Table of contents

Would you rather be the big fish in a small pond or a small fish in a big pond?

This analogy is one of the best ways to think about a startup’s total addressable market (TAM). The market you are in will dictate the total amoseunt of revenue you capture.

That’s why startups, investors and startup agencies care about TAM evaluations.

In this post, we’re taking a closer look at what TAM is, how to calculate it, and all of the ways it impacts B2B startups.

- What Is TAM (Total Addressable Market)?

- How Do You Calculate TAM (Total Addressable Market)?

- Why is Proper TAM Evaluation Vital for B2B Startups?

What Is TAM (Total Addressable Market)?

The Total Addressable Market is your company’s total growth potential or the overall revenue opportunity in your market.

Since most companies don’t have a monopoly or operate in an entirely new category, there are two other markets that you need to consider.

That’s the serviceable available market (SAM) and serviceable obtainable market (SOM).

SAM is the part of the market that can actually be reached when you take into how much market share your existing competitors occupy.

And, SOM is even smaller. That’s the part of the market that can actually be captured.

Let’s say you are starting a brewery in Omaha.

The total addressable market *could* be every single adult over the age of 21 who drinks beer and lives in Omaha.

However, you are certainly not the first brewery in Omaha. So, you need to consider how many competing breweries are in the city, how much revenue they are bringing in, and their market share.

And, to get to your SOM, you need to consider not only the TAM and SAM market, but also the number of adults who drink craft beer and are even open to trying a new place.

Related: 12 Best Tools Marketers Use for Market Research

How Do You Calculate TAM (Total Addressable Market)?

In words of Shankar Shethe of GrowthMentor, one of the crucial reasons B2B startups need to evaluate TAM is to better understand their target market and set proper growth goals, “To set realistic growth goals and ensure you move in the right direction, you have to be well aware of your market and pick a market segment of the right size. To do so, one must evaluate TAM.”

But how exactly should startups approach TAM evaluation?

Over 75% of the startups, investors, and agencies we surveyed use either the top-down or bottom-up approach to calculating TAM. That makes sense given they are the two most common methods.

The top-down approach is the most popular, but it is also the least accurate. To calculate TAM using this method, you start with the total market size, the number of hypothetical buyers in the market, and then arrive at the number your company could feasibly get. These industry and market numbers come from market research like Gartner and Forrester reports.

The second most common approach is the bottom-up method. This is a lot more accurate since it relies on your company’s previous sales data.

To calculate TAM using the bottom-up method, use this formula:

TAM = Total # of customers x Actual Contract Value

A less common approach that 25% of our respondents use is the value theory method. This method tends to work the best when you are creating a brand new category or launching a feature that has never existed before. So, the value theory is an estimate of the total value that you can capture with your new product or feature.

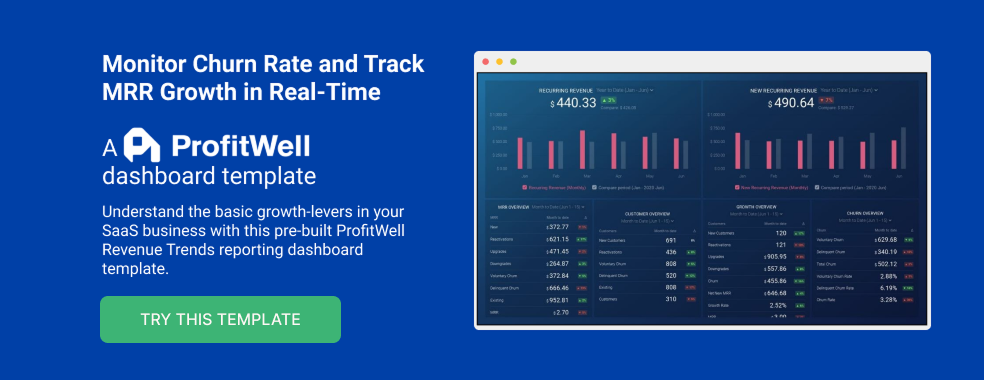

PRO TIP: Are You Tracking the Right Metrics for Your SaaS Company?

As a SaaS business leader, there’s no shortage of metrics you could be monitoring, but the real question is, which metrics should you be paying most attention to? To monitor the health of your SaaS business, you want to identify any obstacles to growth and determine which elements of your growth strategy require improvements. To do that, you can track the following key metrics in a convenient dashboard with data from Profitwell:

- Recurring Revenue. See the portion of your company’s revenue that is expected to grow month-over-month.

- MRR overview. View the different contributions to and losses from MRR from different kinds of customer engagements.

- Customer overview. View the total number of clients your company has at any given point in time and the gains and losses from different customer transactions.

- Growth Overview. Summarize all of the different kinds of customer transactions and their impact on revenue growth.

- Churn overview. Measure the number and percentage of customers or subscribers you lost during a given time period.

If you want to track these in ProfitWell, you can do it easily by building a plug-and-play dashboard that takes your customer data from ProfitWell and automatically visualizes the right metrics to allow you to monitor your SaaS revenue performance at a glance.

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Profitwell account with Databox.

Step 3: Watch your dashboard populate in seconds.

Related: What is a Marketing Research Report and How to Write It?

Why is Proper TAM Evaluation Vital for B2B Startups?

Here are some of the ways that a proper TAM evaluation can help your startup.

Startups

As we alluded to earlier in this post, the biggest reason why startups care about TAM evaluations is to understand their total growth and revenue potential.

“Estimation of TAM is the first step in understanding your revenue potential “in the perfect world situation,” says Charles Cridland of YourParkingSpace. “With this in mind, you can think of a return on investment. Regardless of your funding source, these assessments will help you build a reasonable plan of investment in product development and the growth of your headcount.”

Dave Ericksen of Waterzen says, “TAM is the crux of a business, especially for B2B startups. It helps companies gauge their overall profitability in the market share. I love TAM’s because they allow companies to identify valuable propositions and provide insight on who could buy the product they are offering. It could prove to be a revolutionary metric in the market next year. Investors also prefer TAM as it can help them see the product’s potential if the company they invested in can grow in every marketable aspect.”

Sameera Sullivan of Sameera Sullivan Matchmakers adds, “B2B businesses are a little tricky when it comes to the market sizing. Your clients are basically other businesses, and the market is very fragmented when it comes to identifying the revenue potential of these businesses.

Usually, for B2C businesses, it’s easy to do the math because often you are able to find numbers for the demographics you’re targeting.

When you take up a B2B business to an investor, prepare well for follow-up questions on your market sizing! They are mostly interested in the TAM where you have to defend the business niche you identified as your target clientele, and here if you miss out on potential industries or have a conservative view of the benefits of your startup, expect the panel to exchange looks. Basically what they expect from a B2B business is to be optimistic about the size of the addressable market, and critically pinpoint how your business can span industries directly and indirectly.

The next steps to calculating the TAM are the SAM and SOM (Serviceable Addressable Market and Serviceable Obtainable Market). This is where you refine the number of your TAM to narrow it down to a more realistic number, and because this is a top-down process, properly calculating the TAM with assumptions in place is vital to impressing investors!”

Once you’ve calculated TAM, SAM, and SOM, you can build your go-to-market strategy for your startup.

“Approaching your addressable market with brutal honesty is key to creating an effective go-to-market plan,” explains Kavin Patel of Convrrt. “Most TAMs are in millions; yet almost all won’t crack tens of thousands of customers. For instance, at Convrrt, we’re not another landing page tool. We provide SaaS companies a full-featured landing page platform fully branded theirs so they can scale up. Our TAM isn’t millions — it’s thousands. And given that, we tailor our approach, technology, and services accordingly.

Dan Ni of Messaged.com finally adds, “The use of TAM is crucial to any B2B business because it allows marketing and sales teams to formulate future strategies better and also helps in tracking progress effectively. You get to better understand where you need to grow and expand in your organization. You should evaluate your Total Accessible The market for a variety of advantages. You gain financial projections which is something pertinent if you require investors. Tam data helps in garnering revenue and also aids in getting funding from investors. It also allows you to get a better overview of your company demographic and best of all you can judge the standing of your company better.”

Investors

Startup investors rely heavily on TAM to judge the size of a market and if it makes sense to invest in a business.

“The TAM is important as it shows that an industry or market segment is real,” says Charles Edge of Bootstrappers.mn. “I personally like to see TAM (and CAGR) in terms of both a top-down and a bottoms-up number. For example, let’s say a market is worth a billion dollars. OK, the startup has shown me that based on their interpretation of that market, that the market is real. I also want to see a bottoms-up number in the form of how many sellers in a B2B startup, what kind of marketing is required to reach potential buyers, how long is the typical sales cycles, is there seasonality to the industry, and while we have no clue at the outset whether the numbers are accurate, that tells us that the founders understand how to sell. Great ideas come across our desks every day, but the intersectionality between a great idea and an addressable market don’t.”

Michelle Crames of Austin Capital Partners adds, “As fintech investors, we’re in a sector where there are massive problems to solve. So TAM becomes important because the scale of these opportunities can be immense, the biggest problems will likely be addressed first, and TAM is a proxy for that. $91.5 Billion was invested into FinTech globally through the 3rd Quarter of 2021, 2x the entirety of 2020, so when you’re raising that kind of money, you need big market opportunities, and we see unicorns, companies valued more than $1B, emerging constantly. So our baby unicorns can grow up quickly if they are in a big market that is literally craving their solutions. At the same time, you can’t eat an entire elephant at once, so even if the TAM) is huge, you start with a SAM (serviceable addressable market) that is addressable, and nail that use case, with a strategic path to the bigger opportunity.”

Startup Agencies and Consultants

One of the primary reasons why startup agencies and consultants rely on proper TAM evaluations is for maximizing results and impact from their marketing budget.

Skyler Reeves of Ardent Growth explains, “Understanding your TAM will help you understand which areas of your market to focus on first—especially when it comes to content marketing.

If you take your TAM and segment it into topic clusters, you can take the aggregate metrics for things like revenue potential and traffic potential to figure out which pieces of content you should produce first to begin capturing pieces of your TAM. You can then categorize your topic clusters from your TAM into customer stages to properly balance out your distribution of content across each stage in a way that makes the most sense for your business model. As you begin to produce content and are able to attribute conversions to it, you’ll then be able to see which areas are providing the most impact—enabling you to achieve product-market fit faster.

Lastly, if you evaluate how your competitors are performing across the TAM, you’ll also be able to find areas of weakness you can exploit to accelerate your growth in ways (bonus if you focus on areas you know they won’t be able to quickly respond to).”

So, your TAM calculation allows you to make the most of your marketing budget.

“I usually think of TAM in the context of market segmentation,” says Jon Bennion of Online Marketing Gurus USA. “Knowing TAM empowers sales and marketing teams to make the most of their time and resources by pursuing the best opportunities. Marketing teams can allocate marketing spending based on relative revenue opportunities. Sales teams can calculate segmented market share estimates and create sales programs for different regions, prioritizing their efforts by geography, segment, and industry.”

Mukesh K. Singhmar of SeeResponse adds, “Most B2B startups have a limited marketing budget, at least early on. By being able to accurately size the market, the startup basically knows how many potential customers are out there for its products, and that’s a great data point in order to determine how best to allocate the available marketing budget. In the absence of TAM estimations, the startup is at risk of allocating its lean budget and resources to efforts that could potentially lead to lost revenue and opportunities in the short term, and even worse lose competitive advantage in the long term.Another very important reason which is extremely relevant to B2B startups is that an accurate TAM assessment is huge when building an account-based marketing (ABM) strategy, especially if the startup is selling to mid to large size businesses, for you need to know how many accounts are you going to be targeting if you do choose to go down the ABM path.”

If you have previous sales data, using the bottom-up TAM approach is the most accurate. And creating a sales dashboard using a sales dashboard software is a great first step. You can sign up for Databox today to automatically plug in all of your data and sources into one dashboard.