Table of contents

The COVID-19 pandemic and the resulting economic uncertainty forced businesses to rethink how they approach growth. This especially rang true in the financial services industry, where financial trends have the most direct impact. Curiosity, collaboration, and adaptability all became key to surviving this new climate.

Those three values still influence how financial brands approach the future, and we wanted to see how this industry tackles growth. So, we partnered with the Digital Growth Institute to survey over 135 companies about their marketing, sales, and leadership teams’ views on the future. Their perception of the road ahead affects their current decisions and therefore what we can expect from them in the near future.

We conducted our research from October 2023 to March 2024 and received 136 responses, with 53 of them representing financial institutions. The survey is still open, so you can expect further insights from this study. To participate in the survey and share your unique view on how outlook on the future affects current marketing and sales strategies, click here.

You may also join the Digital Growth Institute’s Website Performance Benchmark Study for Banks and Credit Unions if you’d like to anonymously compare your metrics with other companies and gather helpful data-driven insights without taking the survey. It’s completely free!

With all of that established, let’s dig into the results:

- Predictions for Future Growth for Financial Brands

- What Future Growth Could Look Like Outside of the Financial Services Industry

Predictions for Future Growth for Financial Brands

According to our research, companies in the financial services industry strongly count on digital transformation, sales and marketing alignment, and a growth mindset to prepare for the future.

Marketing, sales, and leadership make these decisions in the context of strong digital performance. Looking at Google Analytics 4 data from the Digital Growth Institute’s Website Performance Benchmark Study for Banks and Credit Unions, financial brands have high reach, engagement, and conversion rates.

According to data from 22 contributors, banks and credit unions saw a median of 125.33k views in February 2024.

In February 2024, banks and credit unions had a median value of 88.37k sessions and 40.76k engaged sessions, based on 22 contributors.

During that same period, these financial services companies’ sites had a median engagement rate of 62.52%, based on contributions from 22 sites.

Looking at data from 16 contributors each, these financial institutions saw a median session conversion rate of 1.09% and a median user conversion rate of 1.81%.

“While an average of 85-92% of all website visitors go to a financial brand to access online banking, one of the biggest growth opportunities for increasing conversion rates for financial brands is simply increasing the number of conversion points. In fact, here are three types of website CTAs that build up consumer courage overtime at every stage of their buying journey:

- Clarity CTAs provide insight, guidance, and help early and often in the awareness stage of a consumer’s buying journey (e.g., “Download the home-buying guidebook”).

- Transitional CTAs are ideal for the consideration stage of the buying journey when a consumer needs to talk to someone before they have enough courage to click “apply” (e.g., “Request a call back to talk to someone”).

- Direct CTAs are only offered at the very end of the consumer buying journey once one has compared all their options and built up enough confidence to commit to moving forward and completing the application (e.g., “Apply for your loan in less than five minutes”).

For example, one financial brand we’ve guided over the years has experienced a 1,500 percent increase in leads from their website by reducing the overall cognitive load—number of pages and content—and utilizing more visual imagery and iconography, as well as increasing the number of transitional calls to action exponentially. Their website went from being the lowest-performing acquisition channel to outperforming all of their physical branch locations.”

Want to get highlighted in our next report? Become a contributor now

Instantly and Anonymously Benchmark Your Company’s Performance Against Others Just Like You

If you ever asked yourself:

- How does our marketing stack up against our competitors?

- Are our salespeople as productive as reps from similar companies?

- Are our profit margins as high as our peers?

Databox Benchmark Groups can finally help you answer these questions and discover how your company measures up against similar companies based on your KPIs.

When you join Benchmark Groups, you will:

- Get instant, up-to-date data on how your company stacks up against similar companies based on the metrics most important to you. Explore benchmarks for dozens of metrics, built on anonymized data from thousands of companies and get a full 360° view of your company’s KPIs across sales, marketing, finance, and more.

- Understand where your business excels and where you may be falling behind so you can shift to what will make the biggest impact. Leverage industry insights to set more effective, competitive business strategies. Explore where exactly you have room for growth within your business based on objective market data.

- Keep your clients happy by using data to back up your expertise. Show your clients where you’re helping them overperform against similar companies. Use the data to show prospects where they really are… and the potential of where they could be.

- Get a valuable asset for improving yearly and quarterly planning. Get valuable insights into areas that need more work. Gain more context for strategic planning.

The best part?

- Benchmark Groups are free to access.

- The data is 100% anonymized. No other company will be able to see your performance, and you won’t be able to see the performance of individual companies either.

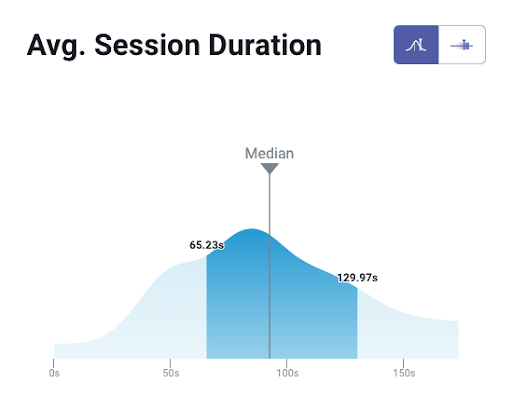

When it comes to showing you how your performance compares to others, here is what it might look like for the metric Average Session Duration:

And here is an example of an open group you could join:

And this is just a fraction of what you’ll get. With Databox Benchmarks, you will need only one spot to see how all of your teams stack up — marketing, sales, customer service, product development, finance, and more.

- Choose criteria so that the Benchmark is calculated using only companies like yours

- Narrow the benchmark sample using criteria that describe your company

- Display benchmarks right on your Databox dashboards

Sounds like something you want to try out? Join a Databox Benchmark Group today!

Who Did We Survey?

Moving on to our survey, 53 of the companies we consulted belonged to the financial services industry. Among those businesses, 54.72% are credit unions, 24.53% are banks, and 20.75% are fintech companies.

The data reveals a company size distribution leaning towards larger organizations (71.2% of companies having 51-500+ employees), with a presence of smaller companies (28.8% having 1-50 employees).

To gauge company mindset, we asked respondents to rank from 1 to 10 their view of growth in response to the state of the world. A score of zero means that the respondent is completely stuck in what we call the GAP (Griping About Problems), where they take a reactive approach to change. Ten indicates a growth-bound attitude with an abundance mindset and hunger for growth. The average answer among financial brands representatives is 7 which we view as trending more growth-bound.

We then asked them to rank their organizations using the same scale. The overall average for this question was 6, which we interpret as moving more toward the Zone of Uncertainty. This means respondents are not feeling as positive about the state of their organization as they are about the world. Furthermore, the Zone of Uncertainty leads to indecision which results in inaction.

We also explored marketing practices, growth mindsets, and current obstacles further with questions related to these categories:

- Marketing and Sales’ Impact on Website Performance

- AI’s Influence on Company Mindset and Future Growth

- Current Challenges and Solutions to Maximizing Growth

Marketing and Sales’ Impact on Website Performance

When we consulted financial brands about the alignment between their marketing and sales teams, it became clear that a good relationship between the two teams improves the process of acquiring and converting leads.

Financial brands reported an average score of 7 when we asked them to score their marketing and sales teams based on whether they’re stuck in the GAP or growth-bound.

We also asked respondents if their teams conduct quarterly website secret shopping studies, one of the Digital Growth Institute’s recommended practices. During a website secret shopping study, someone interacts with a company’s website as if they were a customer to gain insights into the digital buying journey. 88% of financial brands have never facilitated a website secret shopping study, while 40% stated that even though they haven’t tried this method yet, they do analyze their website performance with Google Analytics.

“The lack of commitment to quarterly website secret shopping studies creates friction and unseen gaps in the buying journey for key product lines. As a result, financial brands are losing millions in loans and deposits.”

Want to get highlighted in our next report? Become a contributor now

While many companies have a content marketing strategy with the marketing team at the helm, it’s not as common for sales to also be involved. So, we presented the question of whether respondents have a full-spectrum content strategy shared between marketing and sales that differentiates them through thought leadership. Among financial brand respondents, 46.67% do have a comprehensive, thought-leadership-based content strategy.

Original research is another way for marketing and sales teams to collaborate and get ahead of the competition. We asked financial brand respondents if they performed regular original studies involving clients and prospects. Most (38%) stated that they don’t run these studies, but they do check third-party data.

We also asked what communication channels financial brands use to share their thought leadership to keep themselves in their customers’ minds. The top answers were:

- Corporate social media accounts sharing knowledge and insights (80%)

- Videos (71.11%)

- Articles published on my website (64.44%)

- Email newsletter sent from their corporate brand (60%)

- Regularly scheduled remote events/workshops (49%)

When we asked respondents to share how the relationship between their marketing and sales teams impacts their growth, closer collaboration offered more growth opportunities.

Yvonne Tettamanzi of Banca Intesa Sanpaolo says, “In my case (Subsidiaries banks of Intesa Sanpaolo Headquarter), the relationship that affects the ability to target, capture, nurture, and convert leads is the one between marketing and [sales]. In fact, for the majority of products and services these two areas have to ‘meet’ each other and define together the KPIs to reach and how to use the marketing strategies/tactics and approaches to boost sales and contribute to growth. It’s a synergy that has to be always stronger, giving more ‘space’ to marketing to provide novelties and innovation.”

At Smart Financial Credit Union, Corbin Wilson noticed that siloed marketing and sales teams reduced the company’s growth potential, but future plans look promising. “The two business units of marketing and sales are currently separate organizational silos which presents numerous challenges. While we both have a vested interest in attracting and retaining members, we might differ on the most efficient way to approach it. Additionally, the teams are working on different technology platforms. Targeted campaigns and preapproved credit offers are tactics that have produced results in the past, but the process could have been more cohesive,” Wilson says.

But Wilson does recognize this trend and hopes to nurture growth moving forward: “In the future, a shared platform to assist in tracking the member journey will be a key to future growth. We do a decent job of using analytics to target the right members at the right time with digital offers. I believe there is room for improvement on the sales and service enablement side for the sales teams. I think we will find that the only way to achieve this is by giving them more access and insights into the member journey through the use of technology.”

BCU’s Jill Sammons’ answer shows another way to align sales and marketing through technology. Sammons says, “We recently did a complete overhaul of our new member onboarding process using Salesforce CRM/Salesforce Marketing Cloud. This enables comms to be sent directly from the rep in combination with those sent as part of marketing journeys. Our org has an ‘Engaged Member Growth’ KPI since historical data shows that the earlier a member engages with us, the longer their tenure and profitability with the [credit union]. Eighty-seven percent of new members are digitally active, so we also promote engagement quite heavily within the mobile app where more than 2/3 of members are logging in at least two times a week.”

AI’s Influence on Company Mindset and Future Growth

AI is a major part of financial brands’ recent digital transformation efforts. Respondents in financial services regularly use AI and consider an open mind towards it beneficial to growth.

Among financial brand respondents, more than 60% stated they use ChatGPT or another AI software a few times a week.

When we asked respondents how mindset plays into maximizing future growth as AI becomes more commonplace and how they help marketing and sales navigate this new landscape, they emphasized keeping an open mind with controls in place.

Jody Guetter at Nymbus embraces an innovative approach:

“Mindset is everything. Remaining curious and creative is key to embracing change, new technology, and awareness of opportunity. To support this we have a very open and collaborative work environment where information sharing is nurtured, experimentation is encouraged and freedom to learn is central to our work.”

Want to get highlighted in our next report? Become a contributor now

Jeffery Kendall, CEO of Nymbus, emphasizes the importance of keeping AI on rails, however. Kendall says, “We believe AI has a role in our business but we have two guiding principles right now: 1) AI is useful where there is no need for true precision – e.g. something like categorization of transactions is a good use case. Calculating or modeling financial data is not. 2) AI should be used to assist the human interaction, not replace it. And a final third – safety is everything. We are not confident in the negative implications of sharing our data with public LLMs and are proceeding with caution.”

Adam Remshifski of the American Heritage Credit Union also believes in the intersection of mindset and technology. “I would say mindset and culture are a huge component of utilizing AI/ML into a work environment. With labor and vendor costs on the rise, we need to equip our staff with efficient technology so they can be the best version of themselves. This tech stack can help people focus on what they are passionate about and learn how they can improve their processes. We are currently developing a new Business Intelligence/Data & Innovation division to help not only marketing but the entire company utilize data and tech to run the company more efficiently,” Remshifski says.

Current Challenges and Solutions to Maximizing Growth

We had one final and important question for respondents: What is the biggest challenge they face when maximizing their growth, and how are they addressing it? According to their answers, banks and credit unions are trying to balance the infinite need for growth with the reality of their resources.

PrimeWay Federal Credit Union’s Michelle Oshinski considers “innovating at the speed of life” the top issue to contend with. Oshinski says, “Everyone wants everything in real time. This means finding the right partners, not settling for what works today. We push our partners to work with our APIs and deliver real to near real time. So far that means implementations take longer, but we add more automated, streamlined capabilities. This is true in both our operational systems and marketing systems. For example, we can now notify members when they are not achieving the behavior to waive their monthly fee in ample time to change that. We are currently implementing that notification based on previous use trends.”

Cynthia Ramsey of Progressive Ozark Bank points out the struggles of growing as a one-person team: “The biggest challenge to our organization’s maximum growth is resources. I’m a one-person marketing department, and while we have a robust budget in comparison to many banks larger than ours, we are poster children for how little the banking industry uses customer data. We are looking into a third party partnership at present to provide us with CRM, data analysis etc. to help us leverage our marketing more effectively.”

Colleen Drozda Desselle of CSE Federal Credit Union names “having a balance between innovation and maintaining operational efficiency” as a challenge. Another is “Attracting and retaining top talent. Seems the workforce has changed to extremes in the last 3 years.”

Desselle is trying these solutions: “Organizations can address this by offering competitive compensation, investing in professional development, and creating a positive work culture. CSE has been making strives to look for talent, invest in our future leaders through schools, conferences, and in-house trainings. This has been accomplished by adding some new roles including a Training Manager.”

What Future Growth Could Look Like Outside of the Financial Services Industry

It’s difficult to tell how financial brands’ outlook on the future is unique without examining the approaches businesses take outside of financial services, so we also surveyed non-financial services companies. Eighty-three companies outside of financial services took part in our survey, with the largest industry among them being marketing and advertising at 28%.

Like the financial brand group of our survey, most of the non-financial services companies have under 50 employees. About 35% have one to 10, and about 41% have 11 to 50, making up a total of nearly 76% of this group.

When we asked companies outside of financial services about their place between being stuck in the GAP and growth bound, they were overall slightly more optimistic than financial brands. They reported an average score of 8 when asked whether they were griping about problems or embracing abundance in context of the state of the world.

These companies also had an average score of 8 when answering this question in terms of their organization.

On top of these questions about their organization in general, we also asked non-financial services companies about their practices in marketing and sales alignment, AI, and managing growth obstacles.

- Marketing, Sales, and Website Performance

- How AI Impacts Future Growth and Company Mindset

- Today’s Challenges and Possible Strategies for Better Growth

Marketing, Sales, and Website Performance

The data and answers we received from non-financial services companies on their marketing and sales alignment also supported the importance of collaboration between the two teams.

When we asked about their marketing and sales teams’ outlook on the GAP and growth, non-fiance companies provided an average score of 8. This is the same score they offered for themselves and their organizations.

A larger proportion of non-financial services companies participated in digital secret shopping studies compared to financial brands. Among the non-financial services group, 36.84% said they conduct these studies regularly and apply the results to their growth strategy.

The non-financial services group also highly values thought leadership. More than 70% reported they invest in thought leadership involving an aligned sales and marketing team.

More than 60% of the non-financial services respondents also perform quarterly research on clients and prospects in a joint effort between the marketing and sales teams.

As for the channels, these companies spread their thought leadership through, website articles and corporate social media accounts won out, with the total breakdown being:

- Articles published on their website (80.26%)

- Corporate social media accounts sharing knowledge and insights (63.16%)

- Articles published to third-party websites (51.32%)

- Team member social media accounts sharing knowledge and insights (51.32%)

- Videos (50%)

- Email newsletter sent from their corporate brand (50%)

When we asked respondents in the non-financial services group to tell us how the relationship between their marketing and sales teams impacts their ability to capture and convert leads, they also saw great results when marketing and sales work together.

At Home Gym Supply, William Parrett notices the benefits that come with aligned marketing and sales teams:

“Our marketing and sales teams have an open and transparent relationship. It comes from their robust communications. They never hide any data from each other. Both are aware of each other’s projects and results. It enriches trust between them and helps them to reach milestones together. If they can maintain this communication level, we will continue to maximize our organization’s growth in the future.”

Want to get highlighted in our next report? Become a contributor now

Brand24’s Wojciech Chrzan also sees how collaboration between marketing and sales leads to better growth. “The symbiotic relationship between our marketing and sales teams has been instrumental in enhancing our lead generation and conversion processes. What has worked exceptionally well is the integration of our marketing strategies with sales tactics. Our marketing team’s deep understanding of customer behavior and preferences, derived from data analytics and market research, has enabled the sales team to tailor their approaches more effectively. This synergy has resulted in a more personalized and efficient customer journey, leading to higher conversion rates,” Chrzan says.

Chrzan adds, “However, I firmly believe we can do even better. The future lies in AI. This will not only refine our targeting strategies but also enhance the customer journey.”

How AI Impacts Future Growth and Company Mindset

Looking at responses from the non-financial services group, these businesses also keep an open mind towards new technologies and experiment with AI.

Companies outside of financial services use AI tech at a higher frequency than financial brands. About 37% of this group use AI a few times a week, and 31.58% use it every single day.

Non-financial services companies also stressed the importance of adapting to AI and new technologies when we asked them about their thoughts on mindset in the AI age and how they’re helping marketing and sales adapt.

“The attitude of adaptability plays a pivotal role in maximizing any organization’s growth potential. Hence, we are invariably open to changes. We aspire to scour the potential of AI more, and we will also adhere to the guidelines not to misapply it. Furthermore, we will never take any actions concerning AI that can compromise our clients’ privacy. To navigate the unsteady and turbulent times, we are furnishing our marketing and sales teams with all kinds of resources to upgrade their knowledge of AI,” says Tom Vota of Gotomyerp.

At Plus, Daniel Li has a similar attitude: “In navigating the Age of AI, I believe the mindset emerges as the key to future growth. A growth-oriented mindset is our compass in this era of exponential change. Embracing AI isn’t just about technology; it’s a cultural shift. The team’s mindset dictates our agility to adapt, innovate, and leverage AI’s full potential. It’s not just about using AI tools; it’s about fostering a mindset that views challenges as opportunities and change as the norm. In this landscape, a growth mindset isn’t a luxury; it’s a strategic imperative that propels us forward, ensuring we don’t just navigate change but lead in the Age of AI.”

Today’s Challenges and Possible Strategies for Better Growth

To wrap up the survey, we asked the non-financial services group about their biggest challenge to growth and what they’re doing to tackle it. These respondents have some trouble keeping up with the fast pace of today’s growth and how generational differences affect it.

According to AJ Silberman-Moffitt, speaking from her personal experience as a Senior Editor at Tandem.Buzz, she believes the main challenges at their marketing agency are generational: “I believe the biggest challenge when maximizing the organization’s future growth is generational differences. Tandem employs individuals who classify as Generation X, Millennials, and Generation Z. I believe the way these generations perform their work differs in many ways. That’s not to say that one generation or one way is better. It merely acknowledges that they think and work differently.”

Silberman-Moffitt emphasizes the importance of teamwork in addressing these challenges, stating, “At Tandem, we believe in the power of collaboration and innovation. Our teams must be open-minded to alternative ways of accomplishing our goals, embodying the spirit of ‘collaboration’ by empowering each team member to contribute their expertise. It’s not about a single approach but about finding the best path forward together.”

“I was recently sitting in the office of Joe Laratro, President and Founder of Tandem.Buzz. On his desk was a book titled, ‘Fall in Love With the Problem, Not the Solution’ by Uri Levine, co-founder of Waze, and it resonated deeply with my personal core values. Just like the book suggests, I believe you can’t put a bandage on a wound and hope it will heal. Sometimes, you need a comprehensive approach to ensure a lasting solution. Quick fixes might be easy, but they aren’t always permanent or effective in the long run.”

“We are working diligently to instill a mindset that focuses on our six core values across our teams. I believe instead of rushing to get the work done, properly investing the time and energy into doing the work will go a long way in the company’s future growth.”

Meticulosity’s Eric Melillo is trying to keep pace. Melillo says, “The biggest challenge is staying ahead in a rapidly evolving digital community racing to incorporate AI to reap their advantage. We’re addressing this by investing heavily in cutting-edge automation technology and fostering a culture of innovation but doing so ethically. We also use powerful tools like Databox to turn our data analytics into clear visualizations. This helps us spot trends in the market and understand how our customers behave so we can make smarter business decisions. These initiatives have led to more targeted strategies, improved customer engagement, and a notable increase in market share, demonstrating our commitment to sustained growth and adaptability.”

Predict and Track Your Growth With Databox

Companies that encourage curiosity, creativity, and continuous learning are better equipped to deal with today’s rapid technological change. While financial brands are working towards a change-friendly growth mindset, their counterparts outside of financial service are more proactive about it.

One way to become more growth-minded in your business tactics is to project your growth using your existing data. Databox offers forecasts for the upcoming month, quarter, or year based on your current performance. If you have an idea of what revenue you want to earn at a certain point in the future, you can also use our growth calculator to see what the growth rate would be.

The Digital Growth Institute’s Website Performance Benchmark Study for Banks and Credit Unions can also help you stay growth-oriented. As the study runs, you’ll be able to compare your performance to the group average over time to see what growth looks like in your industry. You just need to anonymously share your Databox metrics to get the group’s results. Sign in to your Databox account and request an invite today.