Table of contents

Starting a business is always somewhat a walk on water as you try and sell your idea to investors and customers.

Despite how well things go though, there’s always one question that keeps startup owners up at night: what’s a good profit margin for a new business?

Of course, you can’t rush through the answer. After all, not making enough profit can put you out of business in no time. And, if you’re making less, you can’t keep convincing investors to shell out money for you.

So, start with the basics – understanding what exactly is a good profit margin for a new venture to guide your strategy. In this guide, we’ll answer this fundamental question for you as we dive into the following:

What Is a Profit Margin?

Profit margin is the money you make after you deduct all your small business expenses such as labor costs, marketing software you’re using, rental costs, and so on.

A good profit margin depends on a handful of factors including:

- The industry you are in

- Your business model

- Your growth goals

- Economic conditions

- Market competition

Most folks take business maturity into account too. But since we’re talking about the profit margin of new businesses today, we won’t recommend worrying about it (for now).

Related: Most Profitable Business Models for Agencies: According to 20 Agencies

Types of Profit Margin

Before we dig into what’s a good profit margin for a new business, let’s first clarify that there are three types of profit margins – each often lesser than the one above it.

These three profit margin types are:

Gross profit margin

This is the profit you get after deducting Cost of Sold Goods or COGS for short. These are the costs necessary for manufacturing the goods (products or services) you’ve sold.

So if you were selling cakes, the COGS involved is the cost of all the recipe items you use to bake cakes.

Put simply:

Gross profit = revenue – cost of goods sold

If you want the percentage amount or the gross profit margin, divide gross profit by revenue and multiply by 100.

Operating profit margin

This is the profit left to you after deducing the COGS and operating expenses. These operating expenses include the cost of creating your products such as rent, marketing, accounting software, payroll, and so on.

For a cake business, this means the costs that go into marketing your store, for example. So if you were using Buffer to run social media marketing for this small business, you’ll factor in the software’s cost as an operating expense.

In simple:

Operating profit margin = revenue – cost of goods sold – operating expenses.

For percentage value or operating profit margin, divide the operating profit with revenue and multiply by 100.

Net profit margin

This is the exact profit that remains after you deduct COGS, operating costs, taxes, and interest.

In short:

Net profit = revenue – cost of goods sold – operating expenses – interest – taxes.

Now for the margin, divide what you get as net profit by revenue and multiply by 100.

Since this is the actual profit you get after removing all business expenses, the net profit margin gives you the accurate value of the profit you’re making.

What Is a Good Profit Margin for a New Business?

While the exact answer varies from industry to industry, research on the US margins pins down the average net profit margin to 7.71% across the board.

However, this benchmark isn’t one you should be standardizing. Because, as we shared, the exact profit margin depends on various factors such as your industry, location, and so on.

Speaking for new small businesses, however, 51.7% of the experts we surveyed say new businesses should have a higher profit margin at the start.

34.5%, however, think that new businesses should have a lower profit margin in the beginning. The remaining, 13.8% of the people we talked to say they aren’t sure.

These are folks from different industries. For example, 36% are in marketing agencies, 28% provide professional services, 16% come from the eCommerce side, 12% are in the SaaS industry, and 4% come from the education sector.

To help you understand whether you should be aiming to keep your profit margin high or low in the beginning, let’s look at what experts from all sides of the POV have to advise:

- New businesses should set a low profit margin at the start

- New businesses should set a high profit margin at the start

- Every business’s profit margin varies from the start

PRO TIP: Are You Tracking the Right Metrics for Your SaaS Company?

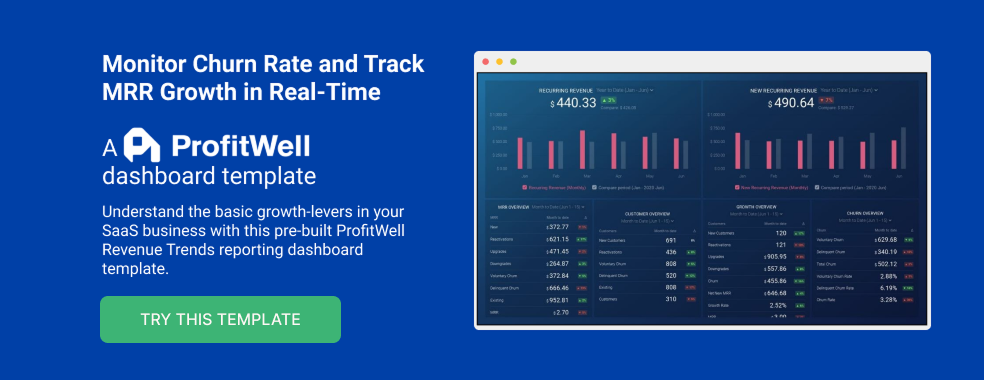

As a SaaS business leader, there’s no shortage of metrics you could be monitoring, but the real question is, which metrics should you be paying most attention to? To monitor the health of your SaaS business, you want to identify any obstacles to growth and determine which elements of your growth strategy require improvements. To do that, you can track the following key metrics in a convenient dashboard with data from Profitwell:

- Recurring Revenue. See the portion of your company’s revenue that is expected to grow month-over-month.

- MRR overview. View the different contributions to and losses from MRR from different kinds of customer engagements.

- Customer overview. View the total number of clients your company has at any given point in time and the gains and losses from different customer transactions.

- Growth Overview. Summarize all of the different kinds of customer transactions and their impact on revenue growth.

- Churn overview. Measure the number and percentage of customers or subscribers you lost during a given time period.

If you want to track these in ProfitWell, you can do it easily by building a plug-and-play dashboard that takes your customer data from ProfitWell and automatically visualizes the right metrics to allow you to monitor your SaaS revenue performance at a glance.

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your Profitwell account with Databox.

Step 3: Watch your dashboard populate in seconds.

New businesses should set a low profit margin at the start

Here’s why:

- Low profit margin helps you beat the competition

- Low profit margin gives you time to develop market reputation

- Low profit margin assists in building your portfolio

1. Low profit margin helps you beat the competition

“When you are starting a business, no one knows about your products or services, and you don’t have a huge army of loyal customers and fans who can spread the word about your brand,” notes Charles Cridland of YourParkingSpace.

However, “you have to compete with established businesses with a good reputation, so you may set lower prices to attract customers. And low prices mean lower profit margins,” Cridland writes.

That’s true in several ways. Unless you’re scratching an itch in a barely competitive industry, you’ll need to initially attract customers based on price. Otherwise, there’s very little incentive for them to leave established businesses and choose you.

It’s only when you’ve made a name in the market, grown word of mouth and referrals, and won prevailing customers with excellent service and value that you can think of growing your profit margin.

Related: 12 Proven Ways to Encourage Customers to Write Reviews (According to 100+ Marketers)

2. Low profit margin gives you time to develop market reputation

There’s only one problem with the point above: when you increase your prices later on to up your profit margin, you might end up breaking your customers’ trust.

PeopleFinderFree’s Eden Cheng agrees. “Cementing feet in the market and customers’ hearts is not an easy task for small businesses. They have to compromise on many things and keeping a low-profit margin is one of them.”

“Most businesses go this way only,” Cheng observes. “During the initial phase, they keep the profit margin low and when they increase the service cost to intensify the profit margin, things might not always turn out good. Sometimes, customers feel cheated.”

The solution? Cheng suggests taking the moderate profit margin route. “A moderate profit margin that’s not too low and not too high and continues with that for at least two years.”

This ensures you aren’t straining your wallet as you build your business. At the same time, transitioning from moderate prices to increased ones is something customers can digest as compared with shifting from low to high prices.

Another way is to not increase the price at all to grow your profit margin. Instead, you cross-sell and upsell.

Cheng talks about: “Once you think that you have built enough of a customer base then just don’t increase the price of present services to increase the product margin. Launch some new products or variants of the existing one and keep their price a little high.”

“If your customer base is loyal then you’ll receive good feedback for the new launch and your profit margin will increase,” Cheng points out. “This way customers’ trust is retained.”

Related: How to Upsell: 12 Tactics to Increase Your Customer Lifetime Value

3. Low profit margin asssists in building your portfolio

This is particularly helpful for service-based businesses.

Essentially, “it really comes down to the product and service you provide and what else the rest of the market is doing,” Deniz Doganay from Digital Debut highlights.

“However, for any new business, it is always good to offer your services a little cheaper just to get things in motion to start building up your portfolio.”

Says Doganay, “Once you are comfortable and the business is continuing to experience decent levels of growth you can then refine and improve your services which is when you will look into better profits and higher average revenue per sale.”

New businesses should set a high profit margin at the start

Now for the logic behind setting a high profit margin from the get-go that the majority of our respondents recommend:

- High profit margin helps you spend on growing brand recognition

- It provides a safety net for all the planning fallacy

- High profit margin saves you from coming across as a discounter

- It helps avoid changes in prices for your customers

- Profit doesn’t increase even as revenue increases eventually

1. High profit margin helps you spend on growing brand recognition

Growing a business isn’t as simple as renting a place and getting some stock and labor. While those are basic costs, Darjan Hren of Hren.io recommends you factor in branding and marketing costs too.

Considering how good marketing is essential to rise above the market noise, you can’t push this expense to the bottom of your list. “The new business does not yet have a brand recognition or a customer base, and building a brand and a customer base requires time and marketing budget,” Hren notes.

With time though, “as the business becomes more and more profitable and grows, the profit margins will come down,” writes Hren. “This is because as the business’s customer base and brand recognition increases, it is able to spend less on marketing.”

Kinsta’s Tom Zsomborgi agrees. “A higher profit margin has a big impact on the overall of your business. You can spend more on product development, hiring, and marketing and keep improving your service.”

In fact, Zsomborgi opines, “A low or break-even margin is dangerous and you can find yourself in trouble easily. Don’t forget most businesses are trying to compete on price but that’s never a good long-term strategy.”

In short, “Higher price/marging provides more growth opportunities and users associate it with better service.” It’s also a good way to play the long game.

Related: How to Find, Prioritize, and Turn More Product Qualified Leads into Paying Customers

2. It provides a safety net for all the planning fallacy

Running a business always involves a learning curve. In fact, planning fallacy or planning incorrectly by under- or overestimating tasks, projects, and prices is common.

“Inevitably as part of the learning curve, there will be scope creep or things will simply take longer than expected,” as Kristen McGarr from Adroit Insights puts it.

“By planning for a higher profit margin, new businesses will hopefully find a balance between over-charging and losing money on each transaction,” shares McGarr.

As your business grows and “once the learning curve has been established but new product or service lines are being launched, businesses could aim for a slightly lower profit margin as a go-to-market strategy,” McGarr advises. “This will help gain popularity and increase demand before raising prices to increase profit margin.”

3. High profit margin saves you from coming across as a discounter

“If you have outside investors, growth is all that matters so lower profit margins are the way to go,” Mark Aselstine from Wine Club Reviews comments.

“For most of us though, who are funding their business through savings, the only thing that matters is profitability, and keeping margins to a decent level from day 1 can help achieve that.” This is, specifically, true for service-based businesses and self-funded startups.

Most of all: “As soon as you’re seen as a discounter, it’s hard to go back.” Hence, it’s best to play it safe and start off with a high profit margin.

4. It helps avoid changes in prices for your customers

“In the beginning, when a company is small and simple, the share of variable costs in the unit cost is high and the share of fixed costs is low,” points out Online Marketing Gurus’ Andrew Raso. “And some new companies may not have fixed costs in the beginning at all.”

However, as you grow and “as turnover increases due to economy of scale, variable costs will decrease and fixed costs will change in leaps and bounds rather than linearly.”

The effect on your customers? “Your price will change several times a month, and your customers may go crazy [if] you try to keep the margin level stable during the growth period.”

Realistically, customers expect transparency, honesty, and a good experience. You need to make sure you’re offering them all three. In particular, aim for providing a great customer experience as 85% of the buyers are willing to pay more for it.

Of course, to provide all this, you need to invest more to stand out. This, in turn, means you can’t start off with a low profit margin.

Therefore, to avoid such a scenario “you should set the margin higher. As operations expand, margins are likely to shrink due to an increase in fixed costs and unforeseen expenses, but this approach will allow you to have at least a more or less stable price,” summarizes Raso.

5. Profit doesn’t increase even as revenue increases eventually

“I think new businesses could have a higher profit margin in the beginning, because contrary to popular belief when revenue increases, profit margins can actually decrease,” observes Kristaps Brencans of On The Map.

The reason? “Established businesses with heightened sales growth are also grappling with more expenses as a result.”

Consequently, “new businesses don’t need to aim low simply because they’re new when there are so many ways to push for more from the get-go,” says Brencans.

“That’s not to say new businesses should be shooting for the unrealistic; do your research about the average profit margins of other businesses within your industry, especially your direct competitors. When looking at the margin that research tells you is the norm, don’t be afraid to meet it.”

Every business’s profit margin varies from the start

As for the remaining, 13.79% of our contributors who weren’t sure if new businesses should have a higher or lower profit margin in the beginning, here’s their take on the matter:

- The right profit margin highly depends on the industry

- The right profit margin depends on the outcome you seek

1. The right profit margin highly depends on the industry

“When starting, whether new businesses should have a higher or lower profit margin depends on the industry,” opines Cleared’s Ryan Rockefeller. The reason? “Businesses with a high overhead will have a lower profit margin and vice versa.”

As an example, Rockefeller shares their industry: “Being in telehealth, I have to consider factors like speed of service delivery and services provided. Since there’s no office space to rent and more patients can be accommodated, we will see more profitability than of sectors.”

Similarly, Tim Absalikov from Lasting Trend shares another industry when talking about profit margin.

Although Absalikov is of the view that the starting profit margin should be high, they say: “In the service and manufacturing industries, profit margins decline as sales increase. This is about the time the business should start hiring more people.”

“In the beginning, when the company is small and simple, the margins are likely to be quite impressive,” Absalikov explains.

“You don’t have a lot of staff and other significant overheads. As your sales grow and your business grows, you get more money. But your margin is likely to shrink because you are probably hiring more people, investing in larger properties, and expanding your product line.”

As Absalikov says it: “Just making more money does not mean you are making more profit.” It makes sense why they think it’s best to kick things off with a high profit margin.

2. The right profit margin depends on the outcome you seek

According to Business Success Factors’ Doug C. Brown: “It depends on the outcome sought.”

“Are you just trying to gain market share to build your revenues up to be attractive to sell to another company? Or, do you want to be profitable in doing so as well as gaining market share?”

“If I had to advise someone on one or the other, it is always best to sell for high profit versus low profit,” Brown comments. “With high profit, you can gain leverage, resources, and do things that you cannot for your client base when your profitability is low.”

Related: Goals Based Reporting: Everything You Need to Know

Plan and Track Your Profit Margin Today

All these expert insights make it clear that although profit margin depends on several factors, the likely answer to what’s a good profit margin for a new business is a high profit margin from the start.

A high profit margin helps you:

- Cover up for planning fallacy

- Business costs that increase later on

- Invest in product development, marketing, and providing good service and

- Set customers’ expectations right (plus retaining their trust without suddenly changing your pricing to grow profit)

Once you’ve settled on the right net profit margin for your business, go on and track it using an interactive dashboard that displays your profit margin in real-time.

Interested? Sign up for Databox today so you can create such a dashboard that automatically sources data from various sources once you’ve plugged them into the tool. From there, tracking your net profit margin is going to be a piece of cake.

![How to Improve Agency Operational Efficiency [Insights from 40+ Agencies]](https://cdnwebsite.databox.com/wp-content/uploads/2023/09/14052320/agency-client-collaboration-1000x563.png)