followers! Don’t be afraid to ask them questions and get their insights on topics relevant to your industry. If you see some of your posts generating lots of comments, take the time to respond to them and provide even more value that way. This makes you more relatable to them and shows them that you’re not just another bland company that doesn’t care about its customers.

HubSpot New Leads

Across all industries, the median number of new leads on Facebook for September 2024 was 499.

Let’s take a closer look at new leads across different industries:

| Industry | New Leads (HubSpot) |

| Apparel & Footwear | MISSING |

| Automotive | MISSING |

| Construction | MISSING |

| Consulting & Professional Services | 24.5 |

| Ecommerce & Marketplaces | MISSING |

| Education | MISSING |

| Food | MISSING |

| Health Care | MISSING |

| Health & Wellness | MISSING |

| Information Technology & Services | 29 |

| Industrials & Manufacturing | 19 |

| Real Estate | MISSING |

| SaaS | 27 |

| Technology | 29 |

| Travel & Leisure | MISSING |

Even though there’s still a lot of industry data missing, the Industrials and Manufacturing industry currently stands as the one with the lowest number of new leads.

This industry often serves niche markets with a limited number of potential customers, which naturally reduces the number of new leads compared to industries with larger consumer bases.

What’s more, the sales cycles in the Industrials and Manufacturing sector tend to be longer due to the complex nature of the products and services involved. This results in a slower lead generation process overall.

Expert recommendation: One interesting tip you can implement to generate more leads through your content marketing efforts is to make your blogs look more like landing pages. You can do this by adding a lead form (eventually with a lead magnet) somewhere near the end of the blog. In general, it’s always a good idea to include some sort of CTA in your blog posts, regardless of which stage of the funnel they’re targeting.

Content Marketing Benchmark Groups for All Industries

All the data we presented in this report is from Databox’s Benchmark Groups product.

With Benchmark Groups, businesses of all niches and sizes can get an objective assessment of their performance by comparing their numbers with industry peers. Spotting room for improvement or simply checking whether you’re ahead of the competition has never been easier.

And the best thing is, you can join Benchmark Groups free of charge. The data both you and other businesses share is 100% anonymous for everyone involved.

We already have a lot of valuable data shared in different groups, but there are some areas where we could use your help and expand.

For more actionable insights that help you assess your performance, we invite everyone to join the Benchmark Group relevant to your industry or the group for all industries.

Below, you can find all the Benchmark Groups we analyzed when creating this report:

- Apparel & Footwear

- Automotive

- Construction

- Consulting & Professional Services

- Ecommerce & Marketplaces

- Education

- Food

- Health Care

- Health & Wellness

- Information Technology & Services

- Industrials & Manufacturing

- Real Estate

- SaaS

- Technology

- Travel & Leisure

Use Benchmark Groups to Increase the Efficiency of Your Content Marketing Efforts

Content marketing still stands as one of the most powerful digital marketing channels for building an engaged audience and generating qualified leads for your business.

However, it’s also one of the most complicated channels to monitor in terms of performance.

With so many hours and funding that goes into the content marketing machinery, wouldn’t it be amazing to be able to see whether your numbers are on point and in line with what others in the industry are seeing?

For the longest time, this has been an insanely time-consuming task, with content marketers spending hours collecting their data, compiling it into one spreadsheet, and then reading it and comparing it with scarce numbers from general industry reports…

Now, there’s a much better way to perform this – Benchmark Groups.

With Benchmark Groups, what used to take hours now only takes just a few minutes. After you join and connect your data, you get immediate insights into the performance of your industry peers that you compare to.

Forget about those hours-long searches for the latest industry reports… with Benchmark Groups, you have all the information you need in a single (or multiple) cohort.

Sign up for a free trial and finally get an objective overview of your performance.

FAQ

Databox is a Business Intelligence (BI) platform known for its user-friendly interface, data analysis, and shareable dashboards. It helps content marketers track and improve performance by unifying key metrics—like engagement, CTR, and conversions—across platforms such as Google Analytics 4, Search Console, HubSpot, and Facebook.

Using Databox Benchmark Groups, you can compare your content marketing KPIs with industry peers, uncover gaps or growth opportunities, and adjust your strategy accordingly. With customizable dashboards and automated reporting, Databox eliminates manual tracking and helps you focus on producing content that drives traffic, leads, and revenue.

Using Databox’s Benchmark Groups, marketers can compare their content marketing metrics, including but not limited to, sessions, bounce rate, engagement rate and conversions with other businesses in the same industry. This is useful because it allows marketers to pinpoint areas that need the most attention and improve upon them.

As described previously, benchmark groups are tools that provide anonymized, peer comparison performance data, thus equipping businesses with vital competitive insights. These groups allow businesses access to pre-existing data on important content marketing metrics, and with that data, businesses could refine their strategies.

Joining Benchmark groups with Databox allows one to pull content marketing data from Google Analytics 4, Google Search Console, Facebook Pages, HubSpot, etc. With this information, Databox will offer insights on what the benchmarks in the industry are and thus help businesses understand where they stand compared to other similar companies.