ORIGINAL RESEARCH REPORT

Beyond Attribution:

The Disappearing Buyer Trail

What Go-To-Market Leaders at High-Growth Companies Are Doing (& Measuring) Differently

Attribution is breaking down. Click data is unreliable, buyer journeys are invisible, and GTM teams can’t agree on what really drives growth. We surveyed 300+ GTM leaders to uncover how the fastest-growing companies are adapting — and where others are falling behind.

The buyer journey has gone dark.

Traditional tools like cookies, click paths, and UTMs no longer capture how decisions are really made. Much of the journey now happens in untrackable spaces – dark social, communities, and word of mouth – leaving GTM leaders with blind spots.

Externally, buyer signals are harder to see. Internally, teams often disagree on which metrics matter. The result is a growing confidence gap.

High-growth companies aren’t waiting for the old trail to return. Instead, they’re building new systems grounded in self-reported buyer signals, tighter team alignment, and disciplined investment in channels that influence pipeline, even when attribution is messy.

This report shares insights from 300+ GTM leaders, highlighting the practices that set the fastest-growing companies apart.

The Disappearing Buyer Trail

Buyer journeys are less visible than ever, with critical signals happening outside trackable channels.

Organic search, once a reliable driver of inbound growth, is losing its effectiveness. Many GTM leaders report declines in SEO performance, forcing them to reduce their reliance on it.

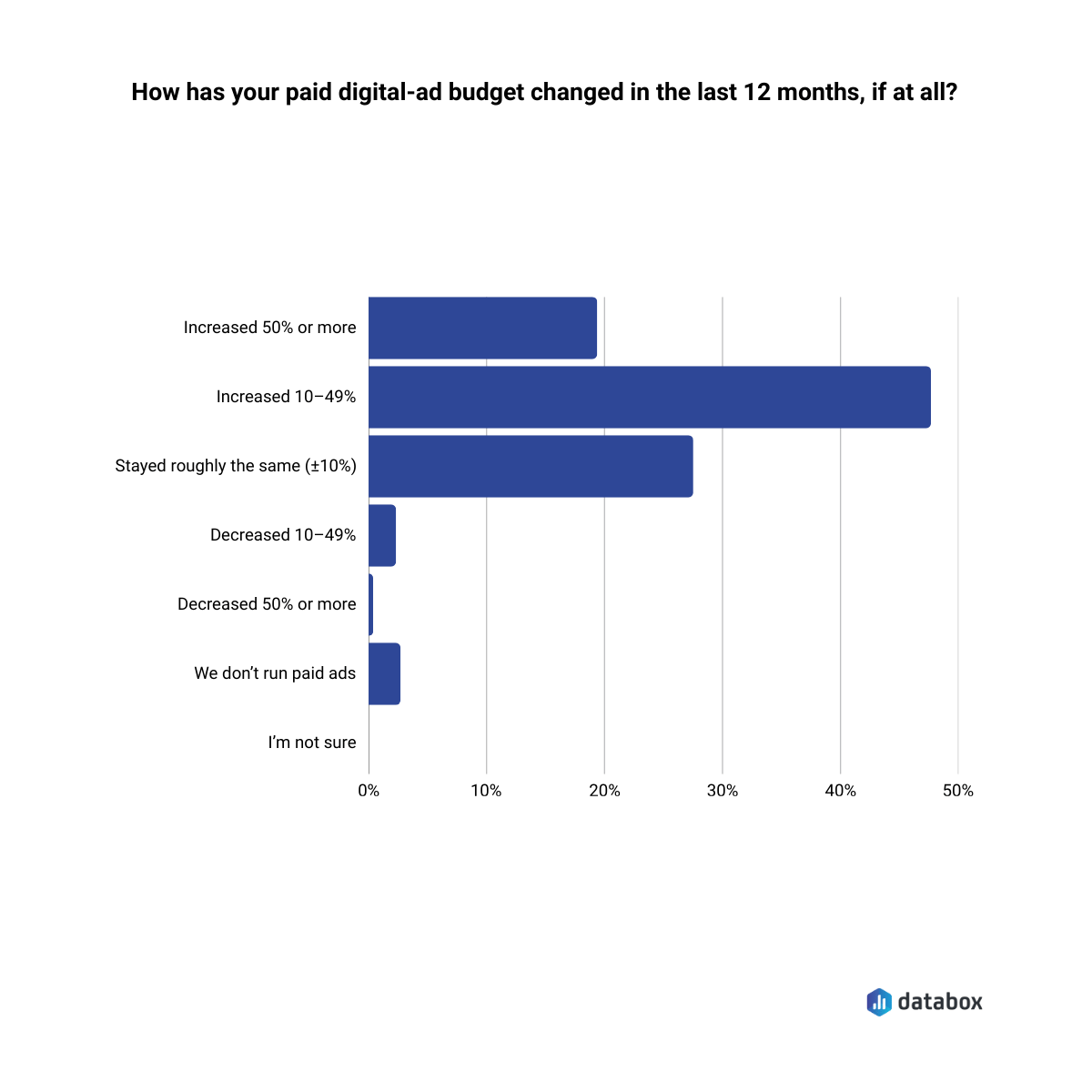

To maintain pipeline, GTM teams are shifting budgets into paid media, with nearly half doing so specifically to offset declines in organic and inbound channels. Yet this shift highlights a deeper issue: as more buying activity happens in untrackable spaces, companies risk over-investing in what dashboards can see, not what actually drives growth.

Monitoring vs. Reality

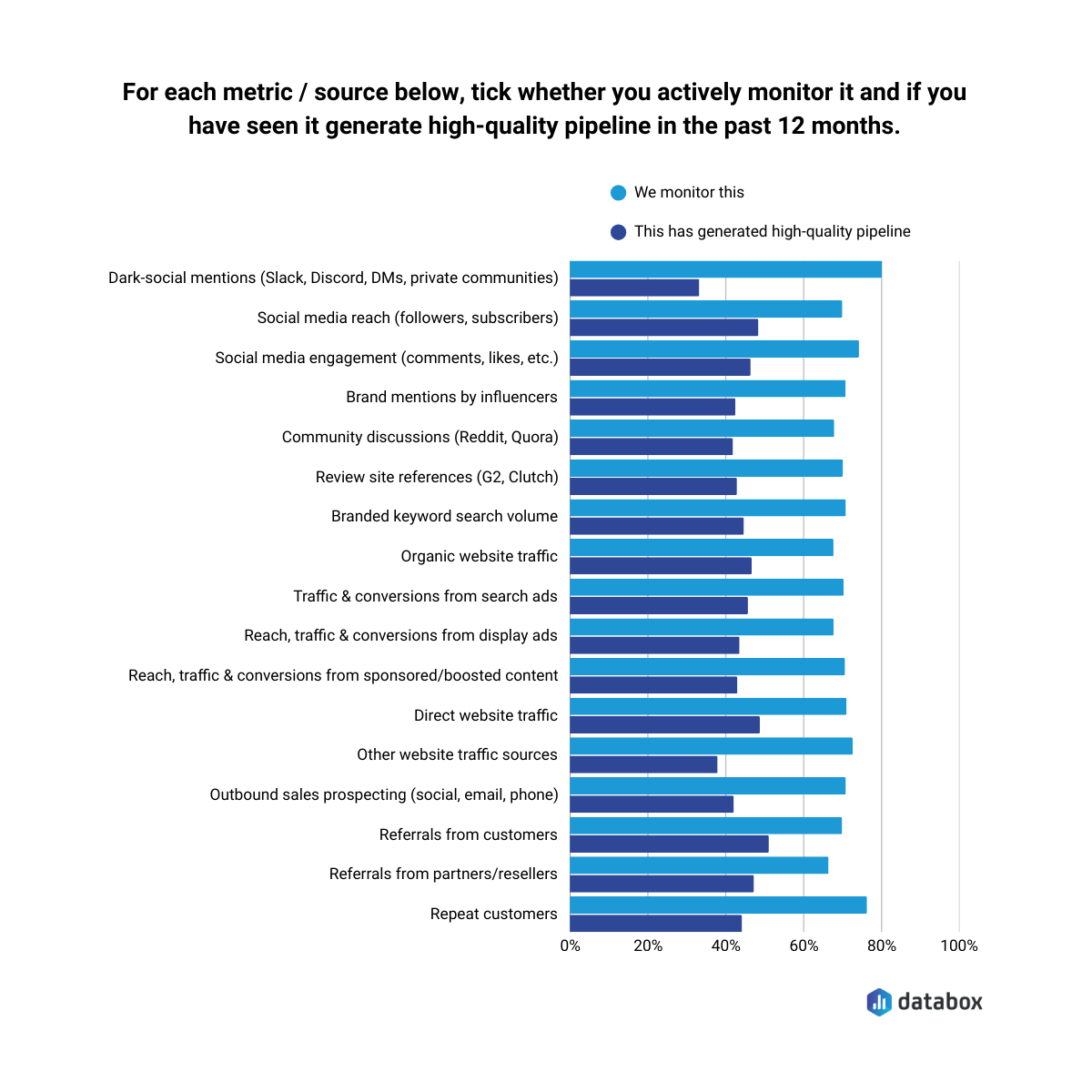

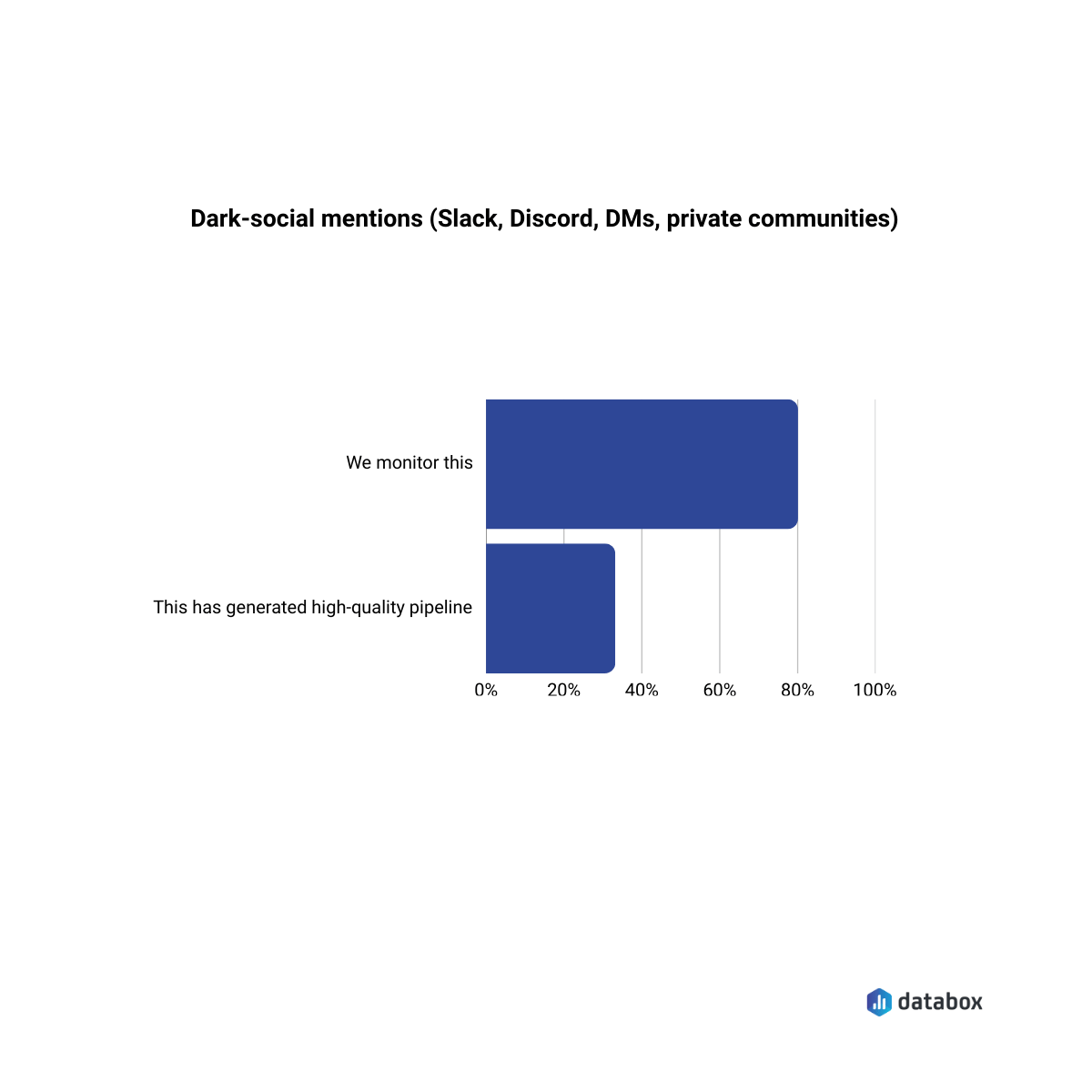

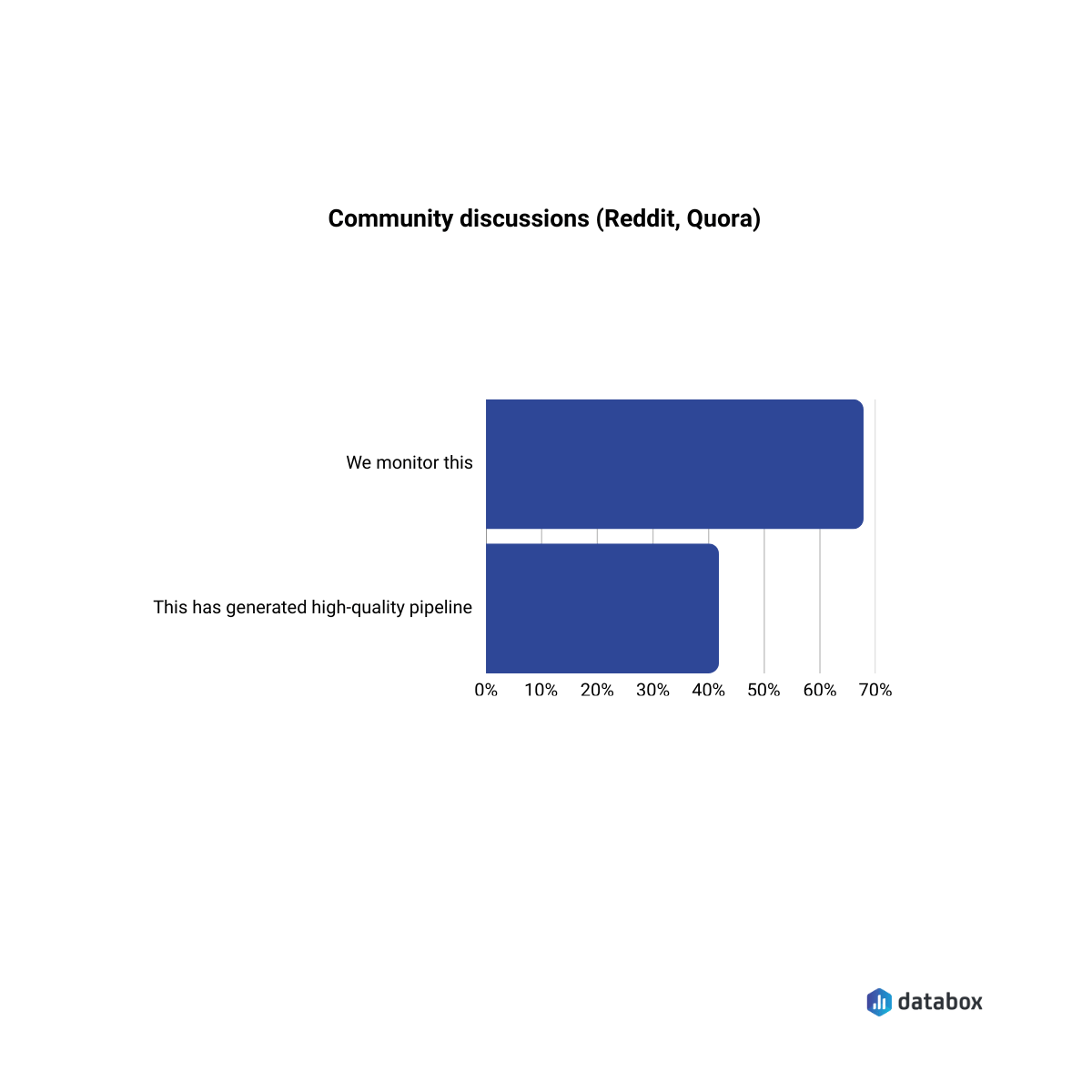

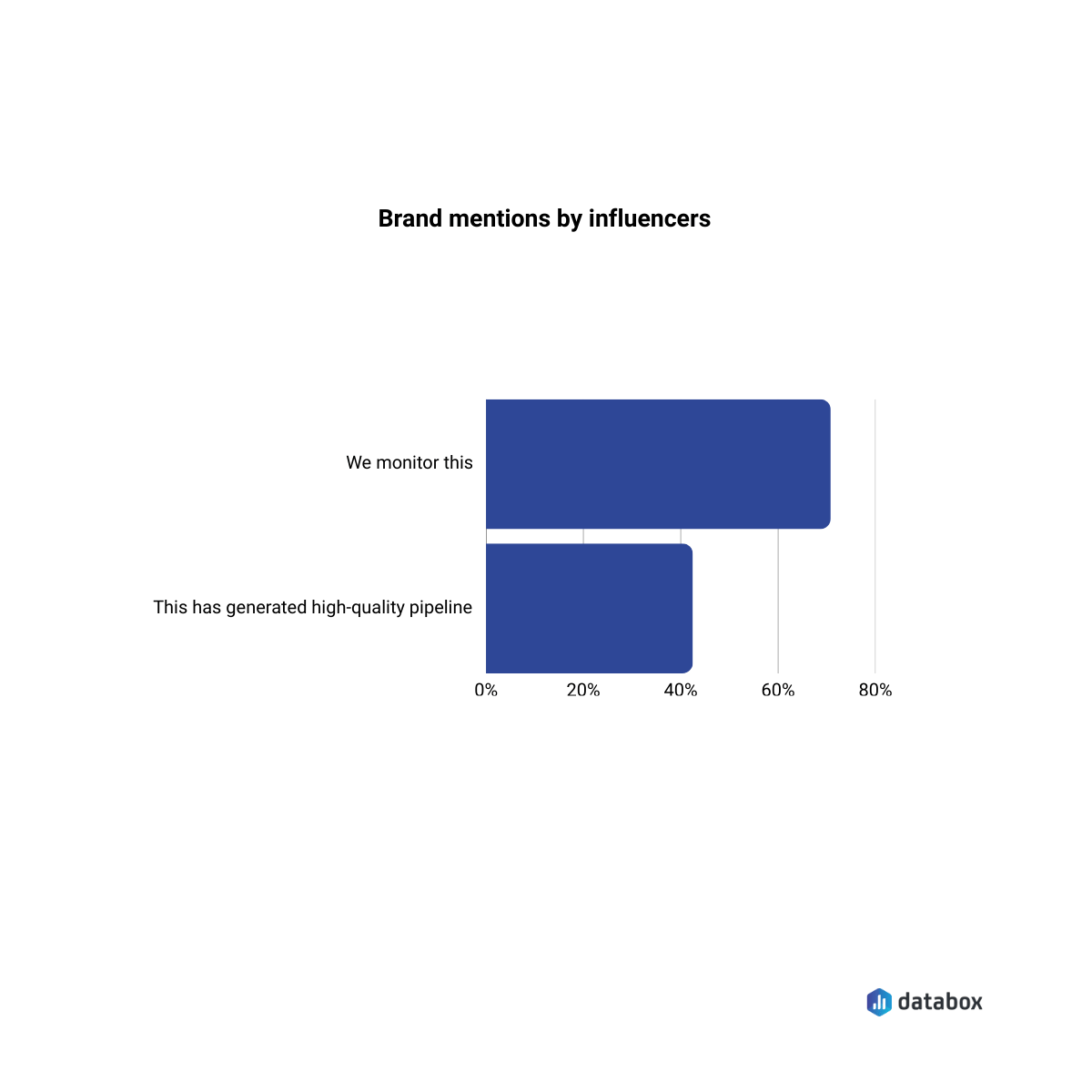

80% of GTM leaders monitor dark social, 68% track community conversations, and 71% follow influencer mentions, yet most struggle to connect these signals to pipeline.

Leaders know where buyers are active, but attribution systems don’t capture the influence of those interactions.

Paid Media Reliance

67% of companies increased paid ad budgets this year, and 46% said it was specifically to backfill lost organic pipeline.

Paid spend is rising not because it’s always more effective, but because it’s easier to measure than the channels where influence actually happens.

Measurement Under Pressure

Attribution errors are rising, leading to misplaced budgets and declining confidence in the numbers.

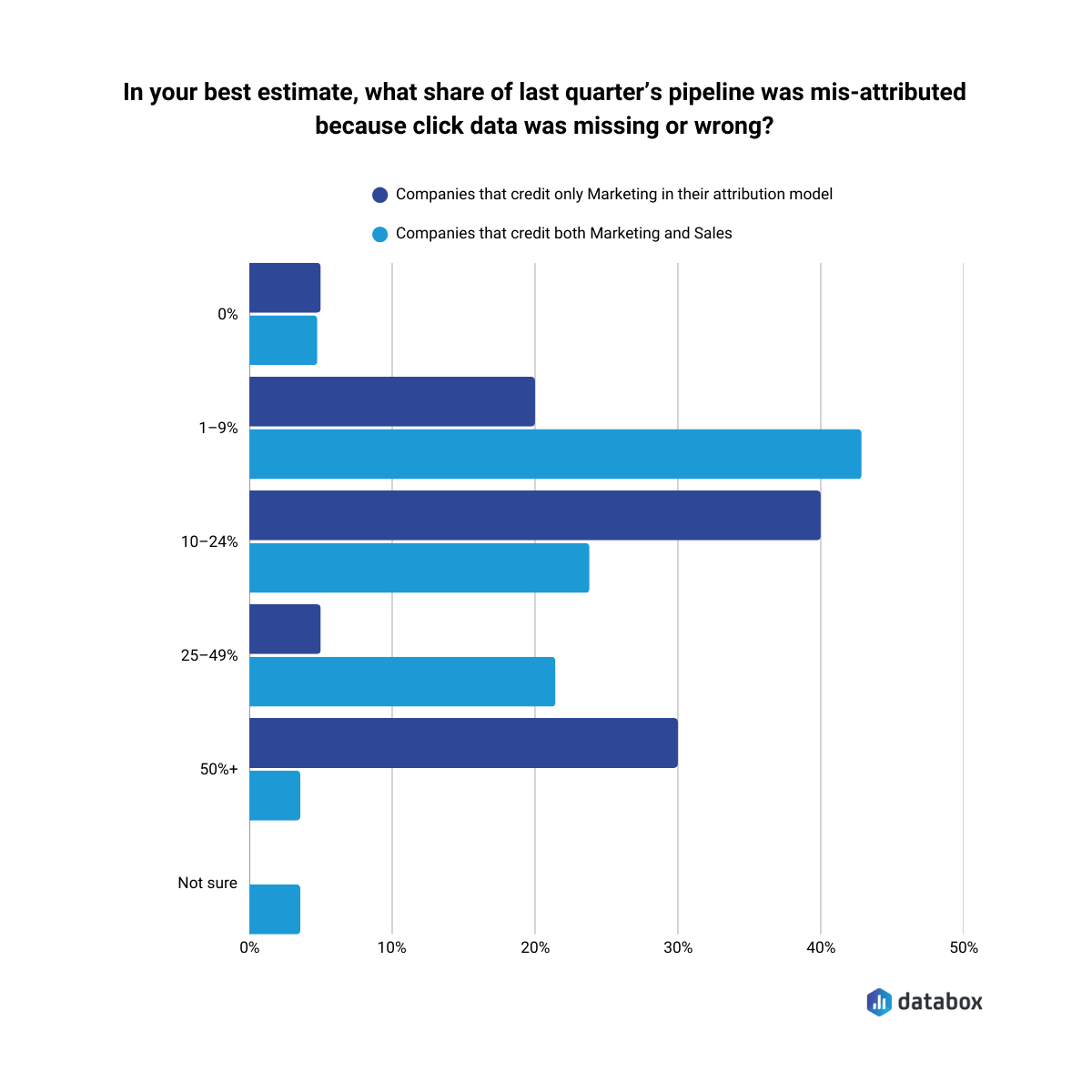

Beyond the numbers, attribution models themselves compound the problem. Companies that assign credit to “Marketing only” when deals close were far more likely to report high error rates. By contrast, teams that include both Marketing and Sales (or the full GTM function) experienced fewer errors and greater confidence in their reporting.

Attribution isn’t just a technical system issue, it’s a structural one. Expanding models to reflect cross-functional contributions reduces errors and improves trust in the data leaders rely on for budgeting and planning.

Pipeline Misattribution

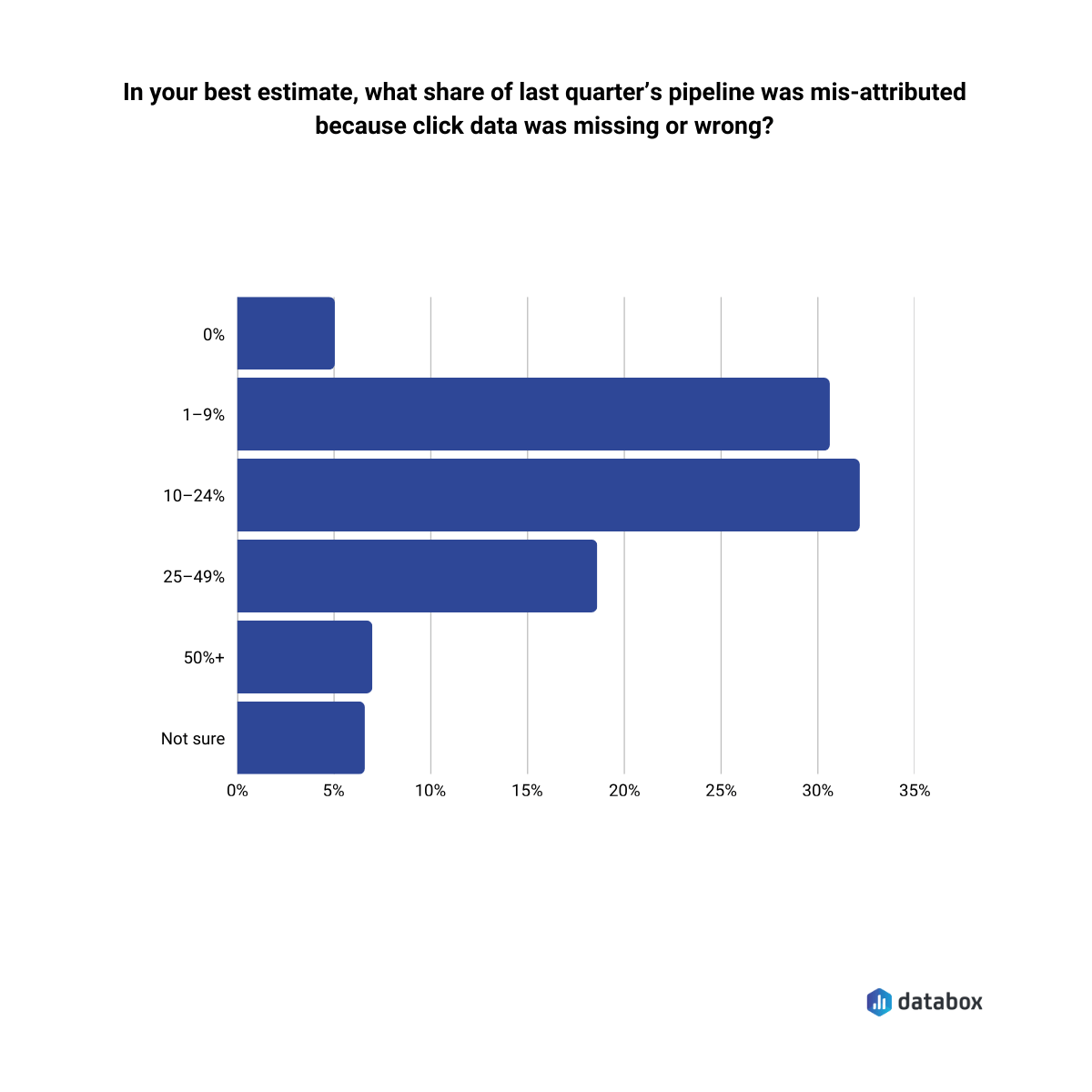

Attribution gaps are no longer small errors — they’re significant.

One in four GTM leaders said at least a quarter of last quarter’s pipeline was misattributed due to missing or incorrect click data, and nearly 7% reported error rates of 50% or more.

Attribution failures aren’t rare exceptions — they’re reshaping pipeline reporting.

Attribution Models

Companies using “marketing-only” attribution were far more likely to report high error rates than those including Sales or GTM in the model.

Broader models reduce error and build cross-team trust in the numbers.

Misaligned Metrics

When teams can’t agree on what matters, even accurate data fails to drive alignment.

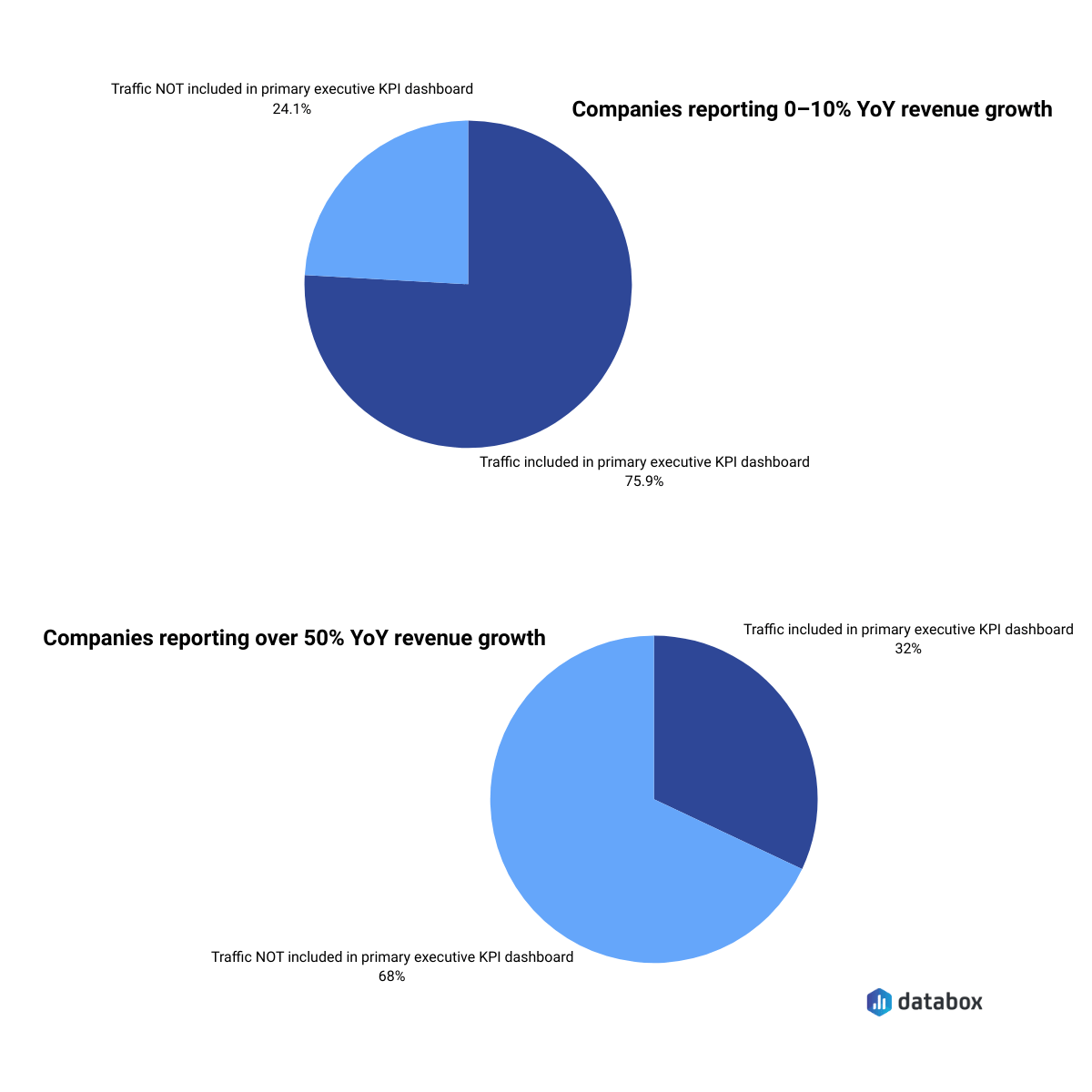

Misalignment also shows up at the executive level, with low-growth companies over-emphasizing fading metrics like website traffic. While traffic isn’t a bad metric, elevating it above revenue signals reduces confidence in what’s really driving growth.

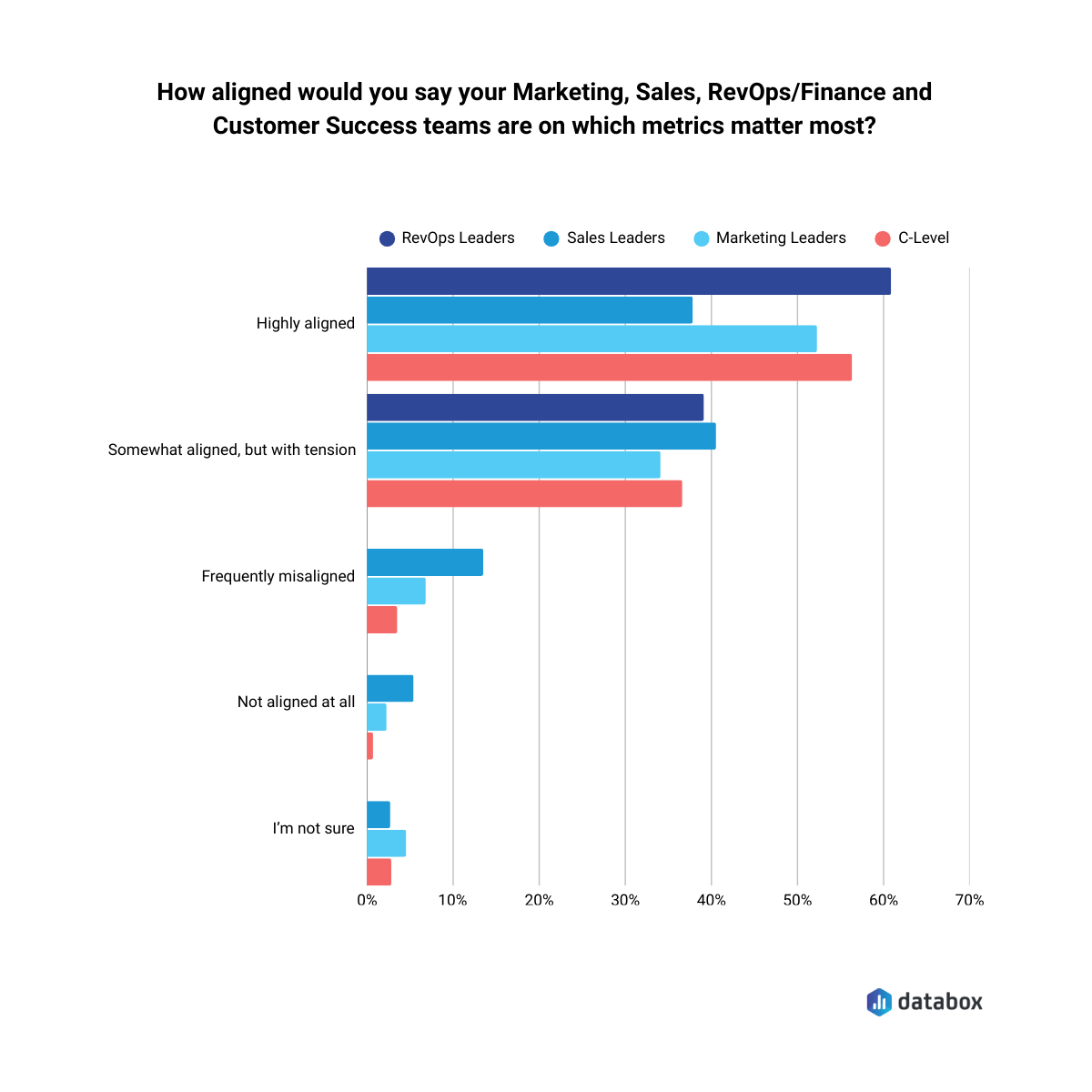

Alignment by Role

Only 38% of Sales leaders report their teams are highly aligned on metrics, while RevOps leaders — whose role includes driving alignment — reported 61% alignment.

Disagreements over definitions slow decisions and create tension across GTM functions.

Traffic in Dashboards

Low-growth companies are more than twice as likely to feature traffic in leadership dashboards (76% vs. 32%).

Overemphasizing traffic correlates with weaker growth and lower confidence.

"Just because something is easy to count does not mean it is the right thing to count. Traffic matters as a signal for marketing, but it is marketing language. To make it relevant at the executive level it needs to be translated into business language like pipeline created, efficiency benchmarks, or share of demand against competitors. High-growth teams keep traffic in marketing reports and focus leadership on the metrics that show how growth is actually happening."

Influence Without Attribution

The channels shaping buyer decisions often leave no trace in attribution systems. Dark social, communities, and influencer mentions are widely monitored but rarely credited with pipeline.

Practitioners say these channels deliver results even if attribution can’t prove it.

As Adam Watson of Hollywood Mirrors shared: “I leaned in most heavily this year into interacting with niche online communities… I wasn’t able to monitor every interaction entirely, but I saw a spectacular rise in inbound demo requests.”

80% of leaders track dark social, 68% watch community discussions, and 71% follow influencer mentions — but only 33–42% connect them to high-quality opportunities.

"The strongest signals happen in the moments you own — on your site, in your events, in your community. That’s where influence becomes measurable and actionable."

Go-to-market alignment starts with a single source of truth.

If your marketing, sales, and RevOps teams can’t align on go-to-market metrics, they’ll never agree on results. Databox unifies GTM metrics across teams so your entire go-to-market strategy runs on shared, real-time data.

We used these research findings to develop 4 tailor-made dashboards that you can try for free.

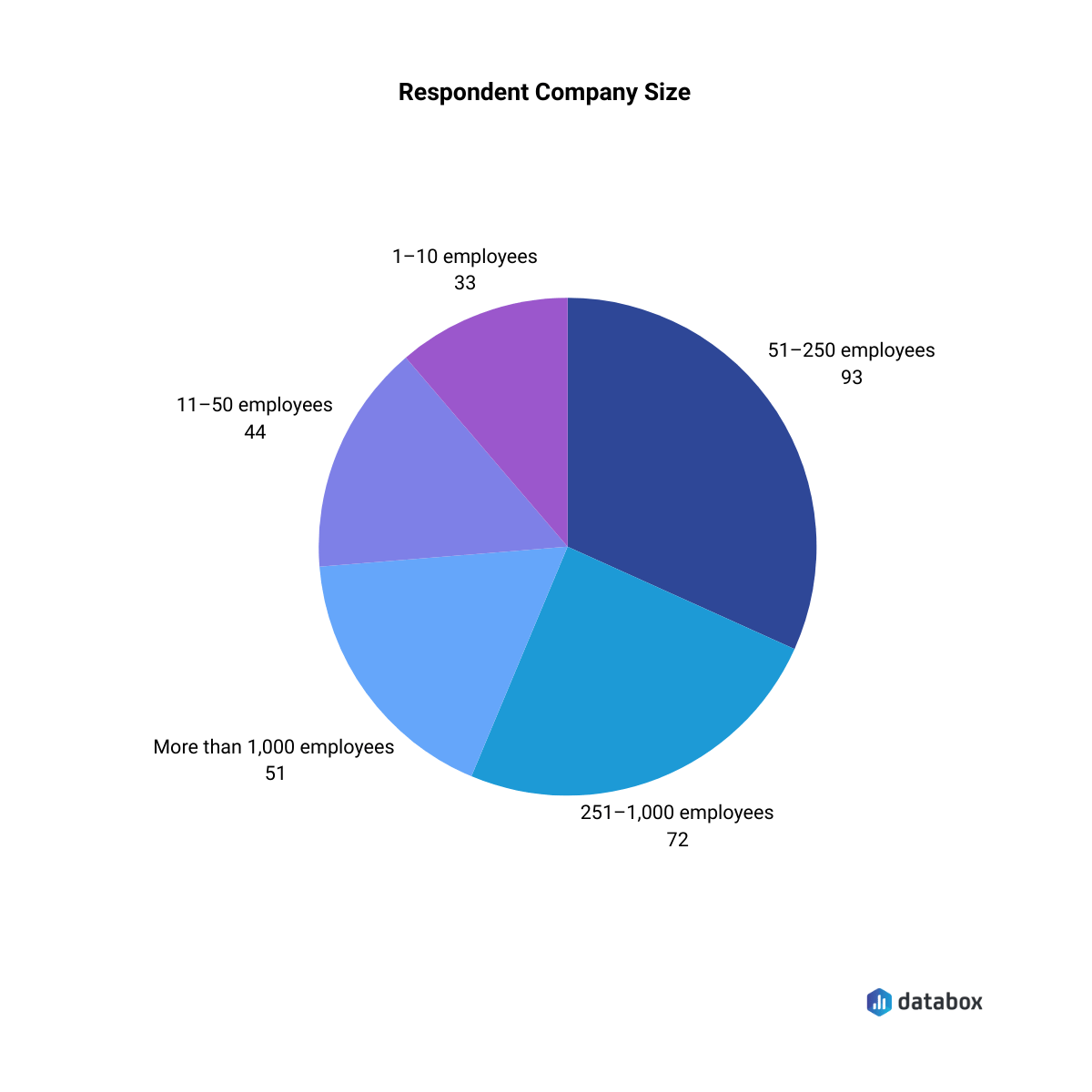

About the Research

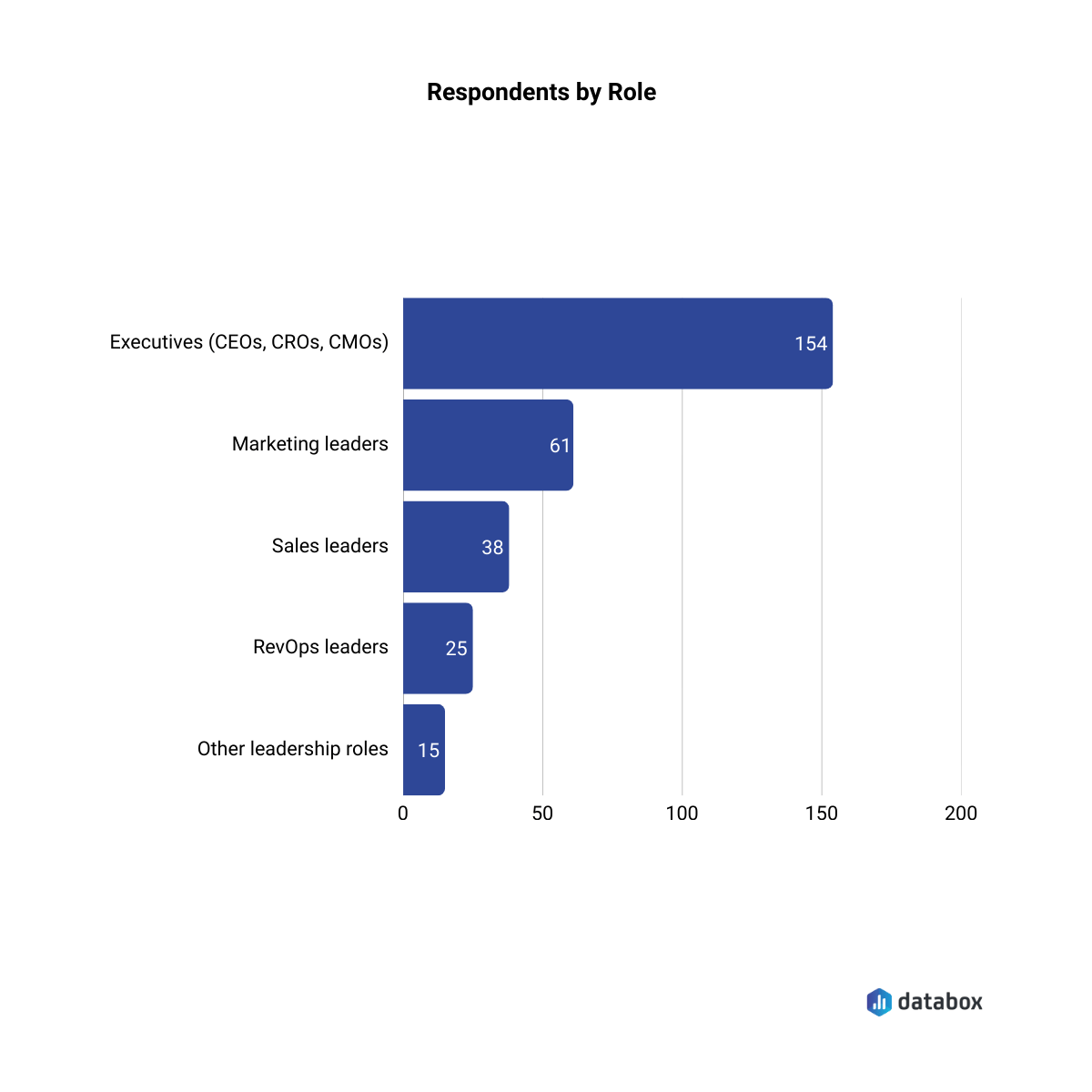

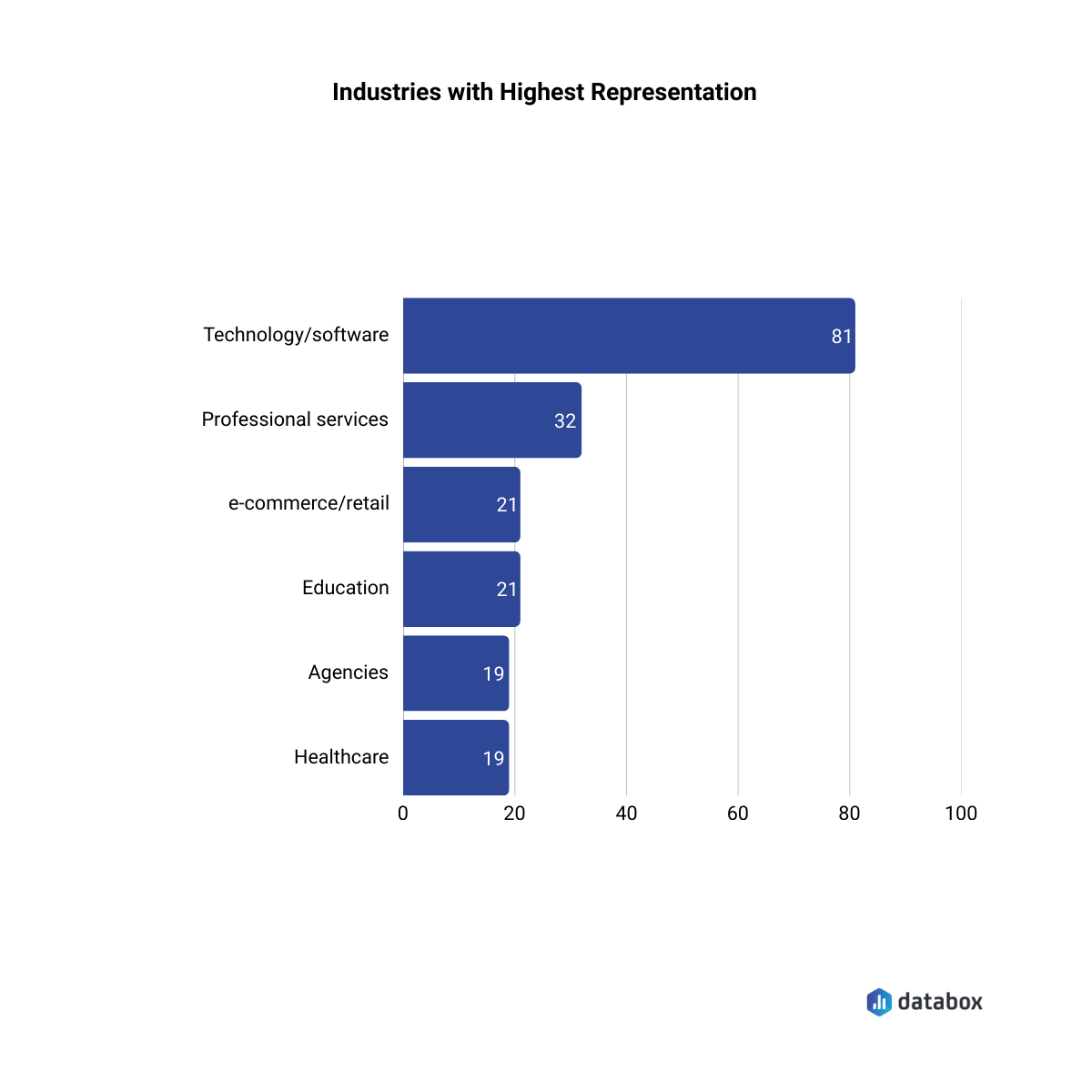

This research is based on responses from 300+ GTM leaders.

Want to see what high-growth companies do differently?

Download the full report!

By submitting the completed form, you agree to our Terms of Service and Privacy Policy