Uses one-click integrations:

If you don't use QuickBooks or WooCommerce, you can pull data from any of our 130+ one-click, native integrations or from spreadsheets, databases and other APIs.

Try this dashboard for free-

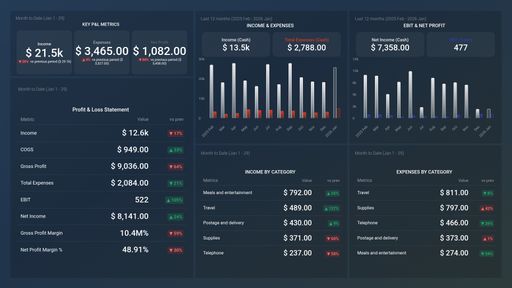

Cost of Goods Sold (Cash)

Cost of Goods Sold (Cash) is a financial metric that calculates the direct costs incurred in producing goods or services sold during a specific period, reflecting the cash outflows related to inventory, manufacturing, and raw materials.

-

Gross Profit (Cash)

Gross Profit (Cash) is a financial metric that calculates the amount of money a business earns after deducting the cost of goods sold. It represents the profit a company generates from its core business operations before factoring in other expenses.

-

Net Income (Cash)

Net Income (Cash) is the total profit earned by a business after deducting all expenses that have been paid in cash.

-

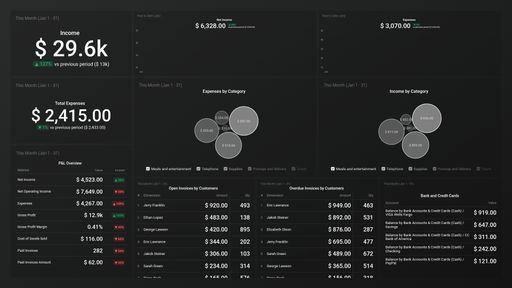

Net Operating Income (Cash)

Net Operating Income (Cash) is a profitability metric that reflects the income generated by a business's operations after deducting operating expenses and taxes but before deducting interest and other non-operating expenses.

-

Total Expenses (Cash)

Total Expenses (Cash) measures the amount of cash spent by a business during a specific period on all expenses including operating, administrative, and non-operating expenses.

- Gross Profit Margin

- Net Profit Margin %

-

Expenses (Cash)

Expenses (Cash) metric in QuickBooks tracks all the cash spent for business transactions or purchases made, providing an accurate reflection of the true cash flow of the company.

-

Income (Cash)

Income (Cash) is a financial metric that measures the amount of actual cash received by a business during a specific period from sales, services, or other sources. It does not include non-cash revenues or expenses.

-

Total Expenses (Cash)

Total Expenses (Cash) measures the amount of cash spent by a business during a specific period on all expenses including operating, administrative, and non-operating expenses.